Founded in China and based in the Seychelles, Huobi has grown to become one of the largest cryptocurrency exchanges based on trading volume. Originally marketed to Chinese investors, the company has grown to cater to over 130 countries.

Having launched in 2013, Huobi is also one of the oldest names in crypto and has built teams in Hong Kong, Japan, South Korea, UK, Australia, Canada and Brazil.

Huobi also has its own token, Huobi Token (HT), which was issued in early 2018 and is well within the world’s top 100 cryptocurrencies by market capitalization.

Analyzing Huobi as a company

Founded by former Oracle computer engineer Leon Li, Huobi built its presence in Beijing as a cryptocurrency trading platform in China and overseas, quickly becoming one of the three largest exchanges domestically by providing relatively easy access to liquidity for Bitcoin traders.

However, following an escalation of Chinese regulatory measures in the cryptocurrency landscape, Huobi was forced to establish a base in the Seychelles in 2017, with a new headquarters established in Singapore to help keep its focus on Asian markets.

In the years that followed, Huobi managed to become one of the world’s most liquid cryptocurrency exchanges and successfully grew its active users far beyond China.

However, Huobi’s journey to prominence has not been entirely free of controversy. In 2019, Bitwise Asset Management accused the platform of wash trading as a means of artificially inflating its reported trading volume statistics. Although the charge was dismissed, Huobi announced that it was creating new measures to counter wash trading within the platform, and trading volumes fell as a result.

Due to regulatory headwinds, Huobi Global’s US arm, HBUS, was forced to close in late 2019 and added Singapore to its limited jurisdictions in 2021. In addition, China’s struggle to regulate cryptocurrency also greatly affected Huobi, and the company announced that it would have to close the accounts of its Chinese customers in 2021.

In October 2022, Huobi was acquired by About Capital, which has helped the company continue its operations as a leading crypto-asset ecosystem. At the core of Huobi’s business is the company’s own blockchain, called Huobi Eco Chain, and a core following of tens of millions of customers across 100 countries worldwide.

What makes Huobi so popular?

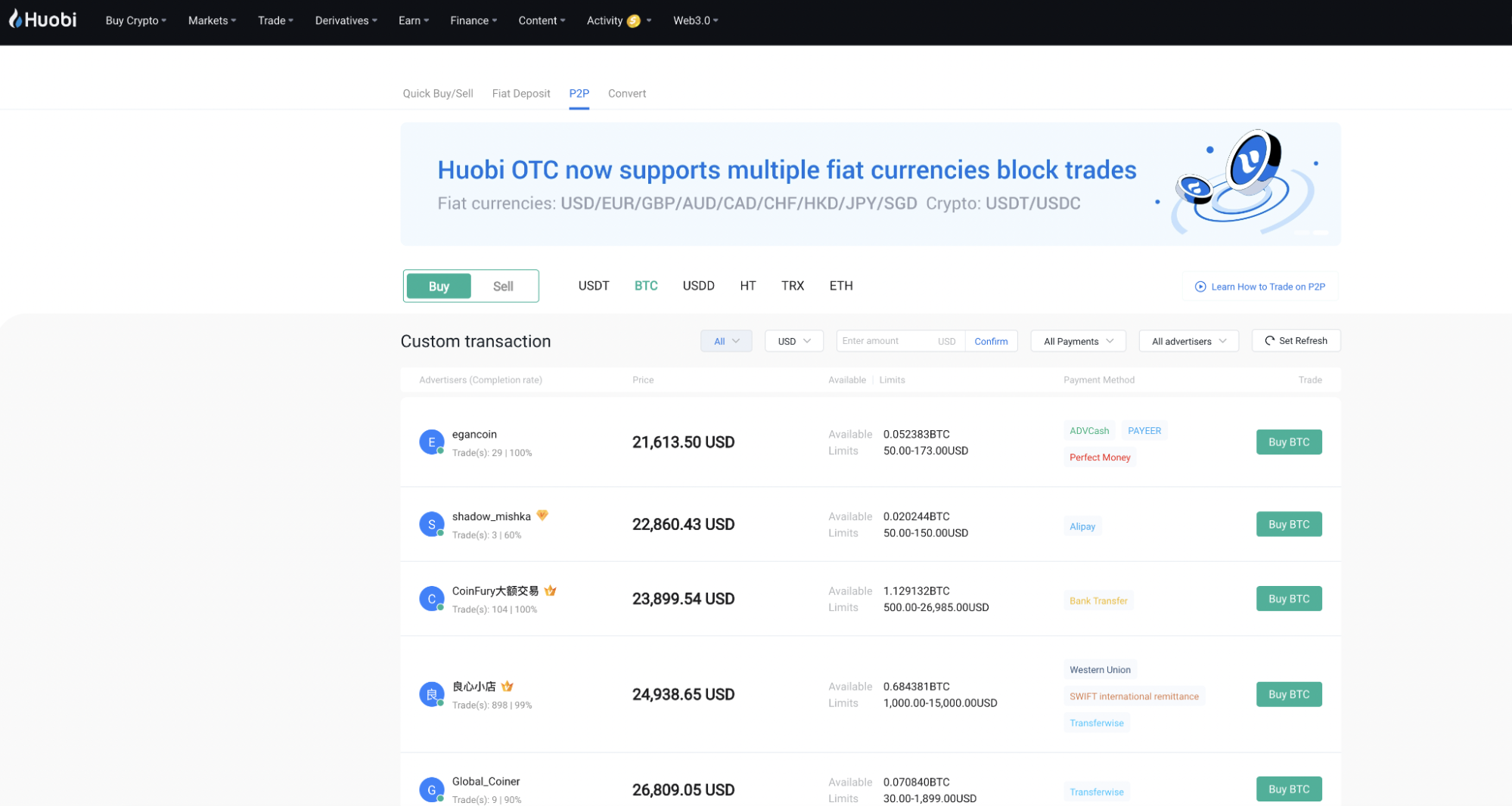

One of the best advantages of Huobi’s platform is its customized user experience, which is shared between Huobi OTC and Huobi Pro.

To accommodate customers of all skill sets, Huobi OTC offers a simplified experience that allows users to trade one of 25 fiat currencies for one of six listed cryptocurrencies. Furthermore, trading in BTC, ETH and USDT does not come with transaction fees.

On the flip side, Huobi Pro offers trading pairs for over 100 cryptocurrencies and has a more detailed screen for users to access. Trades also come with a 0.2% transaction fee in most cases.

Huobi’s tailored user experience is not dissimilar to that used by Binance, and the platform’s user interface is also very similar to Binance, with simple drop-down menus offering a variety of more intricate options for traders.

What is Huobi Token?

However, the real advantage of Huobi comes in the form of its native cryptocurrency, the Huobi Token (HT). Using the token can provide many benefits for investors using Huobi’s platform, and purchases made using HT can provide significant savings in discounted transaction fees for users.

Furthermore, Huobi buys back 20% of its token, which is then placed in a user protection fund that can be redistributed to holders as insurance against potential hacks.

Huobi’s token forms a central part of the Huobi Eco Chain, which hosts DeFi apps that have the power to perform decentralized lending and borrowing functions, offering more financial options to users.

The coin’s favorable position within the cryptocurrency ecosystem has meant that HT has been known to perform relatively well during bull runs. For example, in the crypto rally of 2021, HT climbed from a year-opening value of around $5 to a brief peak of $39.66.

Although the market has since rebounded, bringing the value of the Huobi Token back down to earth, the asset’s market cap of over $800 million illustrates the strength of the token.

How does Huobi work?

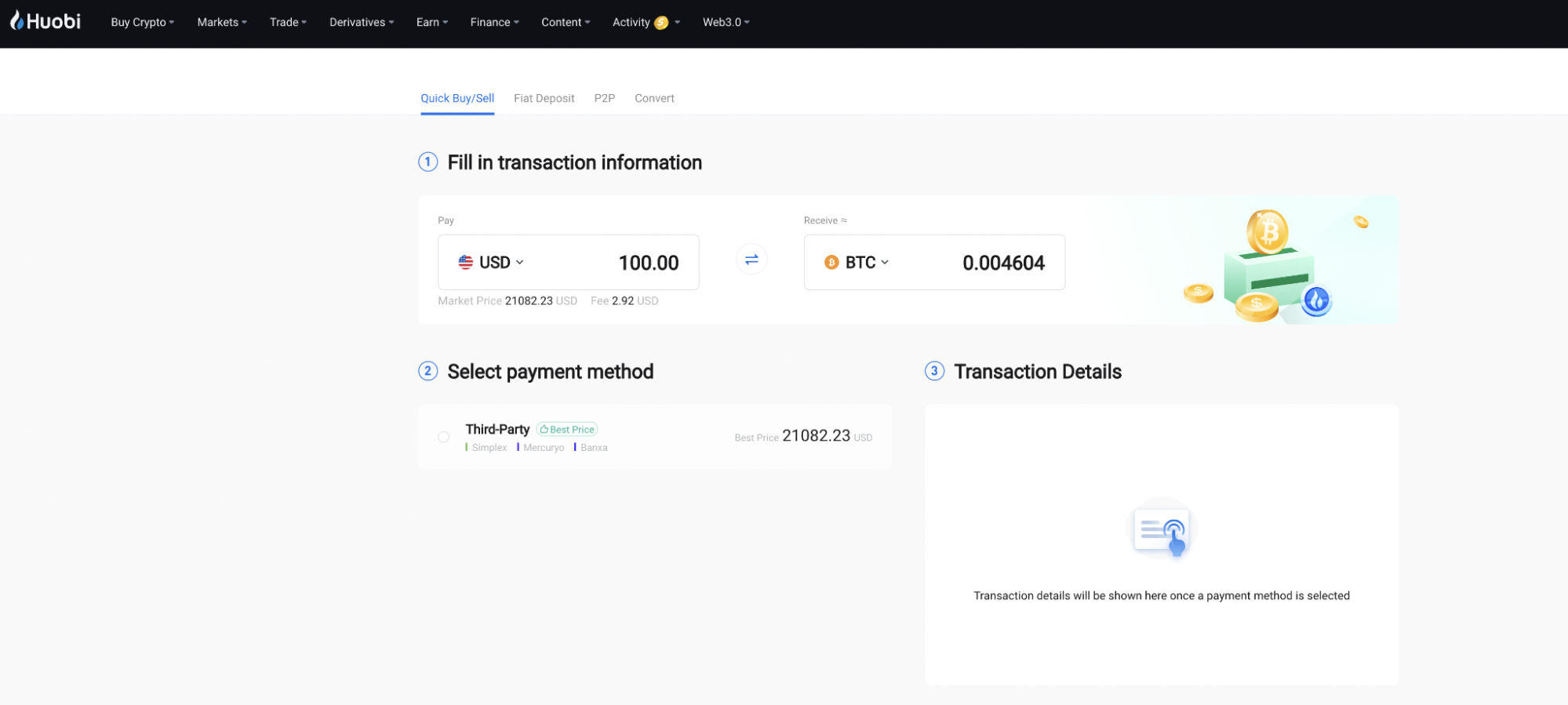

Huobi operates in the same way as many of the world’s leading cryptocurrency exchanges. Users are free to buy, sell and transfer crypto, while the platform earns a small cut from the transaction and trading fees.

The platform’s cryptocurrency purchase process is highly transparent, and the site indicates when third-party market makers can facilitate transactions from fiat to a designated coin.

Furthermore, Huobi also supports P2P trading within its platform, which means users can tap into a significant pool of users to buy and sell their chosen cryptocurrency at transparent prices. For added security, users can see feedback ratings and the number of trades each has completed.

Recently, Huobi developed and implemented a dedicated stablecoin, HUSD, which was backed by the value of the US dollar. However, the asset was delisted by the exchange in 2022. It is currently unclear if there are plans to reintroduce a stablecoin linked to the platform.

Deposit and withdraw crypto on Huobi

Impressively, Huobi has over 90 deposit and withdrawal methods, including bank transfers and credit card payments. The platform’s quick purchase feature allows users to access their assets faster.

Currently, deposits and withdrawals are available on Huobi via the following methods:

- Faster payments

- Visa/Mastercard

- SWIFT international transfer

- USD balance

- US ABA transfer

- LATE

- Fees

In terms of administration fees, the minimum deposit for Huobi is $100, and users can expect a 1% fee if this deposit is completed via international bank transfer.

If you’ve added your KYC credentials, you can withdraw as much as 200 BTC plus withdrawal fees, which are currently 1% for international bank transfers. For cryptocurrency withdrawals, this figure stands at 0.0001 BTC and 0.001 LTC respectively.

Builds on experience

Huobi’s ten years of experience with cryptocurrency has cut through in the development of the platform. Although regulatory pressure has caused the platform to take on significant challenges in recent years, Huobi has adapted and grown.

For investors looking for a change from Binance, Huobi’s framework clearly shares a similar user experience and level of comprehensiveness that will interest users of all experience levels.

Backed by its own blockchain and impressive native currency, we can expect to see Huobi’s past continue to shape a secure and innovative future in the industry.