Okcoin reports 125% jump in institutional crypto trading in Q2

- Q2 marked the fourth consecutive quarter of institutional crypto trading on Okcoin growing more than 2x

- Okcoin’s institutional clientele grew 13% in Q2, 28% in H1 2022

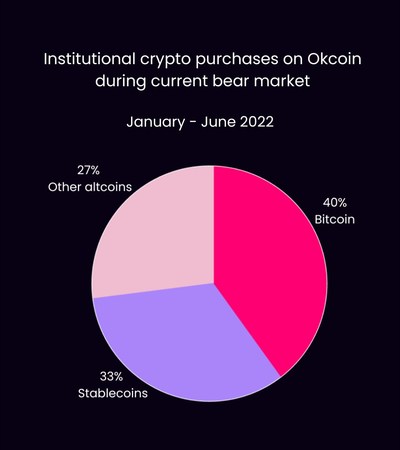

- Institutions are buying dollar-backed stablecoins 3 times more than in the 2018 bear market

SAN FRANCISCO, 28 July 2022 /PRNewswire/ — Okcoin, one of the world’s largest and fastest growing cryptocurrency platforms, today reported a 125% increase in institutional trading volume from Q1 to Q2 2022, the fourth consecutive quarter of more than doubling of institutional trading activity. Okcoin’s clientele – which includes traditional financial trading firms, prime brokers, asset managers, venture and hedge funds and more – grew by 13% in Q2 and by 28% in the first half of 2022. Besides bitcoin (BTC) and ether (ETH) ), stablecoins tether ( USDT) and circle (USDC) were the most popular among institutions in Q2, with purchases of USDT up 116% and USDC up 47% from Q1.

Institutions are buying dollar-backed stablecoins 3 times more than in the 2018 bear market.

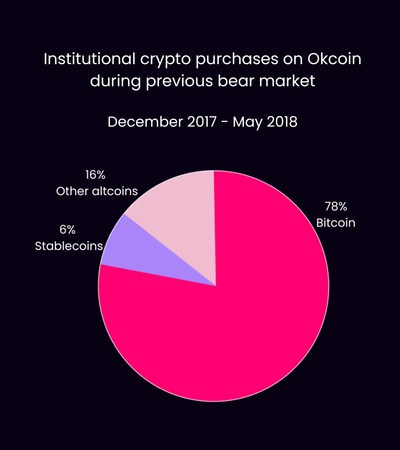

Institutions held oversized BTC positions during the 2018 bear market.

In the first half of 2022, stablecoins accounted for 33% of asset purchases and bitcoin for 40%, amid a bear market in which the crypto market cap fell over 60%. This is a marked difference in institutional activity from the previous prolonged bear market, which lasted from 2018 to 2020. Institutions held oversized BTC positions during that time, with the stablecoin accounting for just 6% of purchases during the six-month low where the crypto market value fell 70%. During the most volatile periods of this recent market downturn, the Okcoin exchange systems experienced 100% uptime and no customer trading disruptions.

“Despite the market slowdown, institutional activity on Okcoin continues to reflect growing crypto interest and greater sector maturity,” said Jason Lau, COO of Okcoin. “While in 2018 we saw institutions liquidating their crypto holdings in response to the bear market, almost all of our clients are seeking greater exposure this time and looking at a longer term. Furthermore, in 2018, the institutions that remained in the market focused almost exclusively on trading bitcoin , and considered stablecoins and other altcoins too much of an added risk. By 2022, the dollar-backed stablecoins are trading almost as much as bitcoin – likely considering them to be ‘risk-off’ cryptoassets, given their lower volatility.”

Since receiving ISDA membership in spring 2022, Okcoin has been working on ISDA contract negotiations with institutional clients and developing NDF and options products to be launched later this year. Bilateral OTC derivatives are in demand by traditional institutional clients who cannot keep crypto on their balance sheet but still want to gain crypto exposure for hedging or speculation.

For more information, please visit okcoin.com/institutions.

About Okcoin

Founded in 2013, Okcoin is a US-headquartered cryptocurrency exchange serving 190+ countries and territories. The platform enables private and institutional investors to buy 50+ digital assets using local currencies, with a goal of making crypto easy for everyone, including first-time buyers. Okcoin was the first centralized exchange to offer direct access to decentralized finance (DeFi) with Serve, a tool to earn APY through decentralized lending, liquidity pools, staking and more. In addition, Okcoin offers institutional trading tools and APIs to asset managers, venture capital and hedge funds, retail brokers, payment processors and more. Follow Okcoin on Twitter at @Okcoin and visit okcoin.com for more information.

SOURCE Okcoin