A new study on digital currency-related lawsuits since 2018 shows a 42% increase in crypto lawsuits by 2022. The highest number of claims in a single year was recorded last year, with 41 total claims in the US. The research also shows that the majority of lawsuits came from the US Securities and Exchange Commission (SEC).

Rise in US Crypto Lawsuits Tracked Since 2018: Report

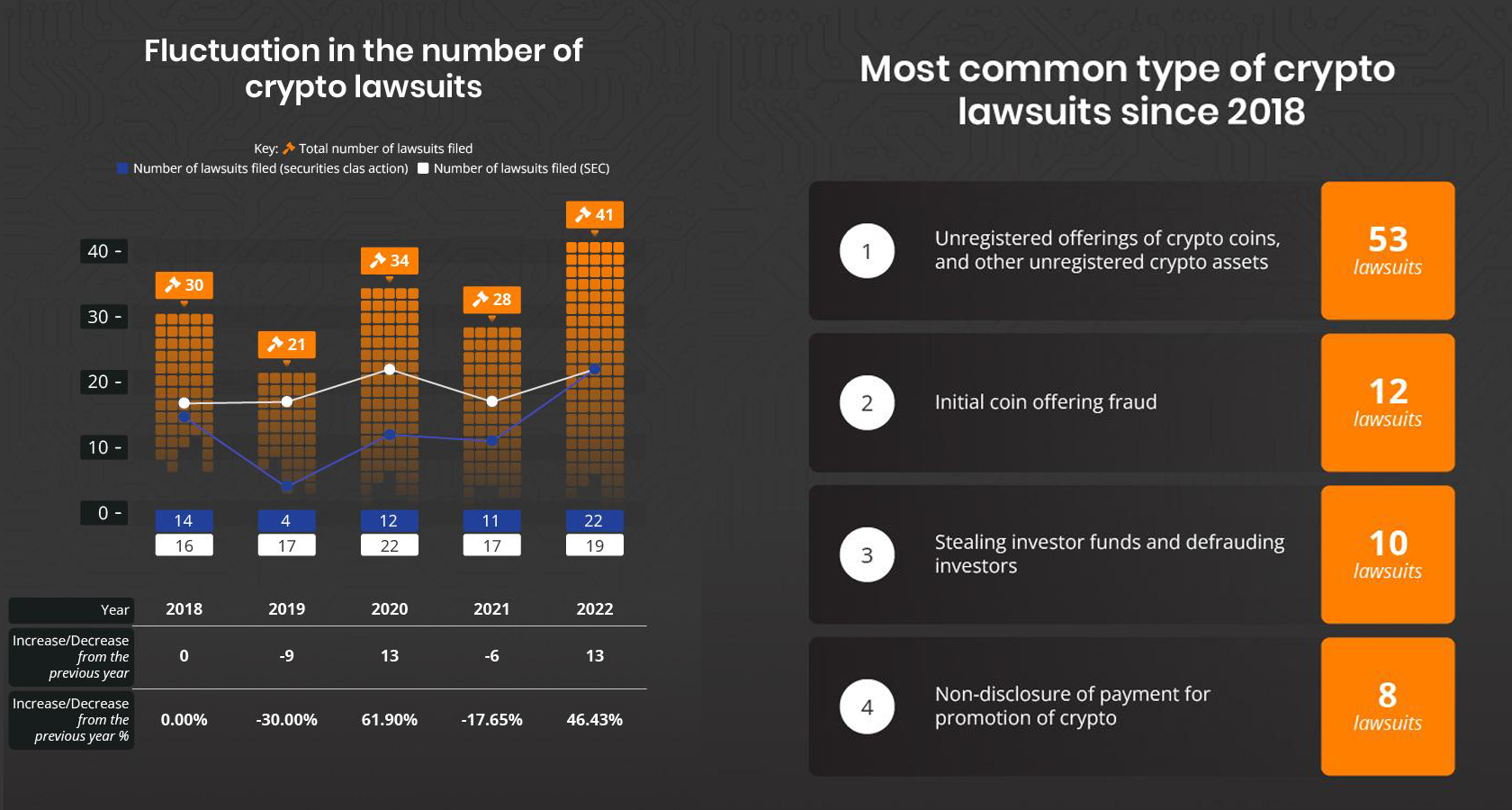

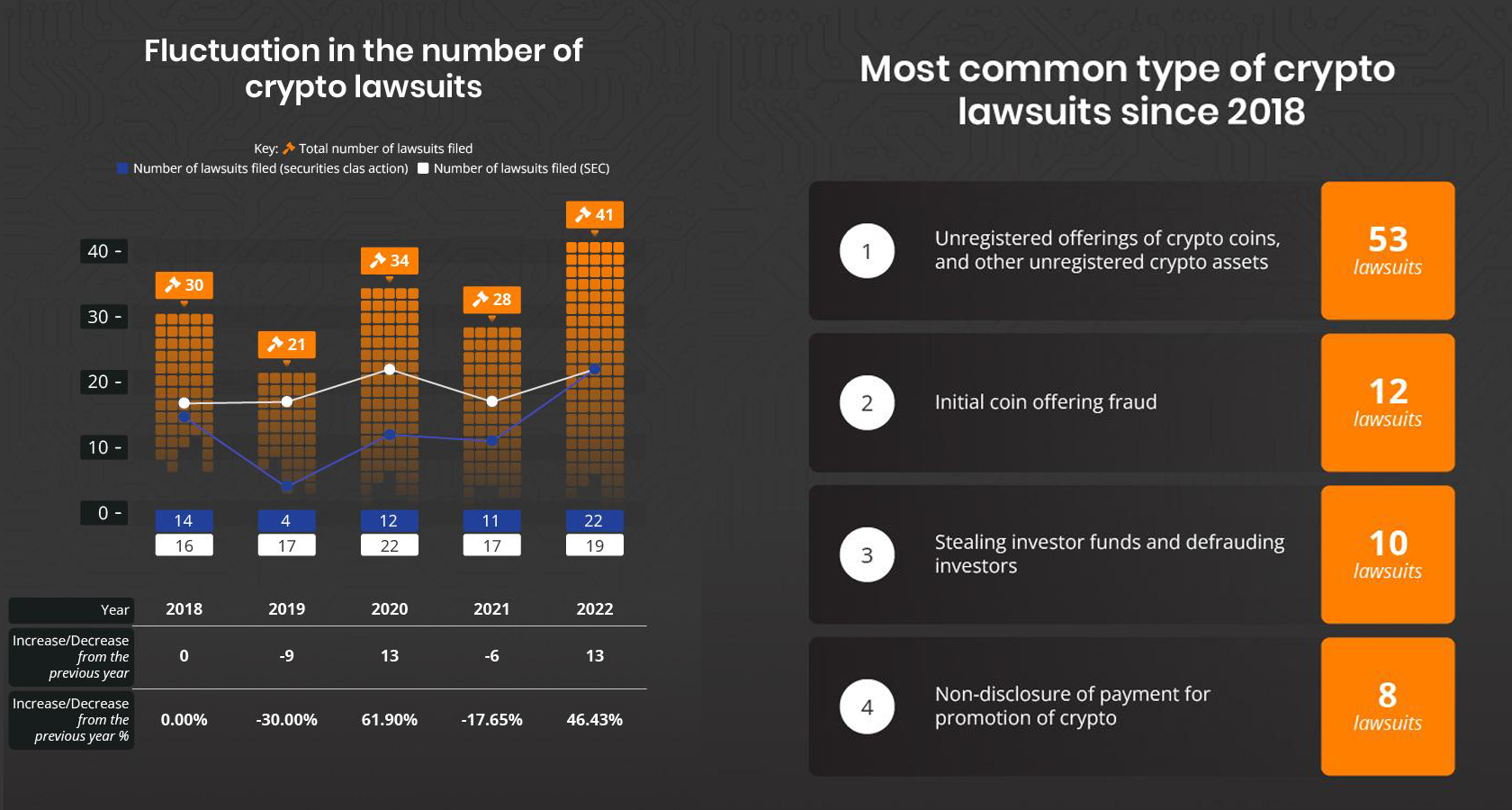

Similar to the price cycles experienced by cryptocurrencies, there are fluctuations in the number of US crypto-related lawsuits filed each year, according to new research published by hedgewithcrypto.com. The study notes a 40% increase in crypto lawsuits between 2018 and 2022, but there have been some declines between the peaks. Of all the years, 2022 had the highest number of lawsuits in the United States, with a total of 41.

“In 2019, there was a 30% decrease as the number of lawsuits fell from 30 to 21,” the hedgewithcrypto.com researchers explain. “This was followed by a dramatic increase of just under 62%, to 34 cases in 2020, before another decrease to 28 in 2021. Finally, there was another increase (this time of over 46%) in 2022, with 13 more cases than in 2021.”

About 19 of the crypto lawsuits in 2022 originated from the US Securities and Exchange Commission (SEC), as the nation’s top securities regulator has cracked down on unregistered services and securities. Over the years, lawsuits related to unregistered services and securities have been the most common in the crypto industry, totaling 53 lawsuits since 2018. Initial Coin Offering (ICO) fraud accounted for 12 lawsuits, while theft or fraud accounted for 10 lawsuits since 2018.

Confidentiality cases or illegal marketing of a cryptocurrency accounted for eight lawsuits, while making false and misleading statements about a crypto product represented five of the total in the past five years. “Non-disclosure of payments for the promotion of crypto products is one of the most notorious cryptocurrency-related lawsuits, often involving celebrities,” the research says.

For example, the Emax campaign case involving Kim Kardashian and the SEC generated over 50,000 articles on the subject registered on Google’s search engine. The fewest lawsuits in the last five years were related to falsification of the company’s income and fraud with pyramid schemes. Hedgewithcrypto.com researchers compiled the US lawsuit data from the SEC and lawsuits registered by Stanford Law.

Tags in this story

2022 , 40% increase , 42% increase , celebrities , claims , class action , crypto , crypto products , cycles , declines , digital currency , Emax campaign case , enforcement , company revenue falsification , fluctuations , fraud , Google , hedgewithcrypto.com , ico scam , Kim Kardashian , lawsuit data , lawsuit , legal battles , lawsuits , majority , confidentiality cases , payment secrecy , product , pyramid scheme scam , research , SEC , SEC cases , Stanford Law , study , theft , United States , illegal marketing , unregistered services and securities, lawsuits in the United States, increase year over year

What do you think is driving the growing number of crypto-related lawsuits in the US? Do you think regulatory action by the SEC is necessary for the industry to thrive, or does it stifle innovation? Share your thoughts in the comments below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.