Veteran Trader Tone Vays Says Bitcoin Could Explode 450% Next Year Despite Recent Crash – Here’s Why

Cryptocurrency analyst and trader Tone Vays describes the long-term bull case for Bitcoin (BTC) after the flagship digital asset hit two-year lows sparked by FTX founder and crypto outcast Sam Bankman-Fried.

In a new video, Vays tells his 123,000 YouTube subscribers that even if Bitcoin falls to around $11,000, the largest crypto asset by market capitalization could still hit a new all-time high of $100,000 next year.

The veteran crypto trader believes that his predicted Bitcoin collapse is likely to attract buyers who plan to hold BTC for the long term.

“We could have a capitulation down to $11,000 and still hit $100,000 next year. Because a lot of Bitcoin is going into cold storage because people can buy it cheap.”

Bitcoin is trading at $16,886 at the time of writing, up about 8% from a two-year low of around $15,600 on Tuesday.

Vays says that if Bitcoin closes this week above the $18,500 support level, it could be an indication that the flagship crypto asset has bottomed.

“If we close the week above this support level [$18,500]I’m going to be a little confident that the lowest may be in. Right now it looks very, very promising.”

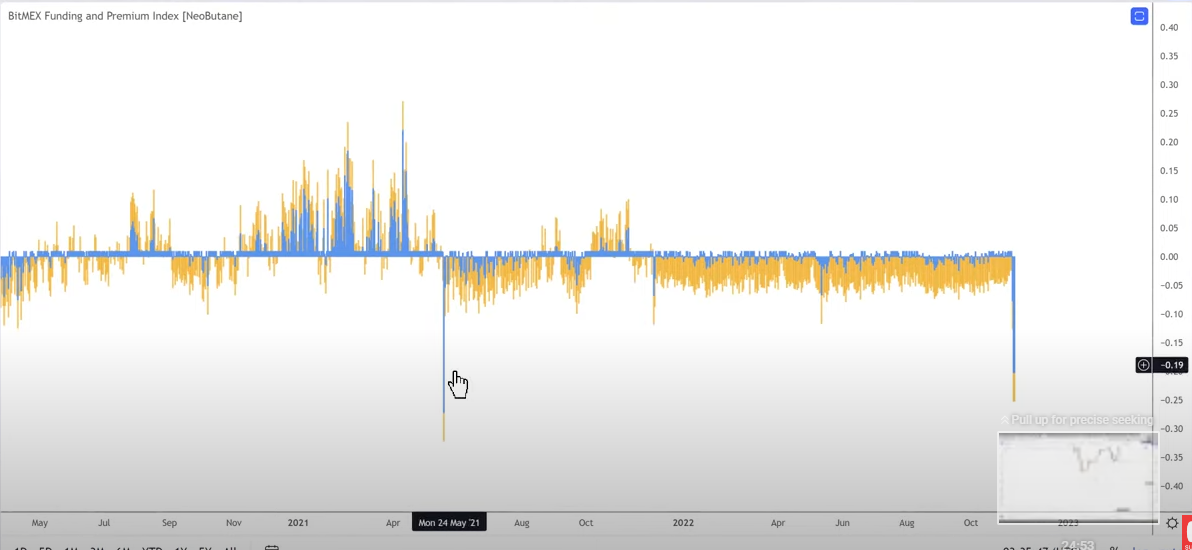

According to the veteran trader, funding rates on crypto trading platform BitMEX also indicate that there may be a bottom for Bitcoin based on historical behavior.

“That’s how markets tend to bottom out. Let’s look at the last time the BitMEX funding rate was this low. The last time the financing rate was this low was in May 2021. Let’s see what happened in May 2021. It was right here [$30,000]. Finally, off of that, we went to a new all-time high [of $69,000].

So I’ll take those odds. I’ll take the chance that the lowest one is in.”

Looking at the trader’s chart, it appears that the funding rates are extremely negative, indicating that the traders are accumulating a lot of short positions. The condition could potentially set up the crypto market for a short squeeze, where traders who borrow units of an asset at a certain price in hopes of selling them at a lower price to pocket the difference are forced to buy assets back when the trade moves against their bias.

I

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: DALLE-2