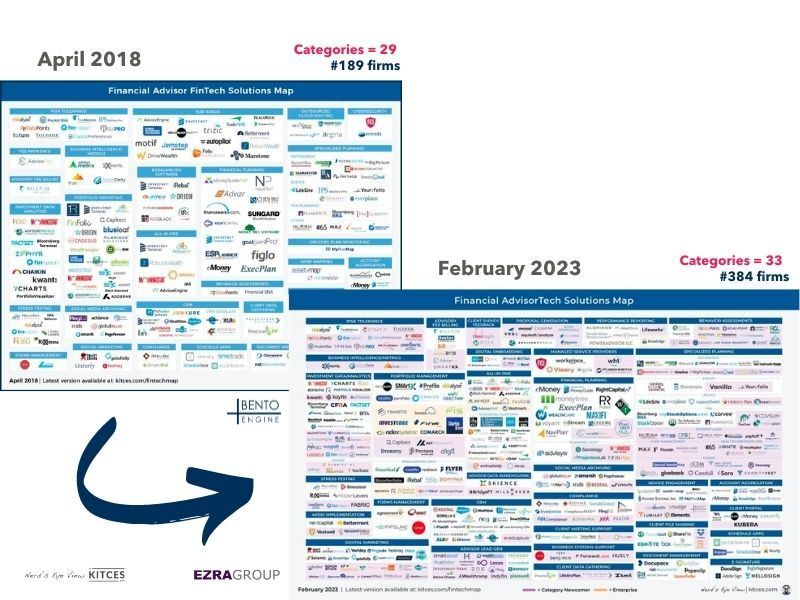

Reflections on Michael Kitces’ fintech map

“Overwhelming” … “too many options” … “like a Cheesecake Factory menu.” These are just some of the reactions one hears when discussing Michael Kitces’ ever-popular Financial AdvisorTech Solutions Map. The map lists companies whose fintech is designed to be used by financial advisors, and organizes them into categories such as portfolio management, risk tolerance and financial planning. It is updated on a monthly basis with the help of renowned technology consultant Craig Iskowitz of the Ezra Group. As the map approaches its fifth anniversary, having debuted in April 2018, it is interesting to reflect on its development over time. The map is representative of the many major innovations taking place within asset management, and the industry’s general development.

At launch, the map contained 189 fintech companies divided into 29 categories. As of February, it stands tall with 33 categories and a whopping 384 firms – yes, the number of AdvisorTech solutions available to financial advisors has more than doubled since the map’s inception, in line with the overall fintech boom.

WHAT DRIVES GROWTH?

Interestingly, growth is not uniform across the board. There are clearly pockets on the map that drive – or benefit from – the industry’s ongoing development. Let’s take a closer look at where the expansion takes place. First, there is a “constant core” of evergreen solution categories such as financial planning, account aggregation and risk tolerance that have seen moderate growth of 19%. Then there’s a “reclassified core,” including many B2B robo solutions that emerged in 2018 and then split into the all-in-one and portfolio management categories. Overall, this reclassified core has remained relatively flat since 2018.

So what is driving the expansion and influx of fintech companies?

We’ve seen remarkable growth in two buckets that can be classified as “growers” and “new kids on the block.” The manufacturers have tripled in size and added a net of 117 firms on the map, spanning seven categories such as CRM, digital marketing and especially specialized planning. The latter category expanded from 22 firms in April 2018 to 56 in February – clearly an expression of the increased need and opportunity for more advanced and customer segment-specific financial planning.

In the end, the new kids added 72 firms across several new categories, including lead generation and the vibrant area known as advisor engagement, where companies offer new and scalable ways for advisors to engage their clients with personalized financial advice.

MEET THE NEW GUARD: FRONT OFFICE AND CLIENT-CENTRIC SOLUTIONS

Stepping back for a moment to analyze the doubling of firms on the map, combined with the new entrants, it’s clear that the AdvisorTech landscape is about to change significantly. In the map’s earlier days, innovation occurred largely in the back and middle office areas. However, as the wealth management industry continues to evolve its value proposition, we are witnessing a marked movement towards front-office and customer-centric solutions.

Driving this movement is a broader desire among advisers, and their clients, to move beyond products and towards advice. A new generation of investors demands a more personalized experience that transcends traditional service concepts centered on the delivery of products. As a recent Vanguard study notes, the advisory landscape has changed dramatically over the past 15 years, and client service has evolved to include a more intentional focus on holistic planning, disciplined execution, and proactive guidance—not just the pursuit of returns and potential for better performance.

Kitces himself confirmed this trend just over a year ago on his blog, noting a shift in “the very value proposition of financial advisors—from selling financial services to selling financial advice—which in turn is slowly but steadily reshaping the entire advisor technology stack.” He recognizes the growing popularity of “advisor support” tools, and the fact that client relationship management systems are increasingly becoming the hub from which client-centric advisors conduct their business.

HOW YOU PASS MAKES ALL THE CHOICES

The rapid emergence of new offers and unique categories is clearly an expression of changing client preferences and developing advisor needs. It is also a testament to the great innovators who are leading the historically sluggish wealth management industry into a new era of choice.

Advisors and their firms are blessed with an abundance of choices today. Like never before, they can tailor their technology stacks to fit their particular value proposition, while supporting their vision of the ideal customer experience and optimal advisor workflows. In addition to using specialized consultants, there are also some powerful online resources available that can help both advisors and their firms assess and design an optimal future technology stack. These include:

• Kitce’s AdvisorTech Directory, which makes the traditional map highly searchable and dynamic.

• The Ezra Group WealthTech Integration Score, which helps advisors choose technology that integrates well with the rest of their tech stacks.

The map has come a long way since its inception, and it will continue to evolve, likely expanding further over the next five years. Let’s resist the immediate knee-jerk reaction to see it as a bad thing. Instead, let’s celebrate what it really means – that the financial advisory experience is moving forward and incorporating new approaches, resulting in better technology-enabled experiences for clients and advisors alike.

Philip Hecker is the managing director of Bento motora fintech that empowers financial advisors to deliver proactive, comprehensive advice at scale to better serve clients, deepen relationships and convert more leads faster.