Plaid adds read-only support for thousands of crypto exchanges – TechCrunch

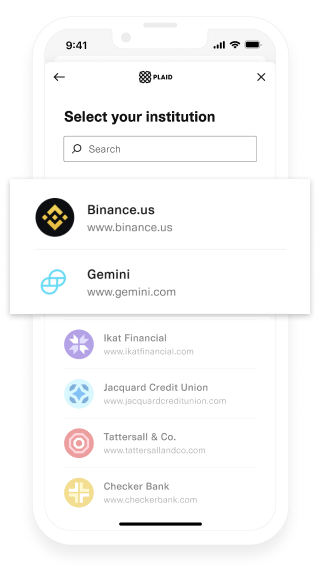

Plaid, the company that builds data transfer technologies to power fintech and digital finance products such as smartphone-based wallets, announced today that it is adding support for thousands of crypto exchanges to its data network. While Plaid has previously integrated with large exchanges on an ad hoc basis, the move is an indication that the company sees crypto as important for growth.

“This is something many customers have asked for, especially companies that offer asset management and financial planning services,” said Alain Meier, head of identity at Plaid, TechCrunch said in a recent email interview. He pointed out that 16% of Americans reported investing in, using or trading cryptocurrencies in 2021, according to the Pew Research Center. “With high market volatility, we believe it is even more important for people to have a clear real – time view of their digital economy, including what is in their cryptocurrencies for planning and for making important financial decisions.”

As of today, through Plaid, users can share cryptocurrency account information, including asset types, balances and transactions with other services they use. Developers can incorporate the data through Plaid Investments API, which now supports cryptocurrencies for use cases such as tax advisory services, financial planning and net worth calculations.

Binance, Kraken and Gemini are among the newly integrated exchanges. Support for additional platforms including Blockchain.com and BitGo is planned later this year, Meier said.

Plaid is not the first provider to collect various cryptocurrency accounts through an API. This award belongs to startups such as CoinAPI, BitCombine and Zabo. But Meier claims that Plaid is one of the few that offers support for crypto exchange along with bank account information and data from other fintech platforms.

Photo credit: Plaid

“If you work with a platform like SoFi for financial planning, you will be able to see your cryptocurrencies along with your other investments, giving you a more comprehensive and consistent view of your finances,” Meier said. “When an account has permission through Plaidthe service can retrieve read-only information from the connected account. “

The crypto market is filled with risk and criminal activity. Binance processed transactions totaling at least $ 2.35 billion stemming from hacks, investment fraud and the sale of illicit drugs between 2017 and 2021, according to a Reuters report. In June, the pension company IRA Financial filed a lawsuit against Gemini alleging that lax cyber security led to clients’ assets worth millions of dollars being stolen from Gemini’s platform.

Meier noted that Plaid’s recently introduced support for cryptocurrencies is read-only, which means that developers do not have access to move money on behalf of users. In addition, he said, all crypto exchanges had to go through a due diligence and risk assessment process by Plaid’s risk team before joining the Plaid network.

“More people are immersing themselves in crypto every year, and it’s becoming more mainstream. We do not see this trend slowing down, and we want to help all customers, not just those in traditional finance. That is why we want to build the services that have the greatest impact. for everyone, regardless of market conditions, “said Meier.” We are extremely positive about the long-term potential of cryptocurrencies and digital assets to improve the transparency and efficiency of financial services. “

Following Plaid’s growth, the roll-out of support for crypto exchanges will lead to identity and income verification, fraud prevention and account financing in May – the company’s first major expansion in several years. The pressure is Stripe, one of Plaid’s most important rivals, who entered Plaid’s territory this spring with the launch of financial data connections to bank accounts.