Popular Crypto Analyst Breaks Down Bitcoin (BTC) and US Dollar Strength in Wake of FTX Fiasco

A widely followed crypto analyst looks at the broader crypto markets after this week’s FTX meltdown.

Cryptanalyst Justin Bennett says his 111,400 Twitter followers king crypto Bitcoin (BTC) is testing a low it hasn’t experienced since June 2022.

“BTC is retesting the June low.

Resistance for now. A recovery would be bullish and pretty incredible given the week we’ve had, but nothing would surprise me at this point.”

With BTC trading for $17,744 at the time of writing, Bennett says he doesn’t think there are many more long positions to clear out.

“I warned about the long liquidations below $18,000 when BTC was $20,800.

Even said I thought we were close to the top, which we were.

Those longs have cleared out and there isn’t much liquidity below this week’s low.

Pull out what you want.”

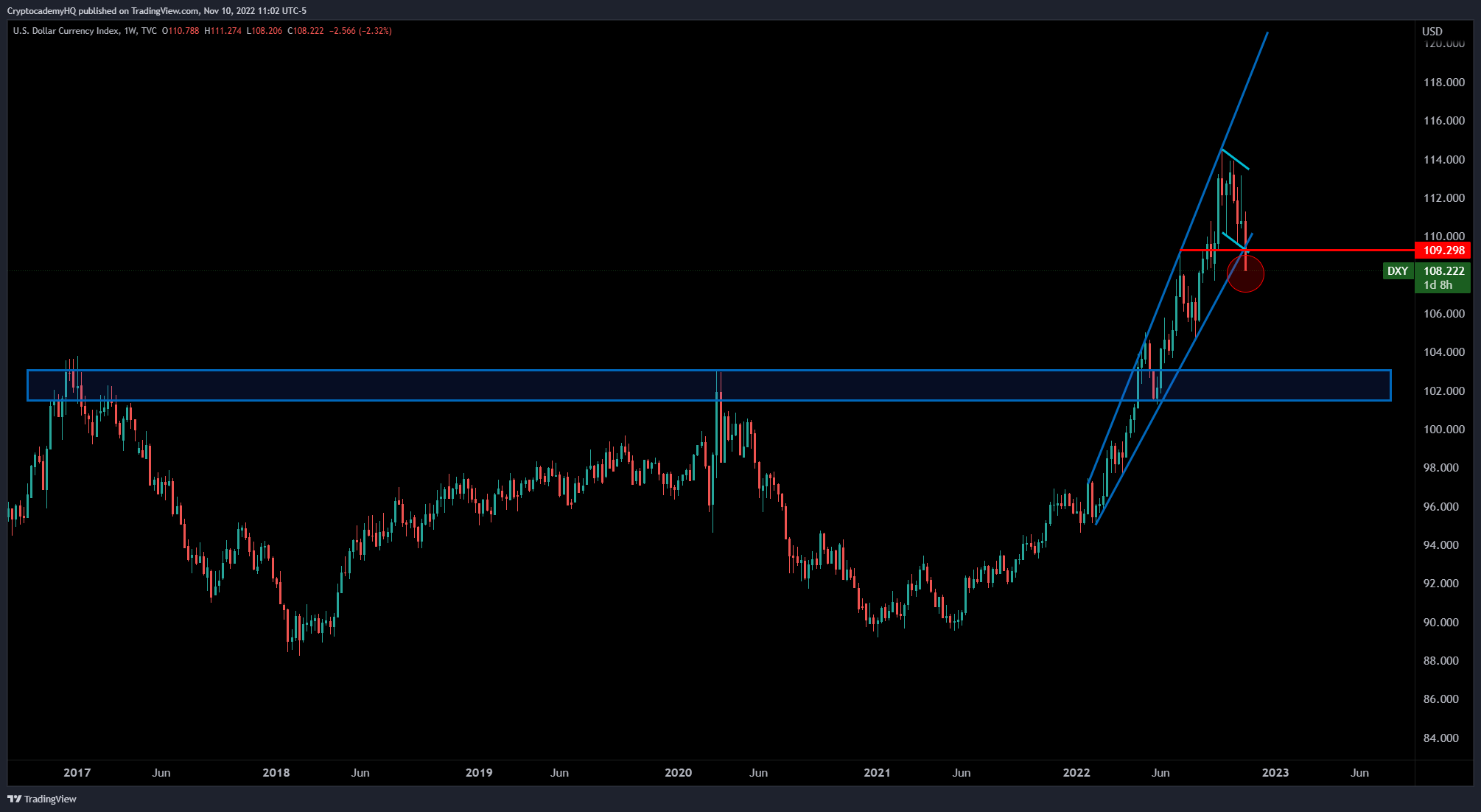

Bennett next proceeding to the US Dollar Index (DXY), an indicator of the US dollar’s strength against a basket of assets. Generally speaking, a weakened DXY usually means strength for crypto markets.

“DXY is already down 1.8% today.

Last Friday’s 2% decline was the biggest one-day percentage drop since 2015.

Crazy to have two daily lights like this for two consecutive weeks.”

Bennett also makes a bold prediction based on DXY’s activity.

“If DXY ends the week below 109.30, a run to 102-103 multi-year highs looks increasingly likely.

That would be short-term bullish for risk assets.

So be careful not to assume that today’s crypto rally is anything more than a bull trap.”

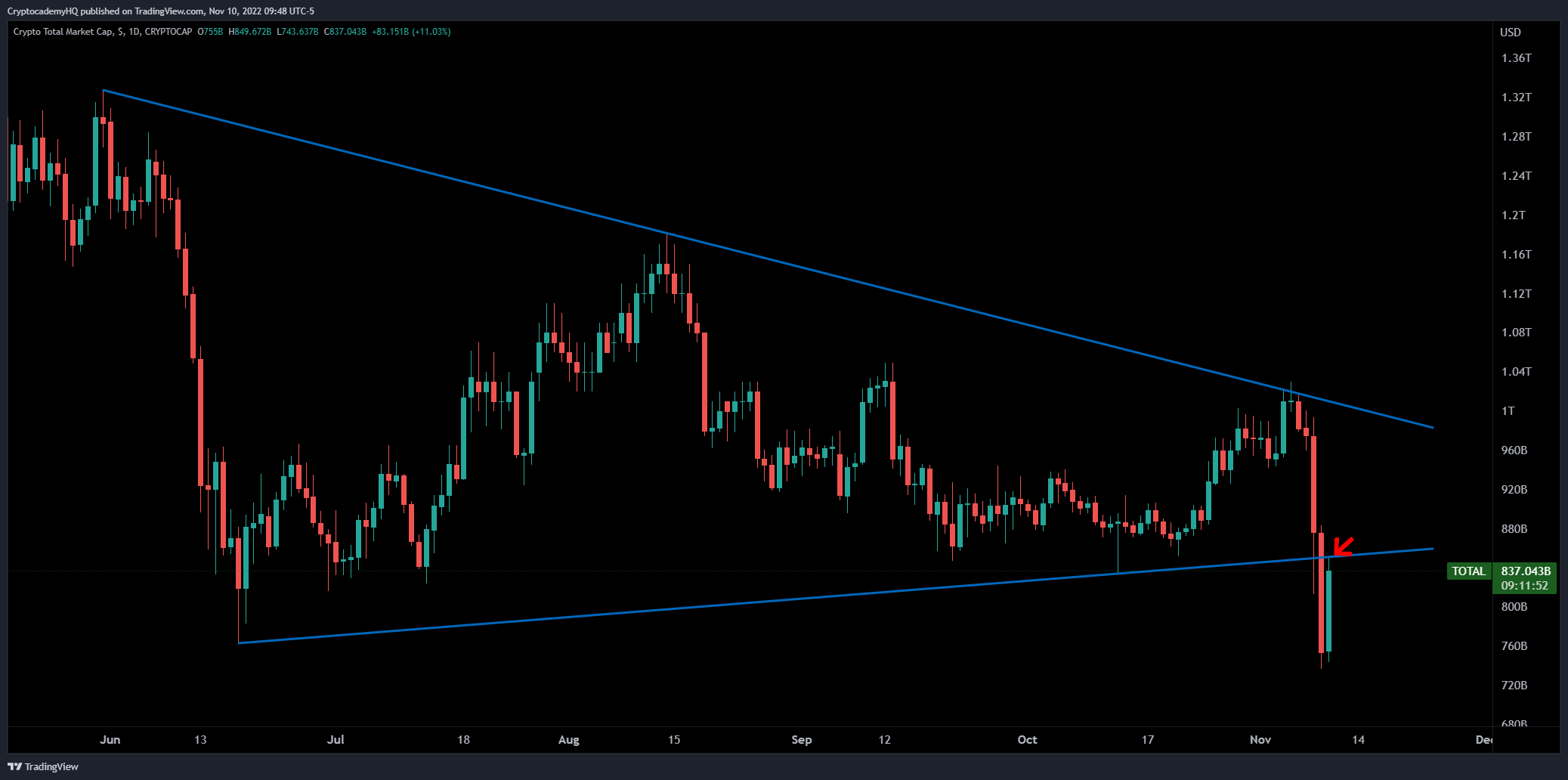

Bennett also looks at the total crypto market capitalization (TOTAL), a measure of the entire digital asset space. The merchant says TOTAL is testing a level it must reverse to be bullish.

“TOTAL is testing the underside of this triangle.

$850 billion is resistance. It is also the level bulls need to regain for crypto to turn bullish.”

TOTAL has shot up to $900 billion at the time of writing, just above the resistance level highlighted by Bennett.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Quardia/AtlasbyAtlas Studio/Sensvector