Want Bitcoin [BTC] close 2022 on a price floor? These analysts believe…

![Want Bitcoin [BTC] close 2022 on a price floor? These analysts believe… Want Bitcoin [BTC] close 2022 on a price floor? These analysts believe…](https://www.cryptoproductivity.org/wp-content/uploads/2022/12/shubham-s-web3-QM91Pbw1b7c-unsplash-1-1000x600.jpg)

- CryptoQuant analysts have found that at its current price, BTC’s bottom is in.

- The assessment on the chain revealed that “smart money” was re-entering the market.

After trading momentarily above the $18,000 price mark, Bitcoins are [BTC] The price returned to change hands below $17,500 after the Federal Reserve raised the federal funds rate by 50 basis points (bps) at its December 14 meeting.

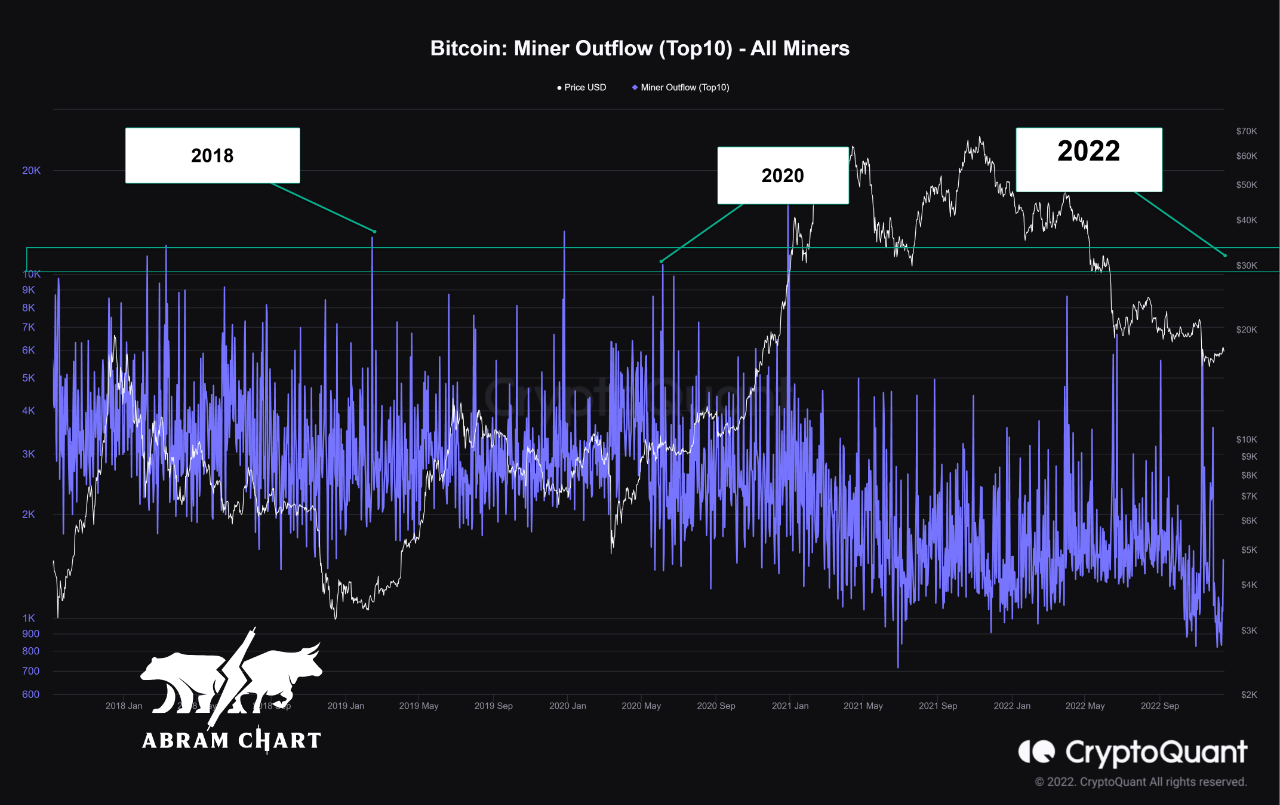

The decline in the price of the royal coin after the Fed’s meeting coincided with the increase in the cost of mining on the BTC network. According to CryptoQuant analyst Abramchart, while BTC was trading below the $18,000 price region, the cost to mine one BTC reached $19,463, indicating that miners at work on the BTC network are mining at a loss.

Read Bitcoins [BTC] Price prediction 2023-2024

Abramchart assessed BTC’s historical performance based on this and believed that the bottom could be in. According to the report, the analyst found a historical correlation between the periods when miners ran BTC at a loss and when BTC logged a price bottom.

“The loss of miners began since June 12, 2022, when bitcoin reached $26,700, and the cost of mining a bitcoin at that time reached $29,450. The same movement appeared at the bottom of March 2020, the cost price of mining was higher than the value of Bitcoin and also the bottom of 2018, Abramchart said.

Source: CryptoQuant

Another CryptoQuant analyst MrPapi shared the same opinion. He conducted a BTC price adjustment for money supply in recent years and also concluded that “the floor is in.”

Due to the impact of COVID-19 in the last two years, the United States government had to print more money to ease the financial stress on the people. According to MrPapi, an adjustment of BTC’s price chart for the increased money supply revealed a correlation between the current BTC cycle and that of 2019.

“Using this chart it suggests the floor was between $15k and $17k,” MrPapi concluded.

Source: CryptoQuant

New money, stronger hands

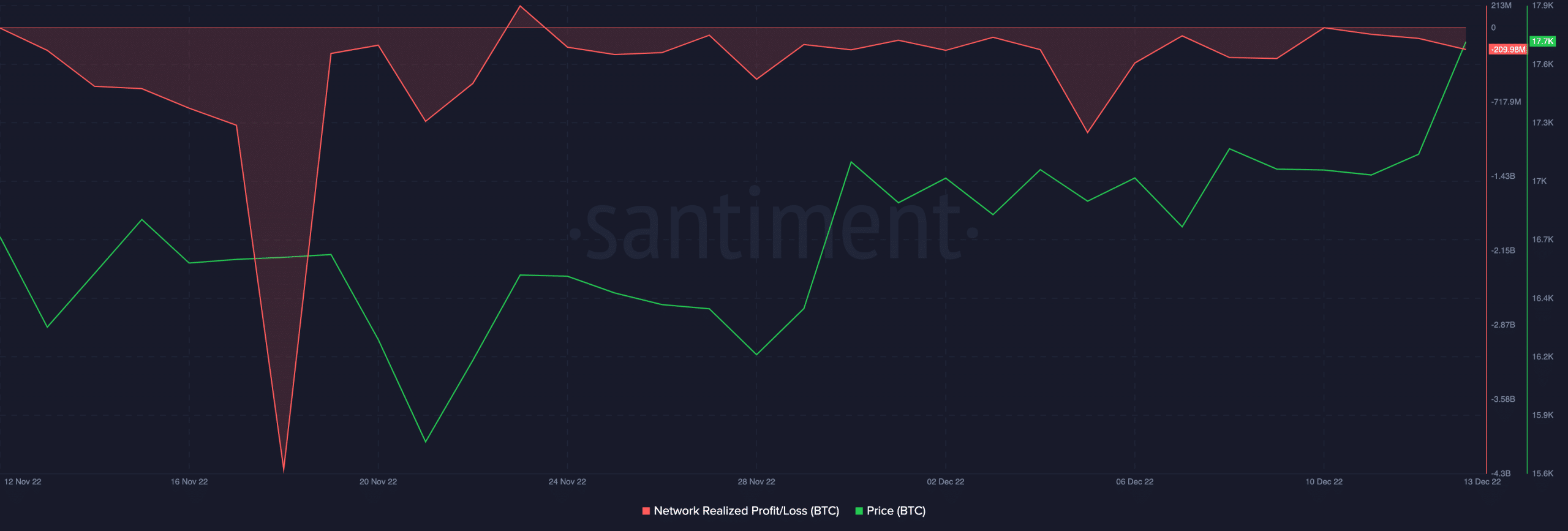

An on-chain assessment of BTC’s Network Profit and Loss ratio (NPL) revealed the re-entry of new demand towards the end of November. Data from Santiment showed a significant drop in BTC’s NPL ratio on November 18, after which the price rallied.

NPL declines are often seen as indicators of short-term selling by less confident investors, known as “weak hands,” and the returns of more strategic investors referred to as “smart money.” These falls are often followed by a rebound in price and a period of recovery.

Source: Sentiment

With increased whale accumulation and increased favorable macro conditions, we are gearing up to end the fourth quarter of 2022. Well, it may sustain a further increase in the value of the leading coin in 2023.