Why Bitcoin to $100K Is Only a ‘Question of Time’: Bloomberg Intelligence

Bitcoin is following what Senior Commodity Strategist for Bloomberg Intelligence, Mike McGlone, calls an “enduring trajectory.” The benchmark crypto is one of the best-performing assets in history, as the expert said in a recent report, and could be on track to register new gains in the second half of 2022.

At the time of writing, BTC’s price is trading at $23,900 with a 3% gain over today’s trade and a 2.4% gain over the past week. The cryptocurrency appears to be moving higher on the back of a decline in inflation expectations for July’s Consumer Price Index (CPI).

This metric has been at multi-decade highs, forcing the US Federal Reserve (Fed) to take action by reducing its balance sheet and raising interest rates. Thus creating a hostile economic environment for risky assets, such as Bitcoin and stocks.

The cryptocurrency could benefit from deflationary forces, McGlone believes. Bloomberg’s commodity index and the prices of key commodities, such as oil and copper, suggest this trend.

In this sense, the experts expect that assets with fixed supplies will increase. This could put gold and Bitcoin to reach $2,000 and $100,000 respectively in the long term.

McGlone believes that the reference crypt is becoming a more stable and less risky resource. This translates to BTC acting as a “high beta alternative to metal (gold) and government bonds”.

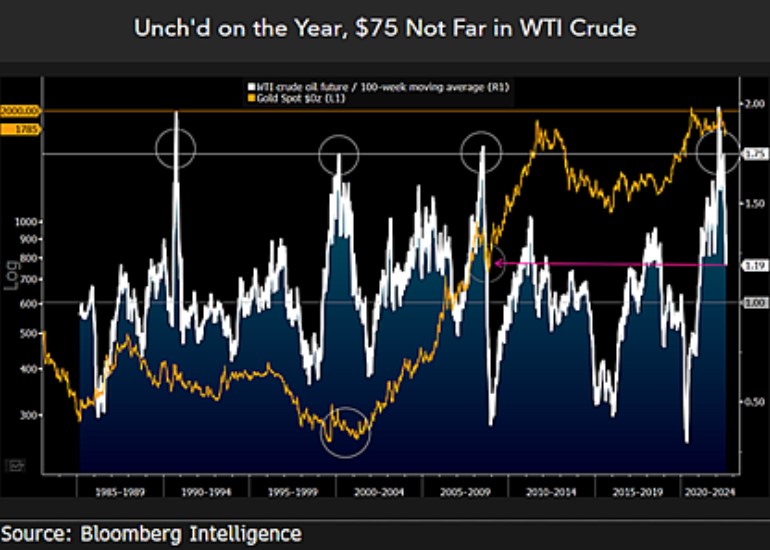

The price of Bitcoin and gold could begin to “accelerate,” the report says, if West Texas Intermediate (WTI) oil, a benchmark for oil prices, follows the downward trend in commodities. McGlone wrote:

It is a matter of supply, demand and adoption over the next 14 years that should drive prices, and we see little reason to complicate what appear to be enduring trajectories, notably in advancing technology (…) .

The other side of the coin, why Bitcoin could maintain its gains

As shown below, the price of WTI oil broke above a key resistance level in 2021. McGlone noted that the price of gold and oil have historically been inversely correlated.

Therefore, he seems convinced that oil suggests appreciation for the precious metal and its 2.0 version, Bitcoin. Bloomberg’s intelligence expert said:

Our bias is tilted towards more of the same pendulum (Oil down with gold rising) swinging tendency for oil to continue down in 2H. As falling copper heralds global deflationary trends and the potential for an end to Fed rate hikes, gold should find support to break $2,000 an ounce.