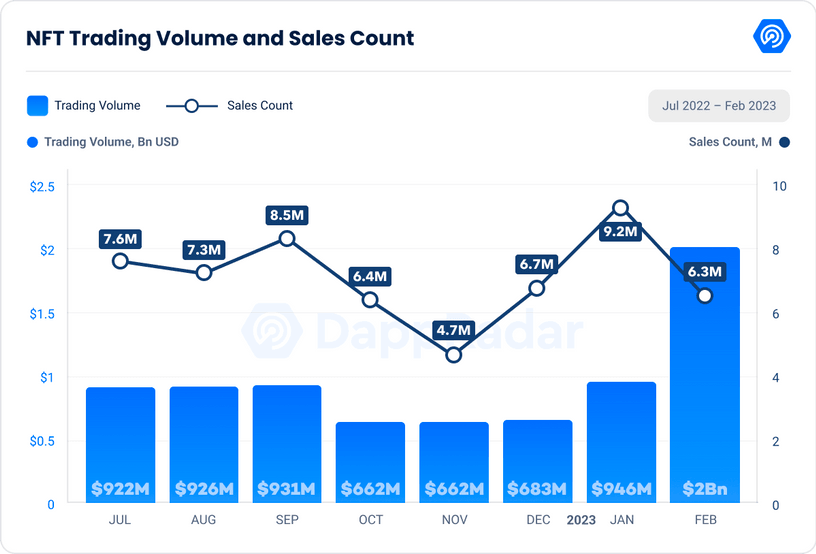

NFT trading volume reaches pre-Luna crash figure of $2 billion

The NFT market appears to have pulled out of its 2022 nadir, according to the latest report from DappRadar.

The NFT market has been on a wild ride in recent months, with February being no exception. The increase in trading volume was nothing short of remarkable, reaching $2 billion, the highest since May 2022. The increase was driven by the popular NFT marketplace Blur, which dominated the market with $1.3 billion in trading volume. The increase represents an increase of 117% from the previous month.

The NFT sector also increased its dominance in February, reaching 9.46% from 8.47% in January, with an average of 153,337 daily unique active wallets (dUAW). from 21% in January to 24% in February.

Polygon, the Ethereum sidechain, saw an explosive increase of 147%, reaching $39 million in NFT trading volume. Meanwhile, other platforms, such as Immutable X and BNB Chain, also had a great month. Immutable X, which primarily focuses on video games, saw a 71% increase in NFT trading volume, totaling $24.4 million. BNB Chain saw similar growth, with $7 million in NFT trading volume.

Blur accused of “market manipulation”

However, the star of the show remains Blur, which boasts a unique trading pattern that sets it apart from other NFT marketplaces. Platforms such as OpenSea cater more to casual NFT enthusiasts who engage in smaller trades occasionally. Blur is intended to hook those who engage in high-volume trades with reasonable frequency.

Despite its success, not everyone is thrilled with Blur’s trading activity. CryptoSlam announced on Friday that it would remove $577 million worth of Blur trades from its data. It cited “market manipulation” as the reason for the decision.

Blur’s unprecedented increase in NFT trading volume is primarily driven by “whales” who engage in constant buying and selling of NFTs through bid pools to produce token rewards for the next airdrop. However, not everyone agrees that this type of token flipping is tantamount to wash trading.

Despite the controversy, Blur maintains that the platform has a lower percentage of laundromats than previously suggested. It cites data from Dune Analytics as evidence to support its claim.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.