TikTok crypto-influencers may suffer if US passes TikTok ban

A bill to ban TikTok has been introduced in the US Congress that could affect crypto-flu revenues, as the firm’s parent company ByteDance eats into US firms’ metaverse market share.

A House panel today advanced a new bill that would give the Biden administration the power to ban the short-form video-sharing platform TikTok, even though US firm Meta sends users of Instagram and Facebook to the platform.

TikTok can be used for Chinese surveillance, says former FCC chief

“We’ve already seen thirty state governments, roughly, ban TikTok from state-owned government entities,” Ajit Pai, former chairman of the US Federal Communications Commission, told CNBC earlier today.

“There is growing bipartisan recognition that TikTok is an app that is ultimately subject to the Chinese government’s control in one form or another.”

Banning TikTok for US users could push them against products like YouTube “Shorts” and Instagram Reels, which are run by US firms.

Pai alleged in 2020 that Chinese telecom firms Huawei and ZTE had ties to the Chinese Communist Party, and warned US carriers against using their equipment.

Similar to the suspicions about TikTok, Pai said wireless equipment manufacturers were legally bound to comply with requests from the Chinese secret police. The FCC banned the sale and import of equipment from Huawei and ZTE in November 2022.

A ban could also come at an opportune time for ByteDance competitor Meta, whose share of the VR headset market at the center of its metaverse ambitions recently ceded to Pico, a company owned by ByteDance. In Q3 2022, Pico took 15% of Meta’s VR Quest headset market share. Meta’s metaverse arm, Reality Labs, saw a 17% revenue surge in Q4 2022 as European consumers warmed up to Pico.

The meta is also battling declining engagement in the Horizon Worlds metaverse, as weekly user retention fell to 11% in January 2023.

Headwinds are increasing for TikTok influencers after last year’s collapse

Bloomberg opinion columnist Lionel Laurent predicted in June 2022 that social media censorship would follow last year’s market route. After the collapse of TerraUSD and Celsius, cryptoflu’s revenue for new registrations dropped by more than 90%.

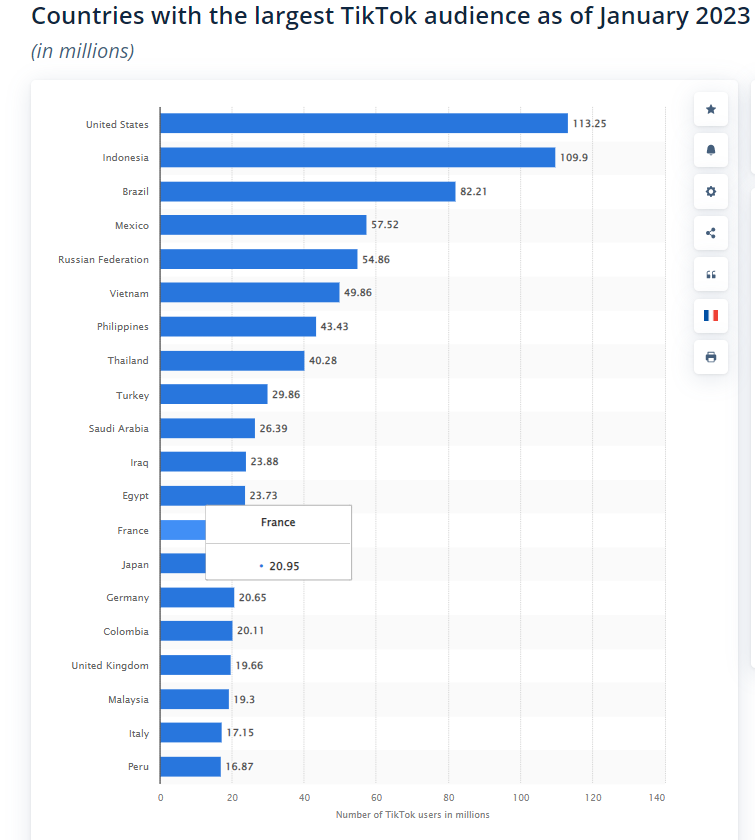

A TikTok ban in the US could see a further decline in influencers’ user revenue, considering the US has the highest number of TikTok users at 113 million. An August 2022 World Economic Forum post suggested that Gen Z is about five times more likely to seek financial advice from influencers.

According to the UK’s Financial Conduct Authority, these self-directed investors are more likely to invest in cryptocurrencies due to hype on social platforms such as TikTok. Investments are driven by influencers who pump crypto projects to generally young, risk-hungry investors fed up with the current financial system.

TikTok crypto-influencer Dennis Liu said in 2021 that the platform offered the highest opportunity for user growth. Another crypto influencer CryptoWendyO uses it to promote his “moon bag” strategy. The method withdraws money from a project after the profit has been earned and moves the funds to another project.

CryptoWendyO said she was convinced to join TikTok because of its ability to spread a large volume of information quickly. The well-known influencer BitBoy convinced CryptoWendyO to try the platform’s potential.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.