Nancy Pelosi visits Taiwan, AMTD Digital’s IPO, crypto and more: Forbes AI Newsletter

Getty Images

TL;DR

- AMTD Digital rose over 30,000% in just three weeks since its IPO, from $7.80 to $2.555 per share.

- Nancy Pelosi visits Taiwan, exacerbating US-China tensions and spooking the stock market.

- New legislation could see the SEC boot up to 270 China-based companies from the US stock markets, including Alibaba.

- Top weekly and monthly trades

Subscribe to The Forbes AI Newsletter to stay up-to-date and get our AI-powered investment insights, breaking news and more delivered straight to your inbox every weekend.

Major events that can affect your portfolio

An unnamed company based in Hong Kong has risen up the list of the world’s most valuable companies this week. AMTD Digital managed to surpass giants such as Visa, Exxon Mobil and Walmart and shortly achieved a value of over $450 billion, despite revenues of only $25 million.

It has been an incredible rally since the company floated on the New York Stock Exchange on July 15 at $7.80, with the share price hitting an all-time high of $2,555.30 on August 2 before falling significantly in the following days. As of Friday morning, the stock is still trading at an insane $870, giving it a market capitalization of over $160 billion.

That’s more than Morgan Stanley, Intel, IBM and American Express.

AMTD Digital was initially thought to be another target for Reddit’s infamous WallStreetBets crowd, but it now appears that may not be the case. Trading volume has been too low to suggest any major retail involvement, and discussion on the site regarding the stock has been limited.

AMTD Digital’s parent company, AMTD Idea, is also listed on the New York Stock Exchange. Despite owning over 88% of a company that is supposedly worth $160 billion, its market cap is a paltry $1.85 billion. Some savvy traders have played this link, with AMTD Ideas’ price also increasing by over 300% in the last month.

Currently, no justification has been given as to why AMTD Digital has grown so quickly, with some suggestions that there may be some less than ethical shenanigans at play.

—

Nancy Pelosi visited Taiwan this week, the highest-ranking US government official to do so in 25 years. Despite functioning as an independent nation since 1945, the Chinese government still claims sovereignty over the island.

The dispute is a constant source of tension in the region, and China views any international recognition of Taiwan as an affront to its authority. It’s no surprise, then, that they weren’t too happy about Pelosi’s visit.

Asian markets reacted to Pelosi’s arrival, with Hong Kong’s Hang Seng closing down 2.4% and Shanghai’s composite index falling 2.3% on the day of her arrival. It has heightened tensions between the world’s two largest economies as we continue to see a trend of fewer economic ties between the countries.

The visit also comes against the backdrop of news that up to 270 US-listed Chinese companies are at risk of being delisted from US markets. The issue surrounds concerns from the Chinese government that meeting the SEC’s disclosure requirements could reveal state secrets.

The Holding Foreign Companies Accountable Act (HFCAA) would allow the SEC to deregister companies that do not provide full and transparent disclosure from their auditors. Among the names on the watch list is one of the world’s most valuable companies, Alibaba.

The legislation would not see companies removed immediately, but it could start proceedings that would see them move from US markets by 2024.

This week’s top theme from Q.ai

Tech has been hit hard so far this year. Almost all companies in every sub-sector of the industry have taken massive hits to their stock prices, regardless of their underlying fundamentals. It’s not just traditional tech companies like Alphabet, Microsoft and Amazon that have suffered either.

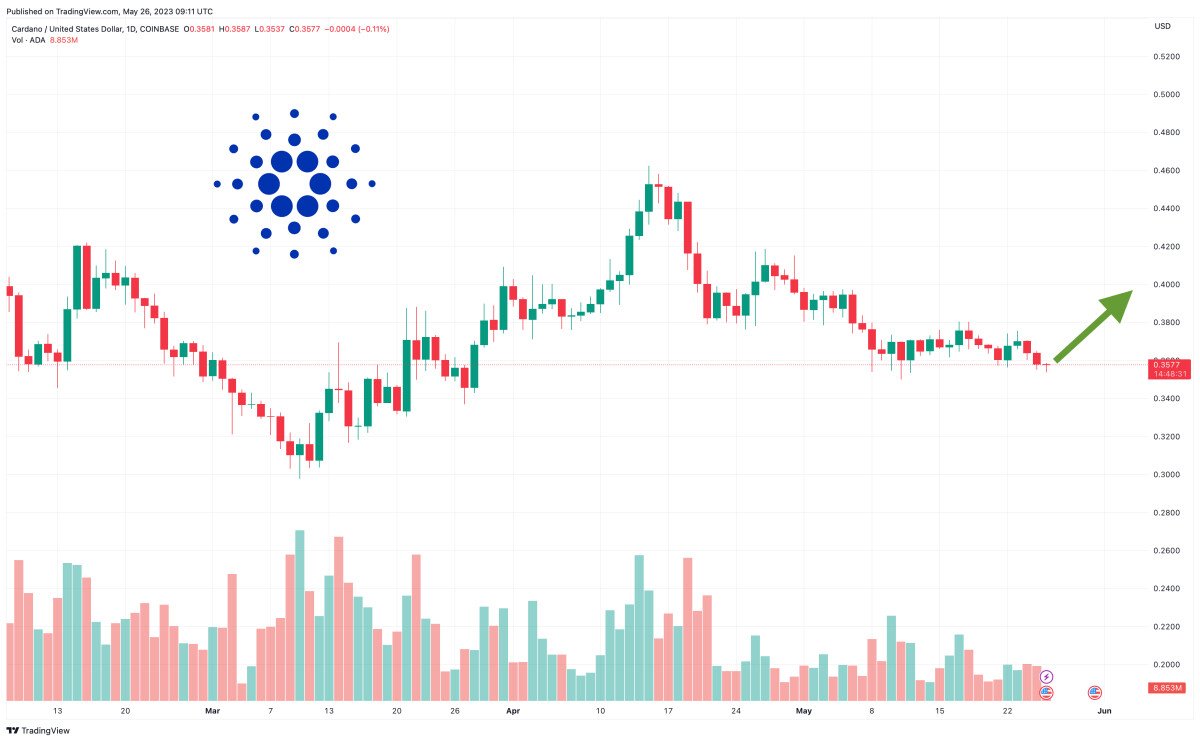

Crypto has been on a huge bull run for the past few years, but the tide turned in early 2022 and we’ve seen some huge losses since then.

Over the past month, we’ve started to see some green shoots emerge in the tech industry and in the crypto space. Despite mixed messages in the second quarter earnings season, the financial results of many companies have generally been better than expected.

There are some notable exceptions, such as Meta, but forecasts have also generally been more optimistic than many investors might have hoped for. These results have fueled a rally in the technology sector, which has seen shares rise significantly in a short period of time. To take advantage of this, we have a range of investment kits specifically designed to invest in the technology sector.

Our Emerging Tech Kit uses AI to take a long position in a mix of tech ETFs, large tech stocks, emerging tech stocks and cryptocurrencies via public trusts. Each week our AI reviews multiple data sets to determine the optimal mix between these verticals.

If you don’t feel as confident about the direction of the market in the short term, another technical play is our Tech Rally Kit. Our AI makes this trade work with a combination of a long position on technology and a short position on the Dow.

So even if the overall market trend is down or sideways, this set can make money if the tech companies outperform the overall market. It’s the kind of trading usually reserved for wealthy investment banking clients, but we offer it to everyone.

Top Trade Ideas

Here are some of the top ideas our AI systems recommend for the next week and month.

Vimeo (VMEO) – The video hosting platform one of ours Top buys for next week with an A rating in growth and technical and a C in growth and low momentum volatility. Revenue increased by 23.6% from the previous year to the end of June.

Spi Energy (SPI) – Clean energy business Spi Energy is one Top Short for next week with our AI, they rank an F in our Low Momentum Volatility, Technical and Quality Value. The company’s earnings per share are down 1.43% over the past 12 months.

Alpha Metallurgical Resource (AMR) – Coal miner Alpha Metallurgical Resource is one Top buys for next month with an A in quality value and a B in our growth factor. Analysts forecast revenue growth of nearly 100% in 2022.

Aspen Aerogels (ASPN) – The thermal insulation company is ours Top Short for next month and our AI ranks it an F in Quality Value and Technical and a C in Low Momentum Volatility. Earnings per share have fallen 24.39% over the past 12 months.

Our AIs Top ETF trades for the next month is investing in Chile, Columbia, online retail and interactive media while shorting US fixed income and industrials. Top buy are the iShares MSCI Chile ETF, the Global X MSCI Colombia ETF and the SPDR S&P Internet ETF. Top shorts are the iShares US Treasury Bond ETF and the Vanguard Industrials ETF.

Recently published Qbits

Do you want to learn more about investing or sharpen your existing knowledge? Qai publishes Qbits on our Learning Center, where you can define investment terms, unpack financial concepts and increase your skill level.

Qbits are digestible, snackable investment content intended to break down complex concepts in plain English.

Check out some of the latest here:

All newsletter subscribers will receive one $100 sign up bonus when they deposit $100 or more.