Regulators get tough on crypto funds after FTX collapses

Crypto exchange-traded fund providers are struggling to establish their products as viable investments, according to regulatory experts, as the crackdown on digital assets continues.

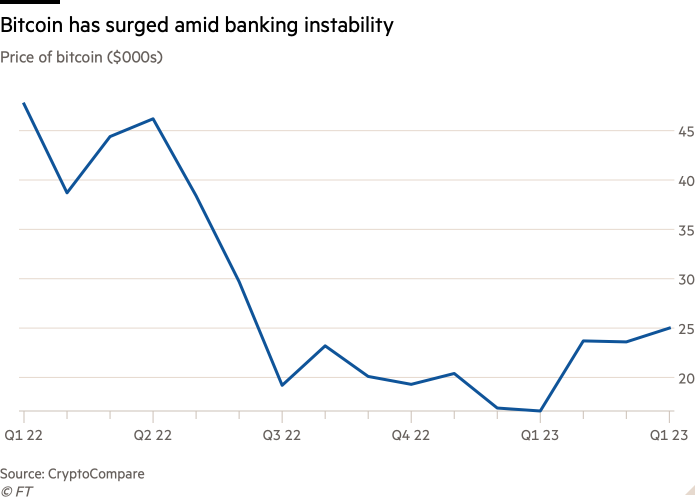

Crypto markets experienced a year of acute turbulence in 2022 as the price of popular digital assets, such as bitcoin and ethereum, fell from record highs. These sudden falls plunged several once-prominent firms – including lending platform Celsius Network and crypto hedge fund Three Arrows Capital – into bankruptcy.

An industry-wide crisis of confidence culminated in November, when crypto exchange FTX – which at its peak represented a pillar of the industry – collapsed within days of a spike in customer withdrawals. The exchange’s failure sparked a renewed sense of urgency among financial regulators to crack down on crypto markets — a trend that in turn poses a challenge to the crypto ETF world.

Crypto ETFs aim to give retail investors exposure to changes in digital asset values, without having to buy or hold them directly. Yet regulators increasingly worry that these investors need protection from volatile prices and security scares.

“We are in the midst of a regulatory onslaught against crypto,” says John Reed Stark, former head of the Securities and Exchange Commission’s Office of Internet Enforcement. “Every day it seems like there’s a new lawsuit against the industry. The SEC is not going to stand idly by, especially when investors are at risk. Investors may not like the rules, but just like seat belt laws, sometimes investors need protection from themselves.”

As the head of financial markets in the United States, the SEC has issued a blitz of enforcement actions against prominent crypto companies, including lender Genesis and exchanges Gemini and Kraken. The commission is also at loggerheads with asset manager Grayscale, which is seeking approval from the regulator to turn its bitcoin trust into a spot ETF holding the cryptocurrency directly.

The SEC has been willing to approve crypto futures ETFs – funds that track futures contracts, which are based on crypto prices but traded on regulated futures exchanges. However, it has repeatedly stopped short of granting approval to ETFs that propose to hold cryptocurrencies themselves, arguing that they trade on largely unregulated platforms where market manipulation poses a persistent risk.

“I doubt the commission is going to change its mind, given that they are suing a new crypto company every week,” argues Stephen Diehl, a software engineer and critic of the crypto industry. “The challenge is on the industry to prove that crypto is a safe investment for Americans’ retirement accounts — and that’s a very high bar.”

But Grayscale has long argued that there should be no distinction between spot and futures crypto ETFs, because futures ETFs actually expose investors to the same crypto market as a spot crypto ETF would. The asset management firm sued the SEC after being denied its request to convert its bitcoin trust into an ETF. Grayscale argued that the regulator’s decision was “arbitrary, capricious and discriminatory”.

“Where this lawsuit lands will likely define the landscape of cryptocurrency ETFs for years to come,” suggests Bryan Armour, director of passive strategy research at investment insights firm Morningstar.

Despite the tumultuous year for cryptoassets, ETFs that provided exposure to them thrived for most of 2022. Investors poured over $240 million into six US bitcoin futures ETFs in the first 11 months of 2022, with more than 80 percent of these inflows from June onwards – precisely when crypto was thrown into an unprecedented crisis of confidence.

This trend has continued into this year. In late January, several crypto ETFs posted eye-popping performances, including the Valkyrie Bitcoin Miners ETF, which recorded a 101 percent return for the month.

Later, in March, several crypto ETFs posted one-week returns of about 30 percent, including the ProShares Bitcoin Strategy ETF, which returned 36 percent, according to data firm VettaFi.

Asset manager ProShares launched the Bitcoin Strategy ETF to much fanfare in late 2021 – when it raised more than $1 billion in its first week of trading. However, performance has fallen in the waves amid the crisis of the crypto market.

However, in 2023, crypto ETFs have been boosted by a rise in prices. Bitcoin – the world’s flagship cryptocurrency – has soared above $28,000, an increase of about 70 percent from $16,500 at the start of the year.

But despite this upswing, direct crypto trading has been affected by fears surrounding the safety of client funds – lending credence to the notion that risk-averse new crypto investors are turning to ETFs as a safer entry point to digital assets.

These fears were heightened by the collapse of FTX and have been perpetuated by several security issues in the decentralized finance space, including last month’s $197 million hack of decentralized finance protocol Euler Finance.

According to Ilan Solot, co-head of digital assets at London broker Marex, ETFs retain their allure for those investors interested in cryptocurrencies but new to the asset class. “If you’re new to crypto, you can manage your own private key [to hold currencies directly] may be riskier than having an ETF in your trading account.”

“If someone wants exposure to bitcoin, using an ETF gives them a less efficient product, but they’re paying for the convenience of not having to hold their own crypto,” notes Solot.