The NFT decline is real (real) – TechCrunch

Less than 24 hours then TechCrunch took a look at a collection of data on the market for non-fungible tokens (NFT). Our goal was to better understand the level of demand for NFTs in light of the number of recent financing rounds at start-up that deal with the creation, trade or revenue generation of the digital signatures.

Given a general decline in trading volume for a number of assets – blockchain-based and others – it was not a massive surprise to discover that NFT sales volumes are also falling. Not to zero, however materially speaking as the cryptocurrency market itself is reset during one of its usual downturns. Like the larger economic cycle, the crypto market has its own fluctuations between periods of optimism and pessimism.

Oslo Børs explores startups, markets and money.

Read it every morning on TechCrunch + or get The Exchange newsletter every Saturday.

After we published that piece, however, some people reached out and suggested that we did not look at the correct calculations to support our claim that the NFT decline was real. So, let’s take another look.

There are a few ways to measure the health of any market. One way is total sales per unit volume, which was the method we chose yesterday. Another way is to track how the value is preserved by individual units – for example in the stability of floor prices for popular NFT sets. You can also track the total value of traded assets instead of their unit volume.

There are a few ways to measure the health of any market. One way is total sales per unit volume, which was the method we chose yesterday. Another way is to track how the value is preserved by individual units – for example in the stability of floor prices for popular NFT sets. You can also track the total value of traded assets instead of their unit volume.

Let’s add the latter two to our analysis to see if we ignored luminous data, and therefore accidentally were slippery yesterday. To work!

NFT measurements, part two

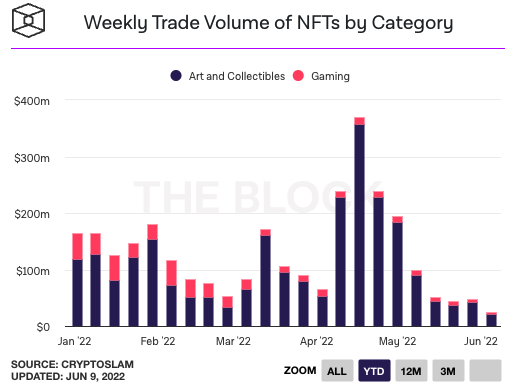

The Block, a publication and data source, provides a lot of information related to NFT sales, sorting by category, transactions, chain and more. The block also has a data set that applies to traded value. Using the same year-to-date time frame as we did yesterday, here’s how the publication tracks trading volume of NFTs, or the dollar value of NFT trades:

Photo credit: The block data

Sharp-eyed readers will notice that this chart supports our position from yesterday that there has been a general decline in NFT trading since the beginning of the year. That said, there is a peak in the time frame for April / May that stands out compared to our chart from yesterday. What drove it? Yuga Labs Otherdeed sales, it seems, accounted for nine-digit dollar volumes.