Security challenges in the growing FinTech landscape

Securing the Future of FinTech Security: Strategies for Addressing Complex Threats and Risks

The financial technology (FinTech) industry is on the rise, offering convenient and innovative ways for individuals and businesses to manage their finances. However, with this rapid growth comes a number of security challenges that need to be addressed. As an SEO and high-end copywriter, we understand the importance of security in the FinTech landscape and the potential consequences of not addressing these challenges.

In this article, we will explore the top security challenges in the growing FinTech industry, including cybersecurity threats, privacy concerns, third-party risks, compliance regulations, mobile device security, social engineering attacks, and insider threats. Our goal is to provide valuable insights that can help businesses and individuals protect themselves from potential threats and maintain their reputation in the FinTech industry.

Cyber security threats

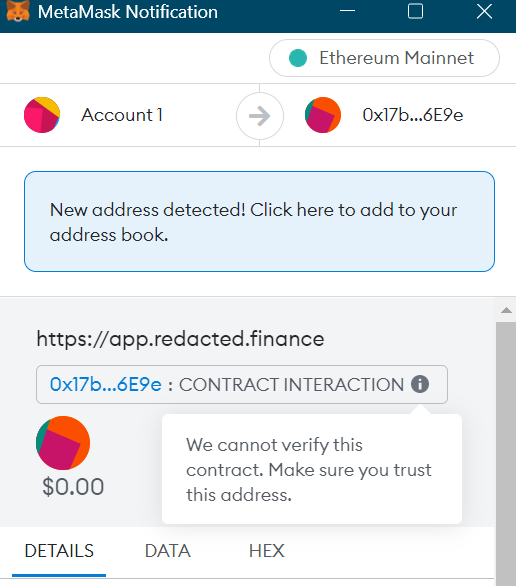

One of the biggest security challenges facing FinTech companies is cyber security threats. The growing use of digital technologies has led to an increase in cyber attacks, such as phishing, malware and ransom attacks. These attacks can lead to the loss of sensitive data, financial loss and reputational damage. FinTech companies must implement robust cybersecurity measures to protect their customers’ data and prevent unauthorized access to their systems. This includes using strong encryption methods, implementing multi-factor authentication and conducting regular security audits.

Compliance with regulations

Another major security challenge for FinTech companies is ensuring regulatory compliance. FinTech companies operate in a highly regulated environment, and failure to comply with the regulations can result in significant penalties and fines. Therefore, FinTech companies need to have a deep understanding of the regulatory landscape and implement appropriate compliance measures to ensure that they follow the rules and regulations set by the regulatory bodies.

Identity verification

Identity verification is an important aspect of the FinTech industry, as it helps prevent fraud and money laundering. However, traditional identity verification methods are often time-consuming, expensive and impractical for customers. Therefore, FinTech companies must implement effective and efficient methods of identity verification that ensure the authenticity of the customer’s identity without compromising privacy.

Data protection

Data protection is a critical security challenge for FinTech companies. FinTech companies collect and process vast amounts of sensitive data, including financial information, personal information and transaction details. Therefore, they must implement strong data protection measures to prevent data breaches, unauthorized access or data theft. This includes implementing data encryption, data backup and recovery, and access control mechanisms.

Third party risk

FinTech companies often partner with third-party service providers, such as payment processors, data analytics firms, and cloud service providers. While these partnerships bring many benefits, they also come with their own risks. Third-party service providers may not have the same level of security measures in place, which could lead to security breaches and data theft. FinTech companies must ensure that their third-party service providers have appropriate security measures in place and conduct regular security audits to ensure compliance.

Security for mobile devices

Mobile devices are becoming the primary method of accessing FinTech services. Although convenient, mobile devices also pose security risks. Devices can be lost or stolen, and mobile apps can be vulnerable to attack. FinTech companies must implement security measures, such as biometric authentication and device encryption, to protect users’ information.

Social engineering attacks

Social engineering attacks involve tricking users into divulging sensitive information. Phishing emails, phone scams and pretense are all examples of social engineering attacks. FinTech companies need to educate their users on how to recognize and avoid these types of attacks. Another important step for FinTech companies to prevent social engineering attacks is to implement multi-factor authentication (MFA) for user logins. MFA adds an extra layer of security beyond just a username and password, making it harder for attackers to gain access to user accounts

Insider threats

Insider threats involve employees or contractors who intentionally or unintentionally compromise a company’s security. These threats can be difficult to detect and prevent. Businesses must have strong access controls and monitoring systems in place to prevent insider threats. An effective strategy for preventing insider threats is to conduct thorough background checks and investigation processes for all employees and contractors. It is also important to regularly monitor employee activity and limit access to sensitive information on a need-to-know basis