Stagnant trade selections leave traders wondering about their next move

Bitcoin (BTC), the world’s largest cryptocurrency, has regained some of its losses and gained modest traction around the $23,500 level as the crypto market regains momentum following continuous gains in the industry. Currently, Bitcoin and Ethereum are trading at $23,516.89 and $1,649.09 respectively.

However, the ongoing recovery of Bitcoin’s price can be attributed to the recent advancements in the cryptocurrency industry. In particular, the Australian Reserve Bank has expressed its willingness to investigate the use of central bank digital currencies (CBDCs) in the country. This move could have significant implications for the CBDC plans of other Commonwealth nations.

Also, France is making strides to take the lead in cryptocurrency regulation in the EU. Meanwhile, China is showing strong support for Hong Kong’s new cryptocurrency policy and the country’s efforts to legalize digital assets. These efforts are seen as significant developments that have helped minimize losses in the cryptocurrency markets.

The possibility of higher interest rate hikes and increased regulatory scrutiny in the cryptocurrency sector could disappoint investors in the coming weeks, serving as negative news. This is another important reason that prevents further gains in BTC values.

The Australian central bank is showing interest in CBDC

The Reserve Bank of Australia and the Digital Finance Cooperative Research Centre, an Australian finance research centre, have jointly announced that Australia’s central bank will launch a live pilot of a central bank digital currency in the coming months.

On 2 March, the RBA announced it was working with the DFCRC to investigate the applications and financial benefits of a central bank digital currency (CBDC) in Australia.

However, the pilot project is set to start on March 31 and end on May 31, with a final report on the findings to be published on June 30. The report will include an evaluation of the various use cases that were developed during the pilot and any opportunities. pros and cons of a digital central bank currency in Australia.

France tightens crypto rules for new users

French senators have passed stricter laws for cryptocurrency firms, which now only require President Emmanuel Macron’s signature to become law. The French National Assembly passed legislation by a vote of 109 to 71 that imposes stricter conditions on new players intending to enter the French cryptocurrency industry.

This move is considered a setback for the cryptocurrency industry and could have a negative impact on crypto values.

On the other hand, Abu Dhabi is working to attract various digital asset companies, including cryptocurrency exchanges, digital wallets and blockchain firms, by offering a favorable regulatory environment and attractive tax incentives.

As a result, this move is seen as a significant win for the cryptocurrency market, which may soon get a boost.

Bitcoin price

The current trading price of Bitcoin stands at $23,450, with a 24-hour trading volume of $22.8 billion. In the last 24 hours, Bitcoin has experienced a decrease of 1.29%. It is currently ranked first on CoinMarketCap, with a live market cap of $452 billion. Bitcoin has a total supply of 21,000,000 BTC coins, of which 19,305,818 BTC coins are in circulation.

The technical outlook for the BTC/USD pair has not changed significantly, as Bitcoin continues to consolidate below the $23,750 resistance level, while maintaining immediate support at $22,800. If the price falls below this level, Bitcoin may find support at $22,150.

Despite being in the oversold zone, there is a possibility of a pullback in the BTC/USD pair, which could result in breaking through the $23,750 resistance level and pushing the price up to $24,250.

Currently, the immediate support level for the BTC/USD pair is $22,800, and if this level is breached, it could expose Bitcoin to the next support area of $22,150.

Buy BTC now

Ethereum price

The current market price of Ethereum (ETH) is $1,645 and its 24-hour trading volume is $6.9 billion. In the last 24 hours, Ethereum has experienced a decrease of almost 0.50%. It is ranked number 2 on CoinMarketCap, with a market capitalization of $201 billion.

In terms of technical analysis, the ETH/USD pair is trading within a narrow range of $1,600 to $1,680, forming a symmetrical triangle pattern. The breakout of this series will determine the next move in the market. A bullish breakout of the $1,680 level could lead to a further increase in the ETH price towards $1,730 or $1,745.

On the other hand, a bearish breakout of the $1,600 level could push the Ethereum price down towards the $1,550 level.

Buy ETH now

Top 15 Cryptocurrencies to Watch in 2023 Excluding BTC and ETH

There are many options for investors in the cryptocurrency market apart from Bitcoin (BTC) and Ethereum (ETH). The Industry Talk team at Cryptonews has curated a list of the top 15 altcoins to watch in 2023.

The list is constantly updated with new ICO projects and altcoins, so be sure to visit it regularly for the latest inclusions.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

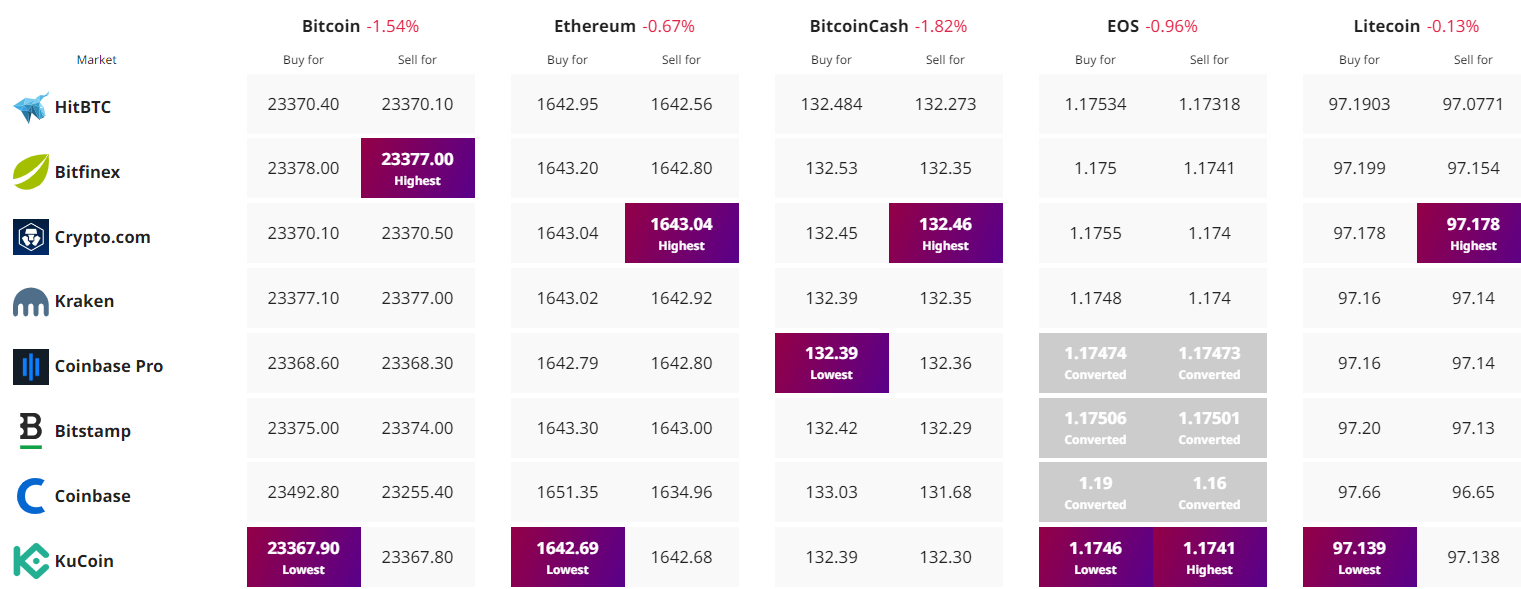

Find the best price to buy/sell cryptocurrency