Tags in this story

crypto wallet, Human readable, Human readable addresses, multisig, multisignature, non-custodial wallet, QR codes, Seed Phrase, Self-custody, shareable links, user experience, UX, Web3

all about cryptop referances

User experience (UX) design affects almost every waking moment of our lives. It’s not just digital either. Have you ever thought about the UX of doors? Perhaps a brief refresher on what UX is will help. A useful definition of UX is as follows: “A person’s perception and response resulting from the use or anticipated use of a product, system or service” (from The International Organization for Standardization).

The following opinion piece was written by Bitcoin.com’s Head of Product Experience Alex Knight.

Back to the doors. We’ve all experienced a door that didn’t open the way it was supposed to. There is a UX error there (there is a name for such doors, search for “Norman doors”).

Fortunately, Norman doors are rare, as are their computer software and web2 counterparts. Unfortunately web3, still in its infancy, is full of Norman doors. Until we fix most of these well-known doors, web3 mass adoption is unlikely.

In this article I will discuss three areas web3 needs to work on. Warnings: this list is not exhaustive, and since my area of focus is web3 wallets, I will talk about UX challenges through that lens. The three areas are:

It is obvious that security is essential for software that handles financial instruments. Two of the bigger security challenges right now are:

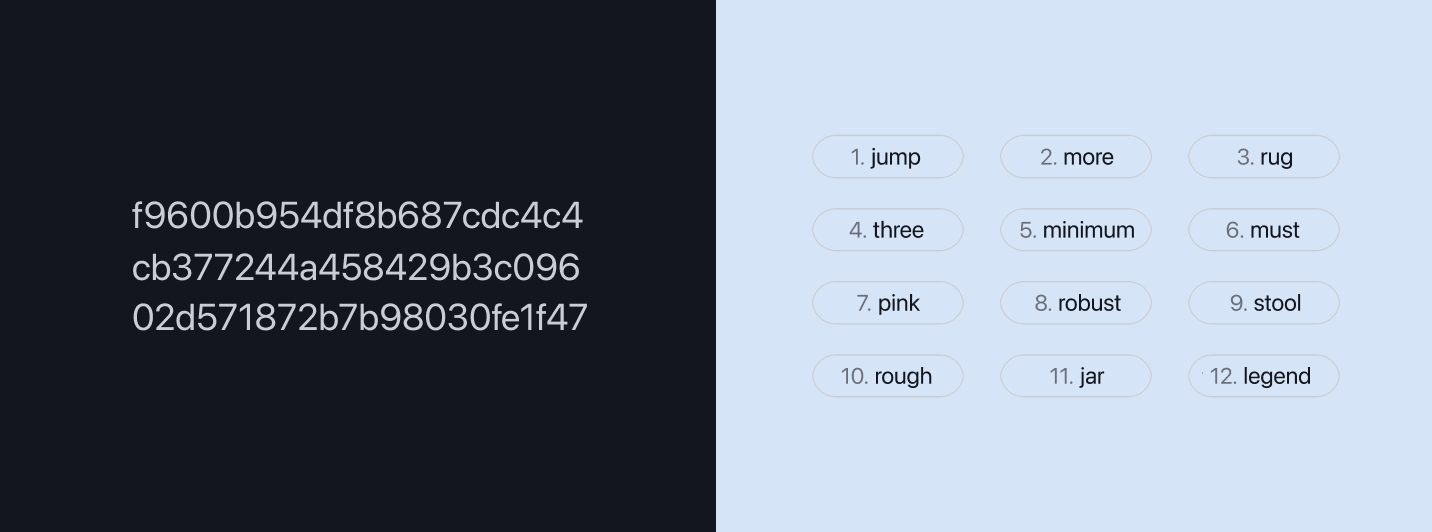

I believe that self-storage is the most important concept in crypto. This is not to say that everyone must use self-storage. However, it is crucial that it always remains a viable option. I refer you to Bitcoin.com CEO Dennis Jarvis’ article on the subject for a compelling defense of self-storage. So far, self-storage has meant that users must manage cryptographic keys. An early UX advance was to use recovery phrases, sometimes called seed phrases, instead of dealing with cumbersome incomprehensible cryptographic keys.

While recovery phrases were improved with cryptographic keys, recovery phrases have proven to be quite complicated. There is a constant drip of stolen crypto due to people not fully understanding the importance of their recovery phrases such as revealing or losing them. This leads to the second security issue: incomprehensible crypto transactions. In most crypto scams, people willingly enter into transactions they don’t fully understand that send their crypto assets away.

Many are working on the issue of recovery phrases. Vitalik Buterin advocates something called social recovery wallets that don’t require recovery phrases. This concept has a lot of promise, although I think a lot more work needs to be done to make it usable for most people.

Another tactic is to replace recovery phrases with something more familiar – passwords. Just as a recovery phrase (set of random words) is more known than a cryptographic key (string of hexadecimal characters), a password is more known than a recovery phrase.

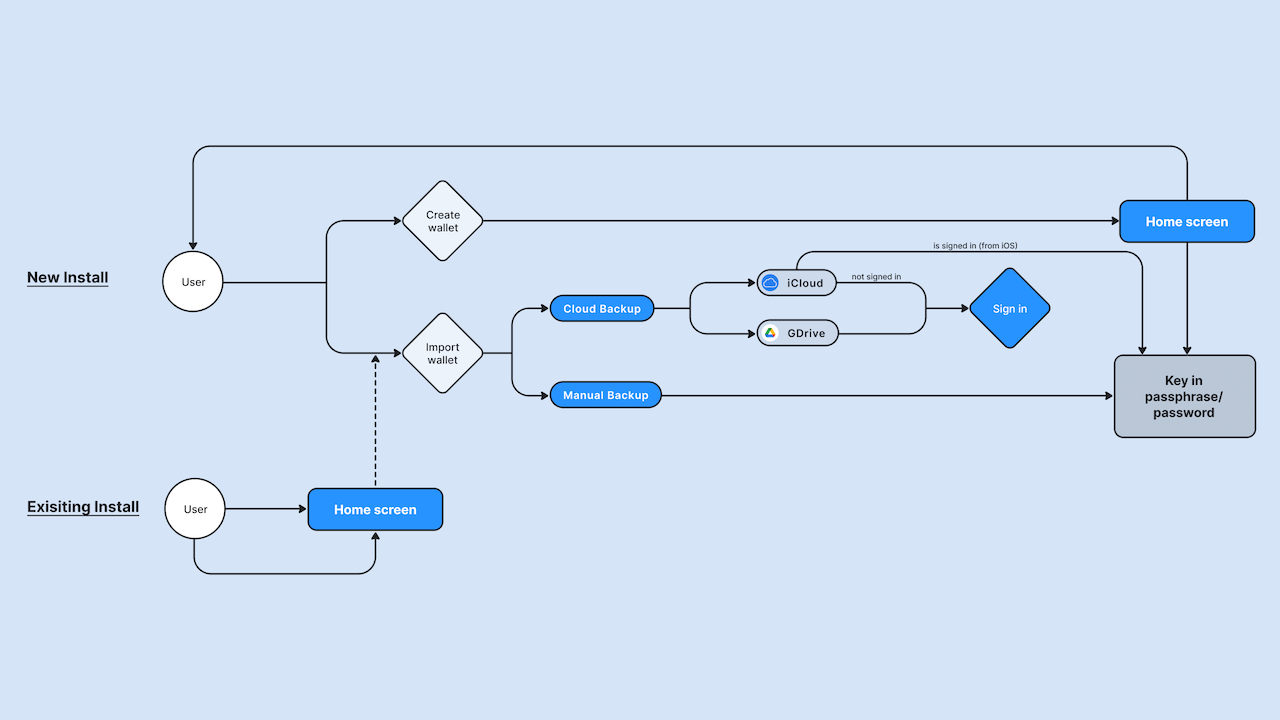

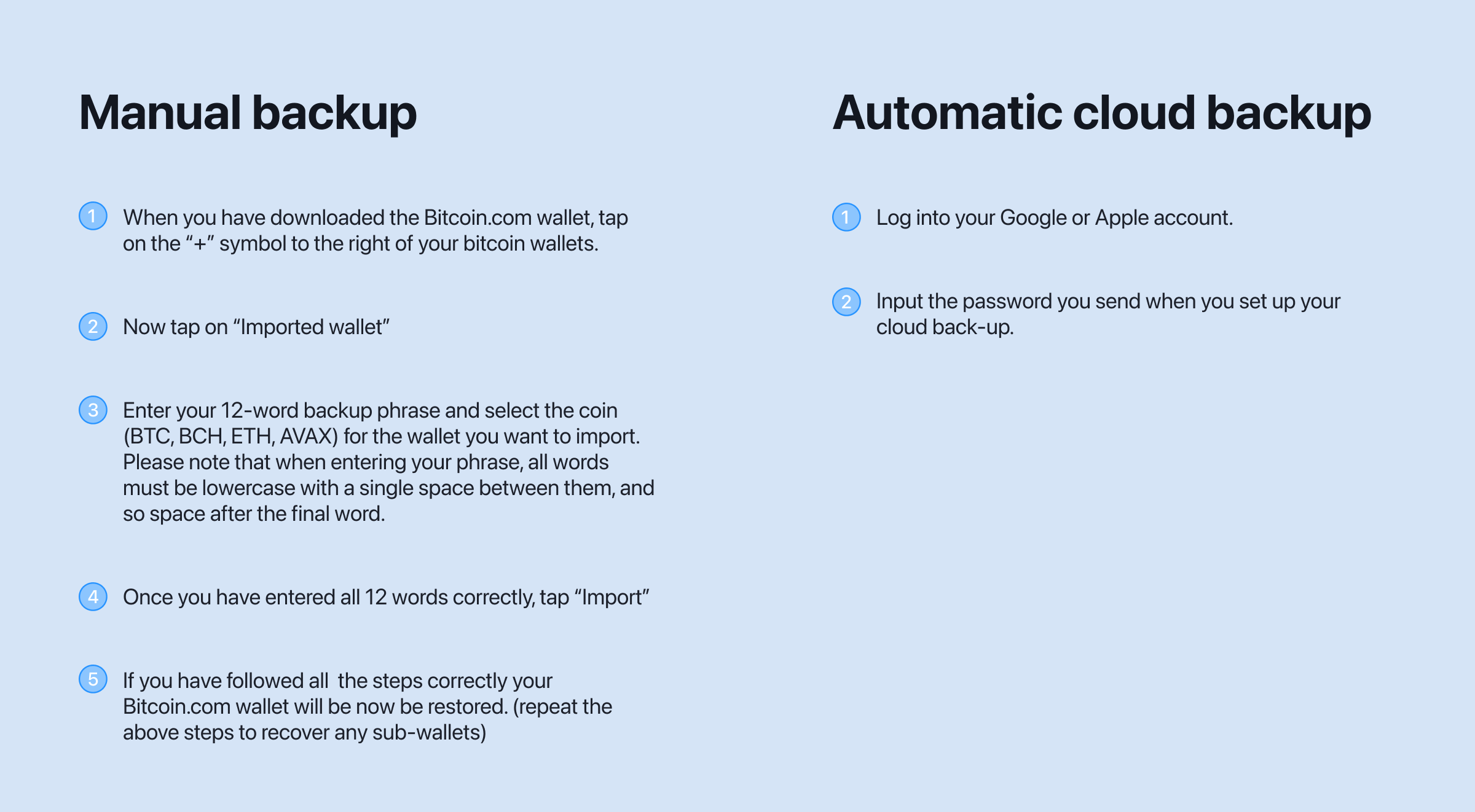

We offer automatic cloud backup services. Create a single custom password that decrypts a file stored in your Google Drive or Apple iCloud account. If you lose access to your device, you can reinstall the Wallet app on a new device, enter your password, and you will regain access to all crypto assets. By creating a mix of encryption and cloud services linked to custodial services to help retrieve things, we can maintain a self-storage service while leveraging centralized technologies to reduce the burden on the user. The ease of use of automatic cloud backup compared to manual backup through recovery phrases is easy to visualize:

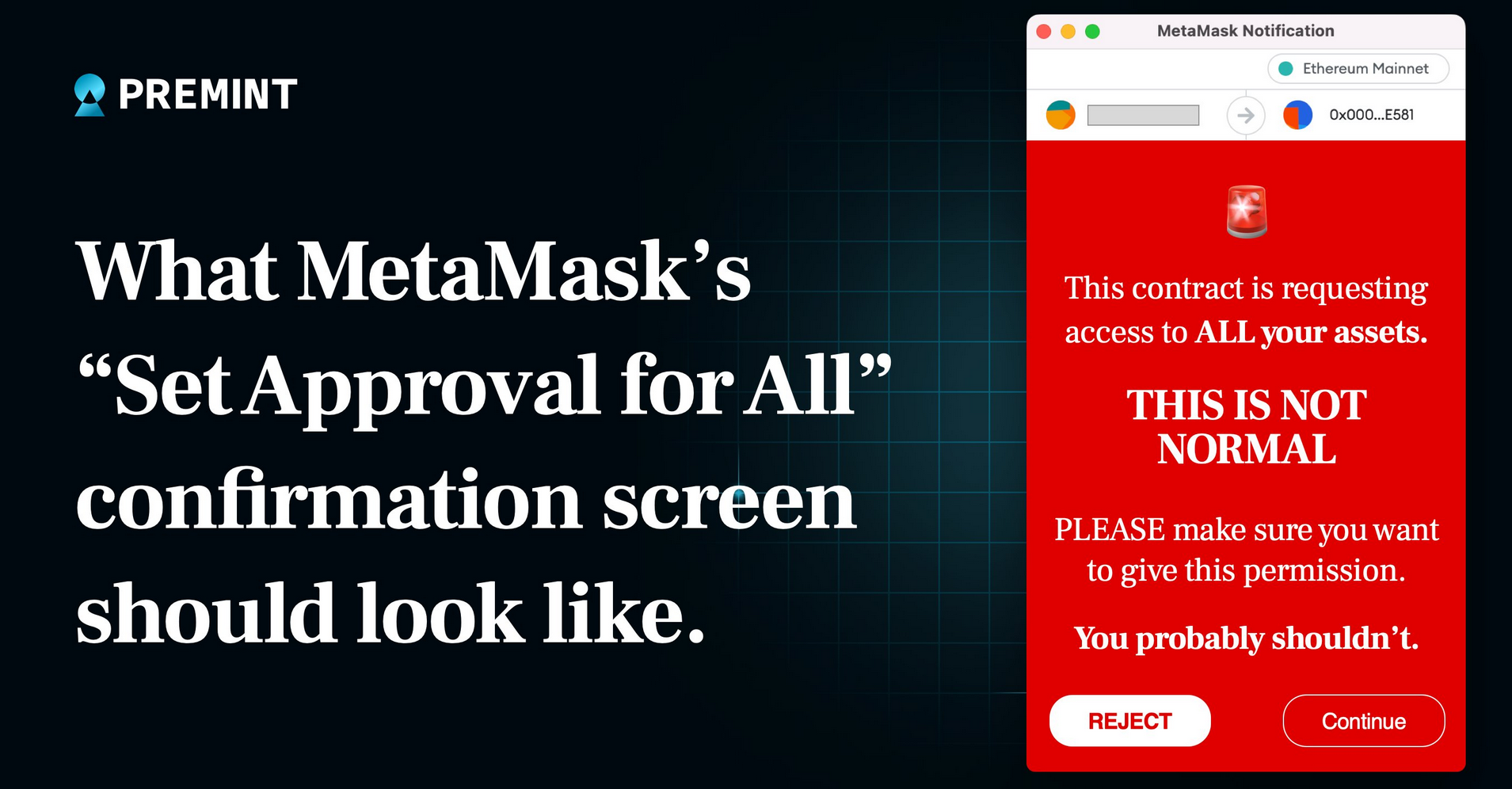

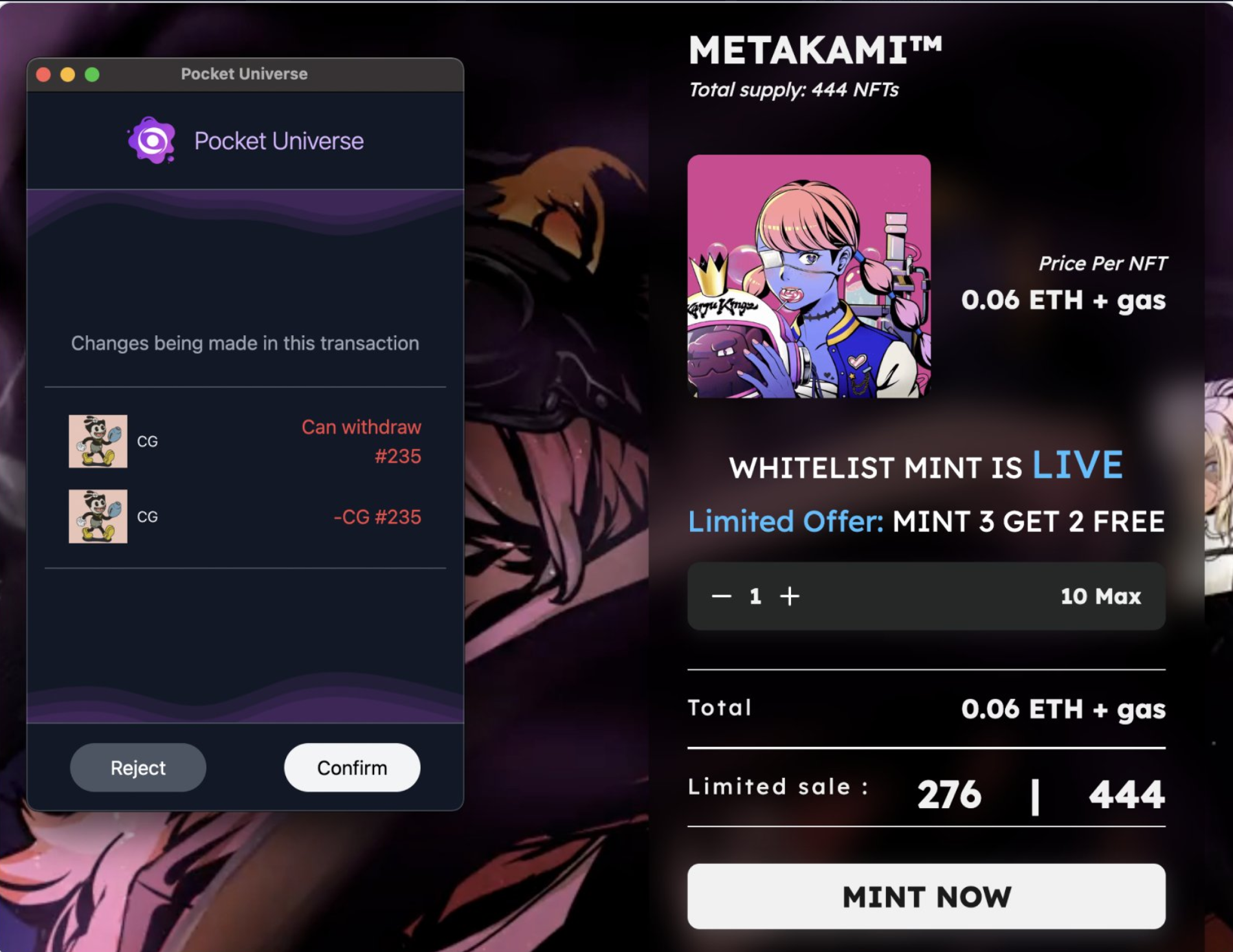

Wallets need to get better at warning users about unintended outcomes of transactions. For example, a common approach is to get users to sign a ‘SetApprovalForAll’ transaction, which allows an adversary to transfer assets from your wallet to theirs. Wallets should alert users when these types of transactions come up, and clearly describe the dangers.

Even better, wallets can provide users with a more readable summary of potential changes in assets transactions allow. For example, you may believe that you are exchanging one asset for an appropriate amount of another, when in fact you are exchanging all of the assets for nothing. The following will help you better visualize which assets a potential transaction could change.

There are two ways most people first interact with blockchain technology: a centralized exchange and a self-service software wallet. The first time people interact with a blockchain “directly” will almost always be through the latter. Software wallets involve a large amount of responsibility and an even greater challenge in easing new users into the “deep end” of crypto – decentralized finance (DeFi).

Education is an important part of this. It is important to give users the right opportunities to upgrade and build towards full self-storage and safely move away from relying on centralized support. People who are more comfortable/confident with crypto will help increase its use and utility as it becomes a more viable alternative to traditional finance. The abundance of technical jargon doesn’t help. As is common with most new technologies, early adopters are usually extremely technical.

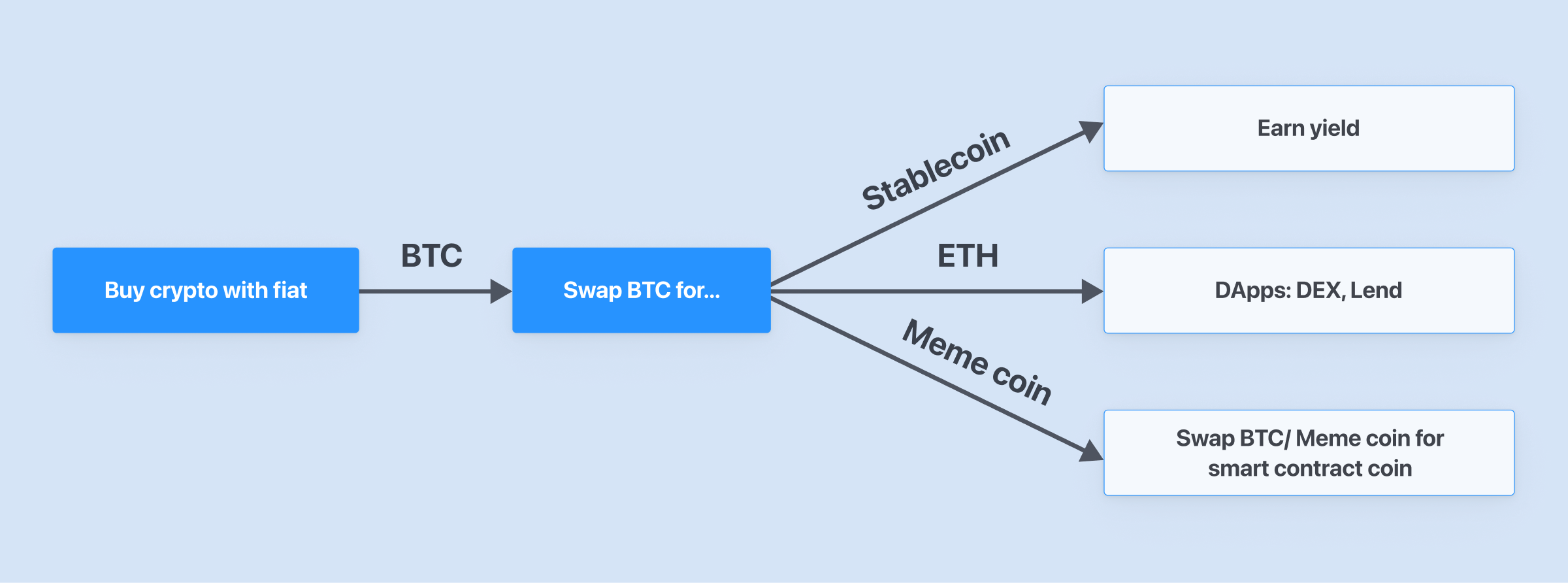

Each action your wallet has should remember a future action that you want the user to perform. For example, let’s assume that the first action a new user should take when downloading the wallet is to buy crypto with fiat. You don’t want to overwhelm new users with hundreds of choices. It’s probably a good idea to just give new users a curated list to buy, with the option of the fully expanded list.

The first actions, such as purchase, should trigger a chain of in-app messages/alerts/emails to try other actions such as switching. Swapping is a big step from buying since every action in a DApp requires paying a transaction fee in the blockchain’s native token, which has no analog in web2.

Wallets are full of technical jargon that is non-descriptive to most people. A good example of this is “non-custodial wallets.” What does this mean? It has recently been adjusted to “self-storage”, which is better, but still not perfect. Another is “multisig wallet.” Even knowing the full meaning, “multisignature wallet,” won’t tell already knowledgeable people what it means. Even users who keep digging deeper by reading full explanations are likely to have some trouble understanding what it is and how to use it. At Bitcoin.com we use “shared wallets”, which we believe everyone can understand without compromising the original meaning.

This last category is not only one of the biggest problems we face, but is intertwined with the previous categories. As crypto matures, it needs to find a wider audience. The developer-driven process must leave room for design. We are slowly starting to see a shift to more design-driven solutions, but there is a long way to go. Let’s look at a couple of examples, starting with random wallets.

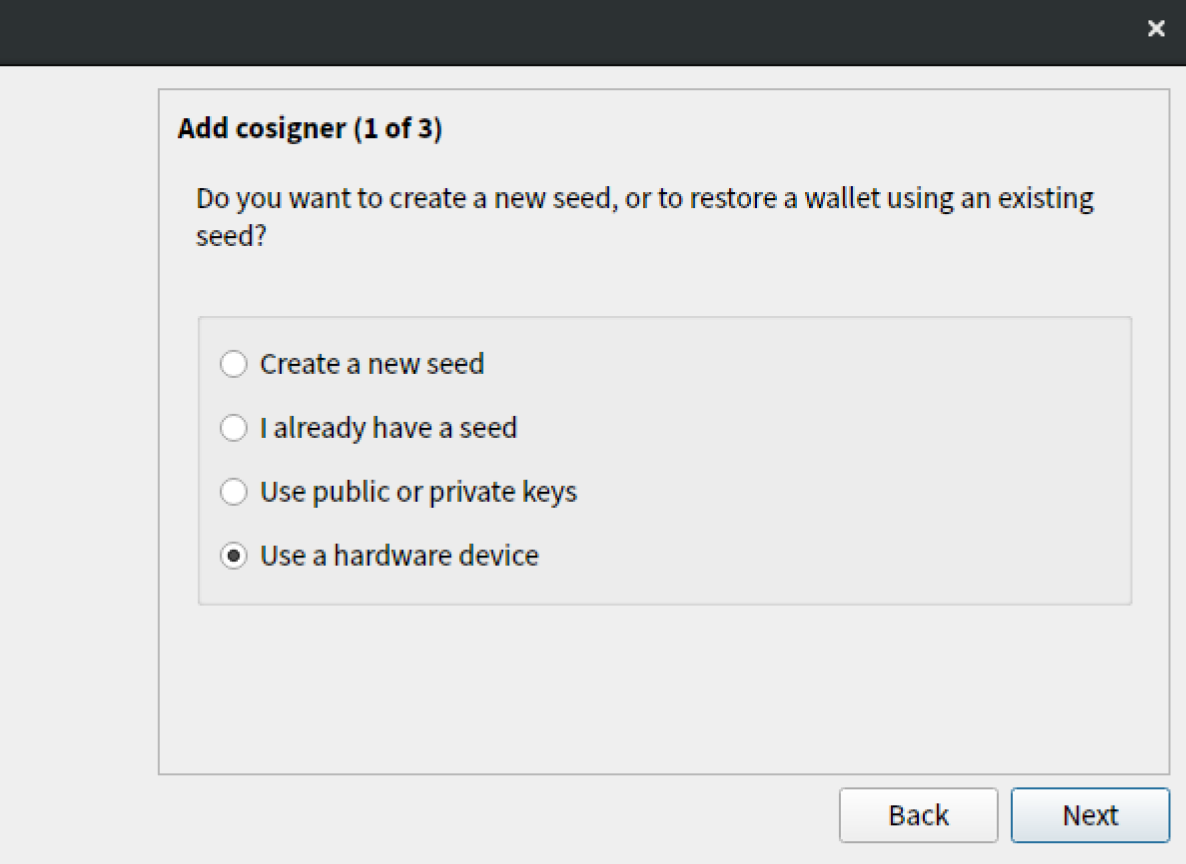

No new user will be able to guess the utility of these from that name. Even worse, even advanced crypto users don’t use them because of complicated interfaces. This is tragic, because as Ethereum co-founder Vitalik Buterin says, multisig is probably the safest way to store crypto assets.

IMO fancy hardware stuff is all overrated and most people should just store the bulk of their coins in a multisig (>= 5 participants) where most of the keys are held by trusted family and friends.

— vitalik.eth (@VitalikButerin) 14 August 2022

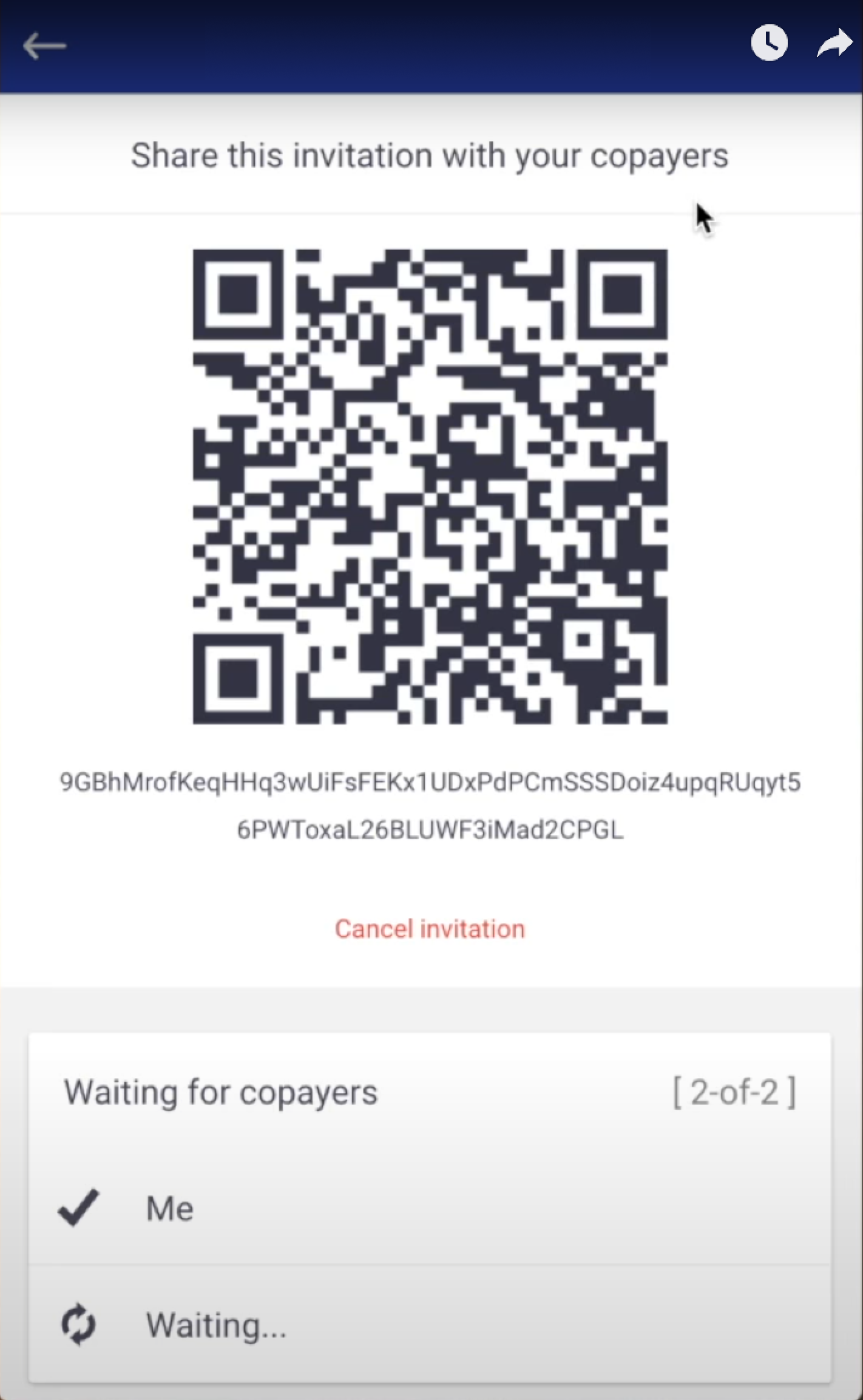

First, “multisig” must be retired. Then multisig options need to be removed for most users. Most people would abandon the process when they encountered a screen like this:

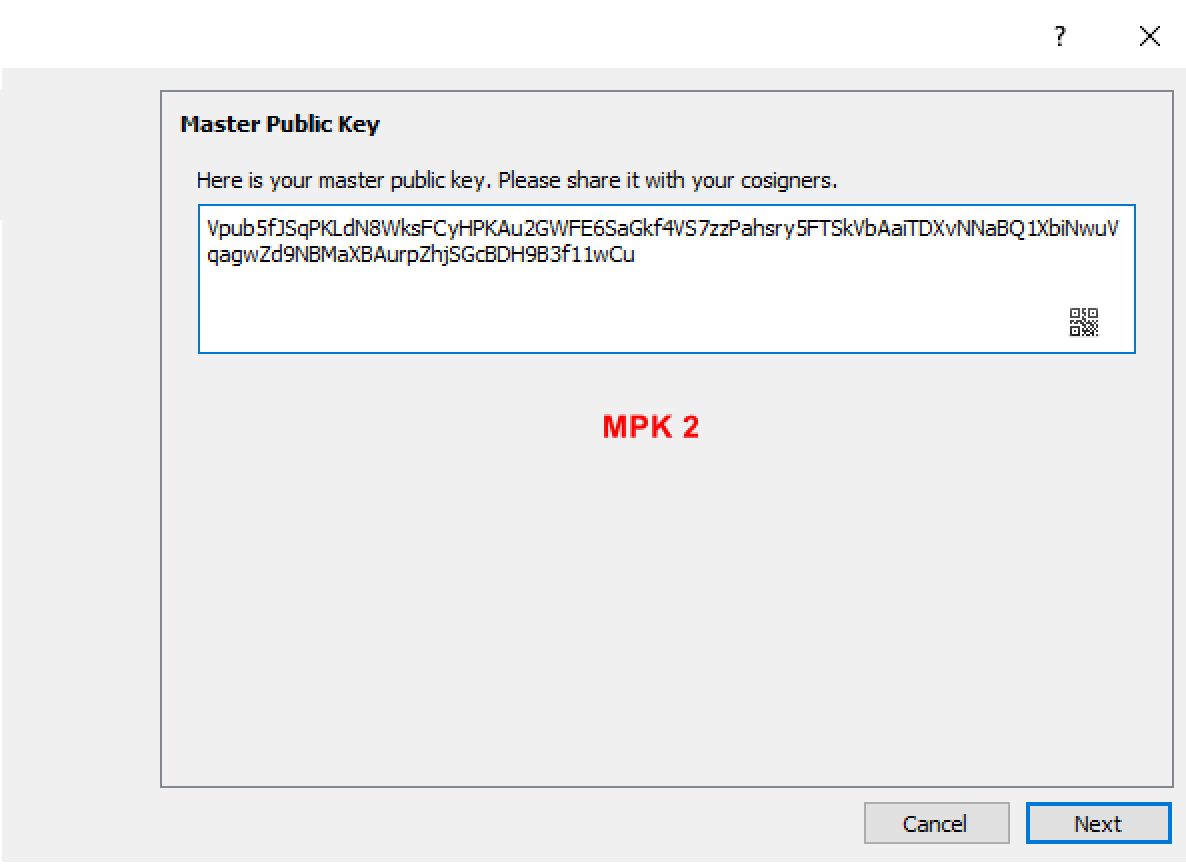

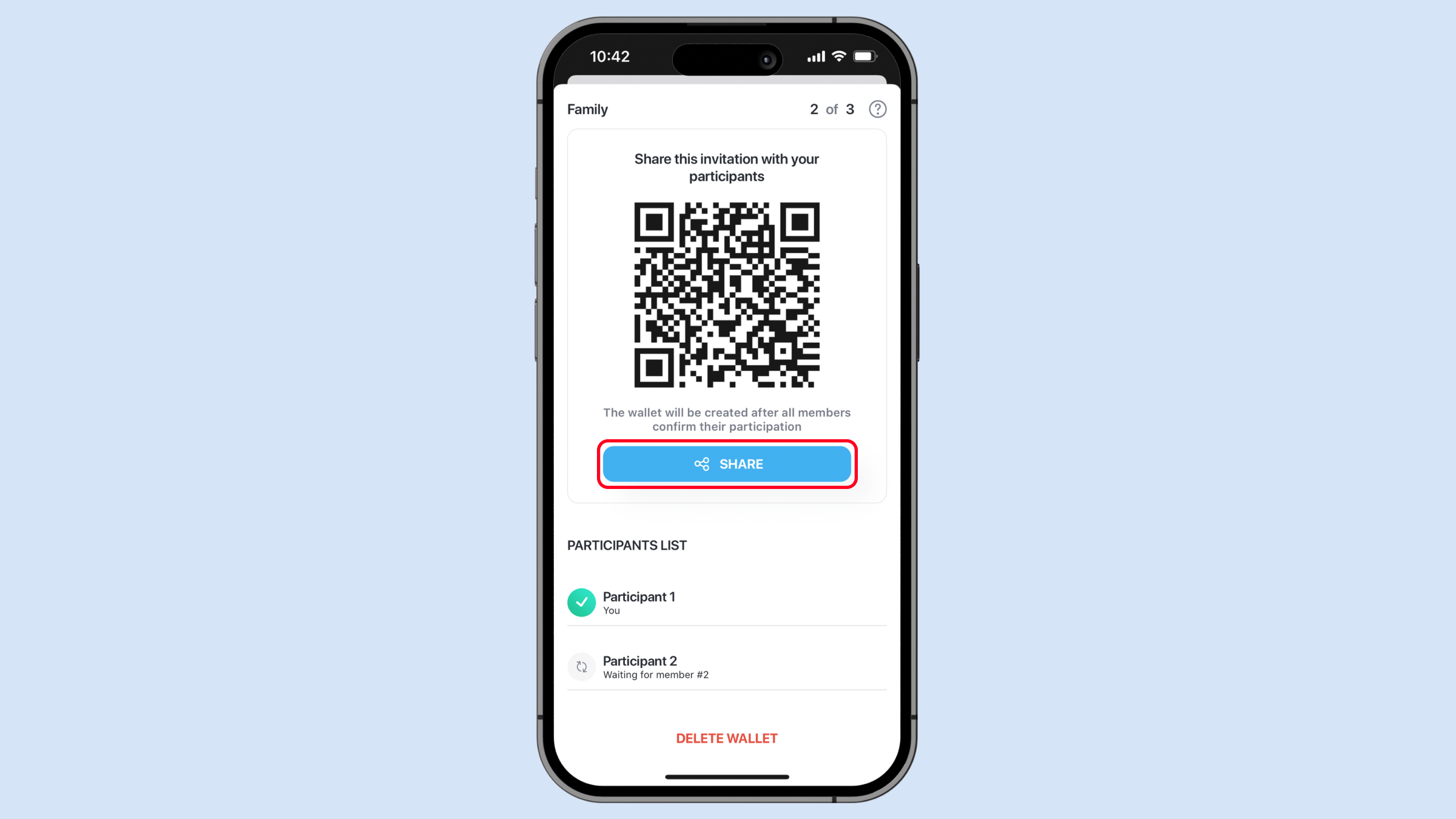

Sharing the newly created wallet should be as seamless as possible, unlike this:

The QR code is enough, redundant information such as the public key can be removed:

A “share” button makes it even easier for users.

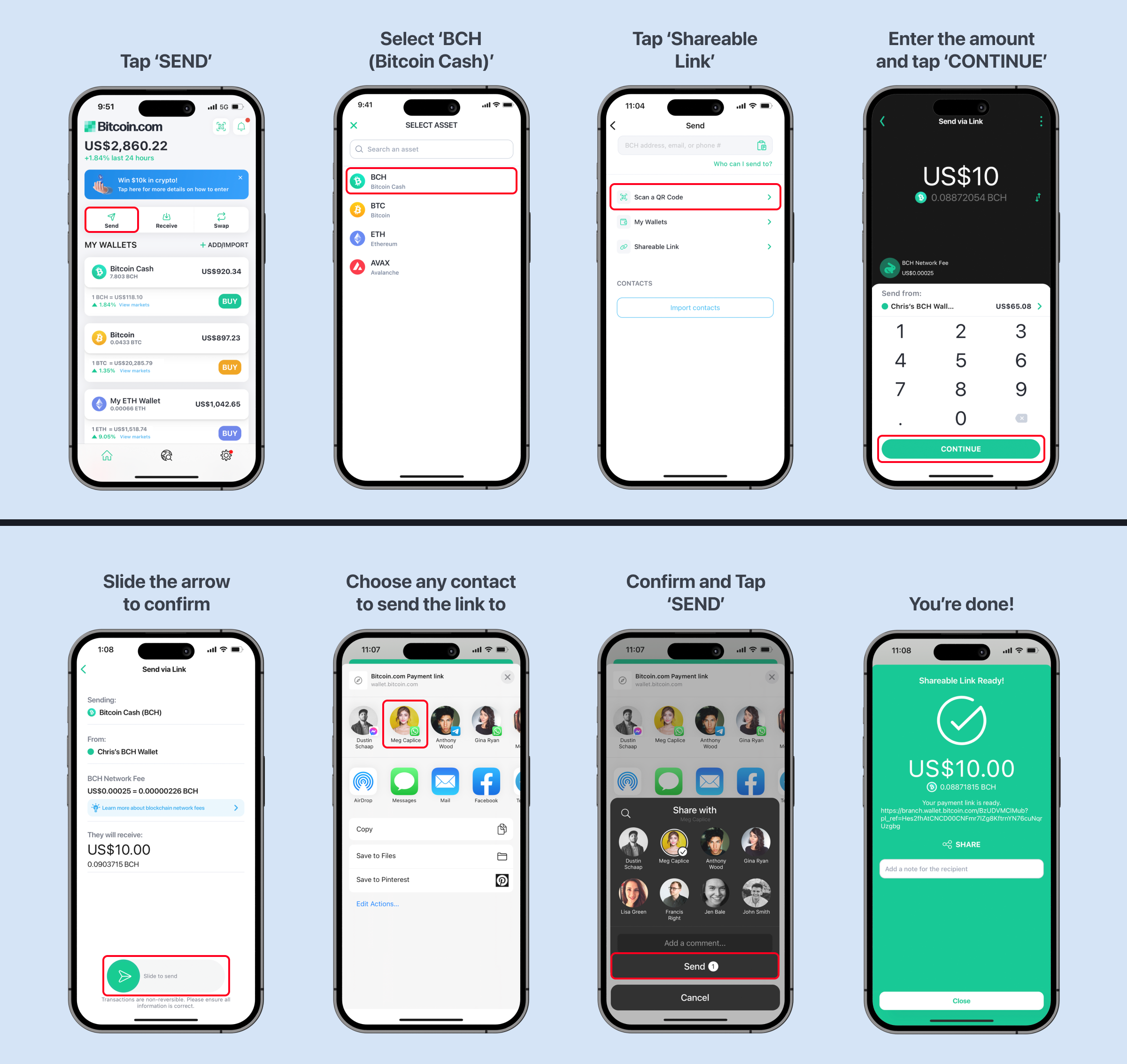

Sending crypto, arguably the most basic action one can take, is still too difficult. There have been attempts like those made by ENS, Unstoppable Domains and FIO to solve the problem, but it’s still a bit of a mess, with different providers using similar domain names and then relying on the wallet to choose which one is the right one and so on.

We’ve taken a different, I would argue simpler, approach: shareable links. You do not need to know the person’s crypto address or ENS. Instead, send the recipient a link via any messaging app (email, Whatsapp, SMS, etc.). The recipient just needs to click on the link and follow the instructions to receive the payment.

I have no doubt that web3 will change the world. The future is already taking shape, but suboptimal designs must be relentlessly chiseled away. I am proud of the design choices Bitcoin.com has made, but have no illusions that they are destined to be the best. Bitcoin.com is one of many companies creating products that push web3 design forward. I can’t wait to see all the design innovations that have helped bring our industry to mass adoption.

What are your thoughts on this story? Be sure to let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.