The NFT Market sees an increase in sales and volume when $BLUR goes live

- The NFT market saw an increase in sales and volume, with over 106,000 sales recorded and 70,000 ETH traded by 26,000 users, reaching a 90-day high in both sales per user and volume per user.

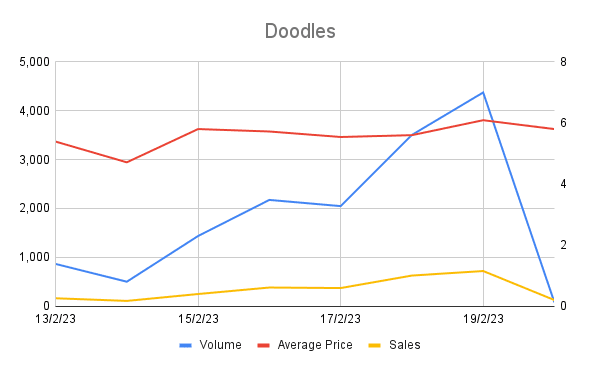

- Doodles saw an increase in traded volume with a total of 14.8K ETH (~$25M) recorded in the last 7 days. Doodles recently announced the acquisition of Golden Wolf, which also contributed to the increased market activity.

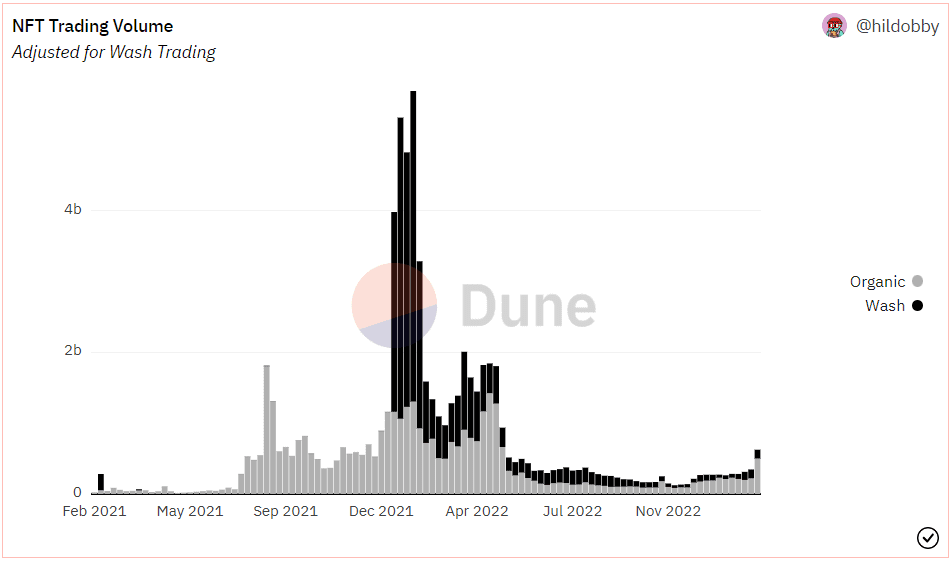

- The Ethereum NFT market saw an increase in suspected wash trades in the past week, with a total of $123M suspected of being wash traded from 6,784 trades. This may be a cause for concern as it may lead to market manipulation.

Yesterday, the NFT market saw a significant increase in sales, with over 106,000 sales recorded, surpassing the previous 90-day high. A total of 26,707 users traded 70,236 ETH, which equates to a volume worth around $4,470 per user. Sales per user and volume per user both hit 90-day highs, indicating increased market activity.

Speaking of marketplaces, the Blur NFT marketplace has been gaining market share since its launch on February 14th. On February 16, it recorded a whopping 57.3% of total sales, 83.2% of total volume, and 40.2% of total unique users. This increase in activity can be attributed to the launch of $BLUR.

Doodles, the popular NFT project, also saw a significant increase in traded volume. Over the past 7 days, it has recorded a total of 14.8K ETH (~$25M) in traded volume on OpenSea, with 4.3K ETH in 718 sales on February 19th alone.

On January 23, it was announced that Doodles had acquired animation studio Golden Wolf, which has worked on popular animated shows such as Rick & Morty and has partnered with Disney.

However, the Ethereum NFT market also saw an increase in suspected wash trading in the past week. A total of $123 million was suspected as wash traded from 6,784 trades, while last week saw $124 million from 5,738 trades. This development is a cause for concern as it could lead to market manipulation.

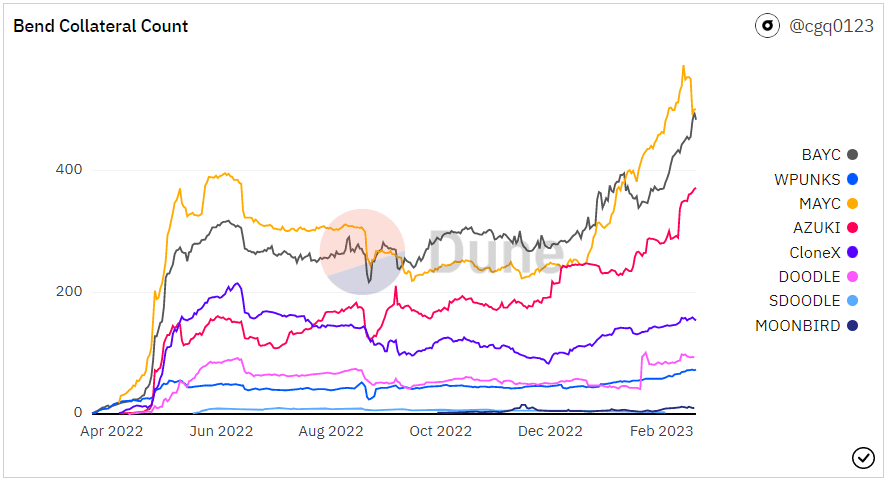

In other news, on February 18th, a group of 59 Mutant Ape Yacht Club (MAYC) NFTs were pulled from the BendDAO security, after seeing an all-time high of MAYCs on February 13th, with 574 NFTs.

Currently, the BendDAO security has a number of NFTs, including 489 BAYCs, 372 Azukis, 156 CloneXs, 86 Doodles, and 73 Cryptopunks, among others, with a total of 156K ETH in deposited and borrowed TVL.

****

Keep yourself updated:

Subscribe to our newsletter using this link – we don’t send spam!