While HIVE Blockchain Technologies (CVE:HIVE) shareholders are in the black for over 3 years, those who bought a week ago are not so lucky

It may be a concern for shareholders to see HIVE Blockchain Technologies Ltd. (CVE:HIVE) share price down 29% in the last month. But that doesn’t change the fact that the returns over the past three years have been spectacular. In fact, the share price has risen a whopping 334% in that time. Without a doubt, the latest fall is to be expected after such a strong rise. The share price action may mean that the business itself has improved dramatically in that time.

Since the long-term performance has been good, but there has been a recent pullback of 15%, let’s check if the fundamentals are in line with the share price.

See our latest analysis for HIVE Blockchain Technologies

HIVE Blockchain Technologies was not profitable in the last twelve months, it is unlikely that we will see a strong correlation between the share price and earnings per share (EPS). Income is without a doubt our next best option. When a company is not making money, we generally expect good earnings growth. That’s because rapid revenue growth can easily be extrapolated to predict profits, often of significant size.

Over the past three years, HIVE Blockchain Technologies has increased its revenue by 79% annually. That’s well above most pre-profit companies. And it’s not just incomes that are falling. The share price rose 63% per year during that time. It’s always tempting to take profits after a stock price rally like that, but high-growth companies like HIVE Blockchain Technologies can sometimes maintain strong growth for years. So we’d recommend you take a closer look at this one, or even put it on your watchlist.

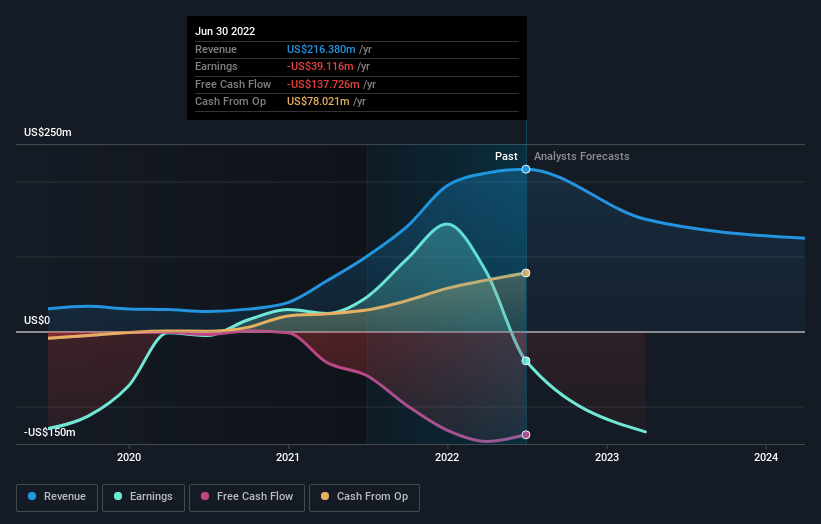

You can see below how income and earnings have changed over time (find the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases over the past year. Nevertheless, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think HIVE Blockchain Technologies will earn in the future (free profit forecasts).

Another perspective

While the broader market lost around 6.2% over the twelve months, HIVE Blockchain Technologies shareholders fared even worse, losing 74%. However, it could simply be that the share price has been affected by wider market turmoil. It might be worth keeping an eye on the fundamentals, just in case there’s a good opportunity. Unfortunately, last year’s performance caps a poor run, with shareholders facing a total loss of 11% per annum over five years. We realize that Baron Rothschild has said that investors should “buy when there is blood in the streets”, but we caution that investors should first be sure that they are buying a high-quality business. It is always interesting to track share price developments in the longer term. But to better understand HIVE Blockchain Technologies, we need to consider many other factors. For example, we have discovered 3 Warning Signs for HIVE Blockchain Technologies which you should be aware of before investing here.

HIVE Blockchain Technologies is not the only stock insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider buys may be just the ticket.

Please note that the market returns provided in this article reflect the market weighted average return for stocks currently traded on CA exchanges.

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the shares mentioned.

Valuation is complex, but we help make it simple.

Find out about HIVE Blockchain Technologies is potentially over- or under-rated by checking out our extensive analysis, which includes fair value estimates, risks and warnings, dividends, insider trading and financial health.

See the free analysis