Muted volatility expectations suggest traders are relaxing on Bitcoin, Ethereum price risks

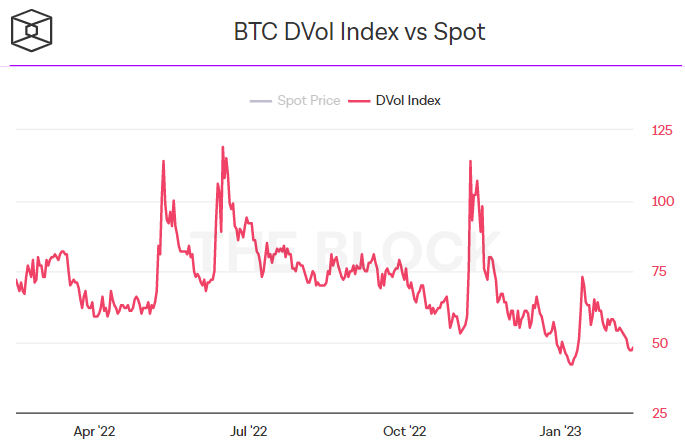

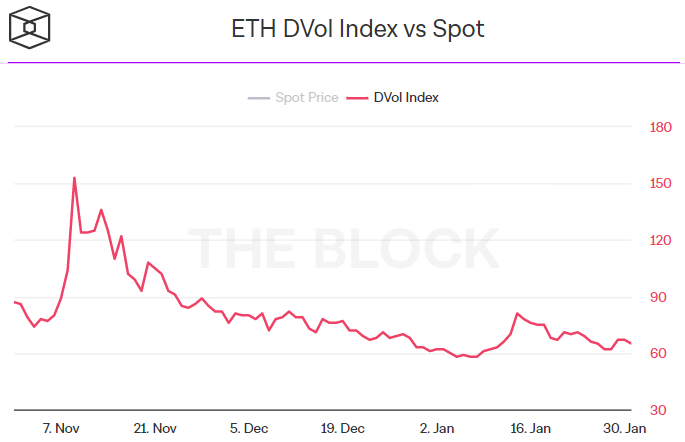

Despite the recent pullback in cryptocurrency markets from multi-month highs reached earlier this month, options markets suggest that traders still have relatively subdued volatility expectations. Deribit’s Bitcoin and Ethereum volatility indices both remain near record lows, according to data provided by The Block going back a year.

The recent decline in crypto prices that has seen Bitcoin fall back to the mid-$21,000s from previous annual highs above $24,000 and Ethereum fall below $1,500 from previous annual highs above $1,700 is caused by a combination of 1) concerns about a more restrictive US interest rate outlook in the wake of recent hawkish Fed communications and stronger than expected US data and 2) concerns about a US regulatory crackdown on major US-based crypto firms.

Deribit’s Bitcoin Volatility Index was at 48 on Monday, not far above the record low it hit last month of 42 and well below mid-January at 73. Deribit’s Ethereum Volatility Index, meanwhile, was last at 62, just above its early January record low of around 58 and down sharply from recent highs in mid-January above 80. Deribit is the dominant cryptocurrency derivatives exchange, accounting for around 95% of open interest across all Bitcoin and Ethereum derivatives markets.

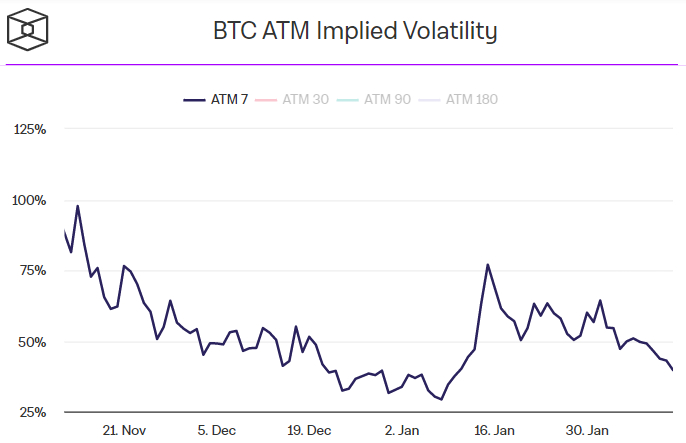

Short-term volatility expectations also subdued

Despite looming US consumer price index and retail sales data this week that could simultaneously inform expectations of the Fed’s tightening outlook and the prospect of a potential US recession later this year, Bitcoin’s 7-day implied volatility according to At-The-Money (ATM) Options Markets fell to 39, 68% on Monday, the lowest in more than a month.

That’s despite warnings from macro strategists that this week’s upcoming data could really shake things up for crypto, with an upside inflation surprise touted as a potential catalyst to send Bitcoin back towards $20,000.

Are investors underestimating the risk of price volatility?

With Deribit’s Bitcoin and Ethereum Volatility Indices and Bitcoin’s 7-Day ATM Implied Volatility all at subdued levels, the interpretation is that investors are not positioning themselves for big moves in the short to medium term. But this relaxed attitude to the risk of crypto price volatility may be misplaced, with many strategists warning that the choppy bear market conditions of 2022 could return.

In fact, Bloomberg senior macro strategist Mike McGlone on Monday issued a reminder to crypto traders – “Don’t fight the Fed”. Monetary tightening by the US Federal Reserve “was the dominant headwind for (crypto) markets in 2022 and will remain so in Q1 (2023),” McGlone continued. The Fed raised interest rates aggressively from near zero to above 4.0% in 2022 and looks set to lift them above 5.0% in the first half of 2023, according to the latest commentary from the bank’s policymakers.

Commenting on the Bitcoin market, “the more tactically oriented are likely to focus on responsive selling, and it may take a while for the buy-and-hold types to gain the upper hand”. McGlone’s comments align with a popular sentiment held by many analysts at the moment – crypto (and US equity) markets seem to be ignoring macro risks. Many analysts go a step further than McGlone and outright predict that the crypto pullback that began earlier this month has longer to run.