We don’t think FinTech Ventures’ (WSE:FIV) earnings should make shareholders too comfortable

Investors seem disappointed FinTech Ventures SA (WSE:FIV) latest earnings, despite the decent statutory profit number. Our analysis has found some underlying factors that may be cause for concern.

See our latest analysis for FinTech Ventures

Examining cash flow against FinTech Ventures’ earnings

Many investors have not heard of accrual rate from cash flow, but it is actually a useful measure of how well a company’s profits are supported by free cash flow (FCF) over a given period. In plain English, this ratio subtracts FCF from net income, and divides this figure by the company’s average working capital during that period. You can think of the accrual rate from cash flow as the “non-FCF profit ratio”.

As a result, a negative earnings ratio is positive for the company, and a positive earnings ratio is negative. While having a positive accrual rate, which indicates some level of non-cash profit, is not a problem, a high accrual is arguably a bad thing, because it indicates that paper profit is not matched by cash flow. That’s because some academic studies have suggested that high accrual ratios tend to lead to lower profits or less profit growth.

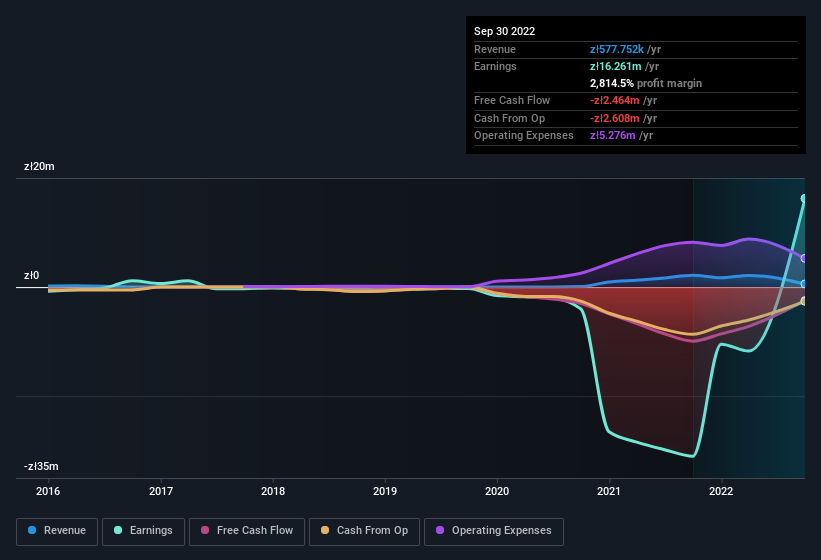

For the year to September 2022, FinTech Ventures had an accrual ratio of 0.33. Therefore, we know that its free cash flow was significantly lower than its statutory profit, which raises questions about how useful this profit figure really is. Although it reported a profit of zł 16.3 million, a look at free cash flow indicates that it actually burned through zł 2.5 million in the past year. We also note that FinTech Ventures’ free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of zł2.5m. However, that is not all there is to consider. The accrual rate reflects the impact of unusual items on statutory profit, at least in part. The good news for shareholders is that FinTech Ventures’ accrual rate was much better last year, so this year’s poor reading may simply be a case of a short-term mismatch between profits and FCF. As a result, some shareholders may look for stronger cash conversion in the current year.

Note: we always recommend investors to check the balance sheet strength. Click here to access our balance sheet analysis of FinTech Ventures.

How do unusual items affect profits?

Given the degree of accruals, it is not too surprising that FinTech Ventures’ profits were boosted by unusual items worth zł23 million in the last twelve months. We cannot deny that higher profits generally make us optimistic, but we prefer it if the profits are to be sustainable. When we crunched the numbers on thousands of publicly traded companies, we found that a boost from unusual items in a given year is often not repeated next year. Which is hardly surprising, given the name. FinTech Ventures had a fairly significant contribution from unusual items to its profit to September 2022. All things being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our view on FinTech Ventures’ performance results

In summary, FinTech Ventures got a good boost to profit from unusual items, but could not match the paper profit with free cash flow. Taking all this into account, we would argue that FinTech Ventures’ profits probably give an overly generous impression of its sustainable level of profitability. So if you want to delve deeper into this stock, it’s crucial to consider any risks it faces. All companies have risks and we have discovered that 4 Warning Signs for FinTech Ventures you should know about.

Our investigation of FinTech Ventures has focused on certain factors that can make earnings look better than they are. And on that basis, we are somewhat skeptical. But there are many other ways to inform your opinion about a company. Many consider, for example, a high return on equity as an indication of favorable corporate finances, while others like to “follow the money” and seek out shares that insiders buy. Although it may take some research on your behalf, you may find this free collection of companies that boast high returns on equity, or this list of stocks that insiders buy to be useful.

Valuation is complex, but we help make it simple.

Find out about FinTech Ventures is potentially over- or under-rated by checking out our extensive analysis, which includes fair value estimates, risks and warnings, dividends, insider trading and financial health.

See the free analysis

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.