Mastercard Share: Real Value With Big Crypto Tailwind (MA)

yalcinsonat1/iStock Editorial via Getty Images

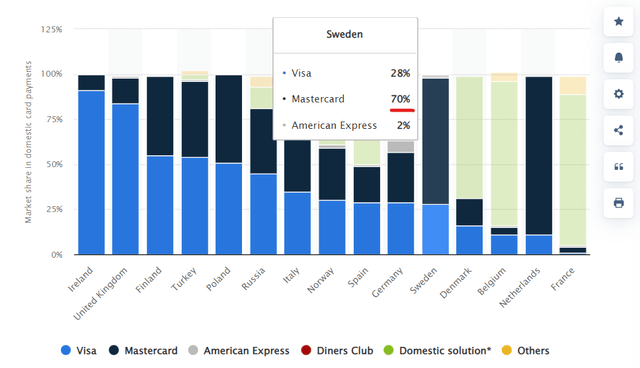

Mastercard (NYSE:MA) is a global payments titan that owns one of the most popular card processing networks in the world. Visa (V) has the largest market share in the US, with 53% share vs. MasterCard at 23%. But in certain countries in Europe, such as Poland, Sweden, the Netherlands and Germany, Mastercard is closing in rival or dominant, as you can see in the chart below with Mastercard represented by the dark blue bars.

Visa/Mastercard Market share (Statistics)

Mastercard has a high-quality business model, which takes a percentage of every transaction where the Mastercard network is used. This has resulted in super high profit margins, high return on capital and solid network effects.

The company recently reported a strong earnings report for the third quarter of fiscal 2022. Top-line and bottom-line growth exceeded analysts’ expectations, despite economic headwinds. Mastercard is poised to take advantage of the Crypto tailwind as the company has announced a new service that helps banks with secure crypto trading. Therefore, in this post I will break down Mastercard’s third quarter results in detailed detail and reveal the valuation. Let’s dive in.

Third quarter breakdown

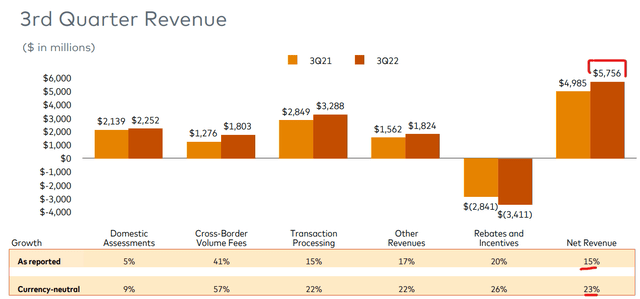

Mastercard generated solid financial results for the third quarter of fiscal 2022. Revenue was $5.67 billion which increased ~15% year-over-year and beat analyst estimates of $95.09 million. On a constant currency basis, revenue increased by a brisk 23% year-over-year, with a 1% tailwind from acquisitions.

Income Mastercard (Q3F22 report)

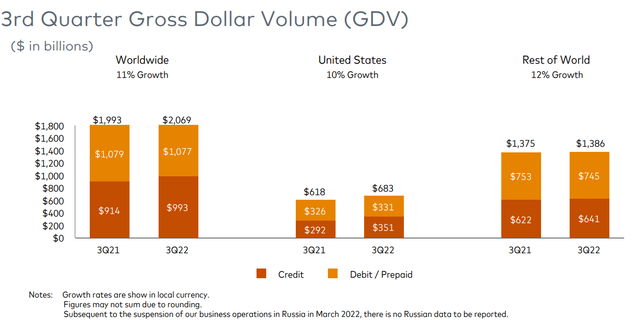

The primary drivers of revenue growth include solid gross volume growth of 11% to a staggering $2.1 trillion. In addition, Cross Border volume reported a huge 41% growth to $1.8 billion, this was also a similar trend to what rival Visa reported in its September quarter earnings report, and was driven by strong pent-up travel demand. According to the Mastercard Economics Institute, an estimated 1.5 billion more passengers will fly globally in 2022 compared to the previous year. With tourists spending 34% more on experiences than pre-pandemic.

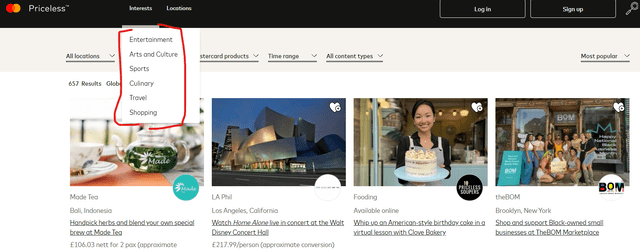

Mastercard is poised to continue this trend as the business has expanded its Mastercard Travel & Lifestyle Services platform with a number of new partnerships. This platform includes the lowest hotel rate guarantees, lounge access when flights are delayed, and even a series of “Priceless Experiences”. These experiences are quite interesting and include walking tours, art classes and even wine tasting at a winery. This service looks set to compete directly with Airbnb ( ABNB ) experiences, as the travel industry becomes further commoditized. Mastercard earns its money from associated commissions and transaction volume, so such “Priceless experiences” can generate additional revenue for the company and improve the customer’s relationship with the Mastercard brand. A quick look at the prices shows that the experiences are quite expensive compared to other sites like “Get Your Guide”, so it looks like Mastercard is targeting the premium customer. WhatsApp service is another interesting benefit that allows members to message a “lifestyle manager” directly with travel requests.

Mastercard priceless experiences (Mastercard)

Back to Mastercard’s core dollar volume values, Domestic Assessments, which are the fees charged to issuers and acquirers based on the volume of activity when they are in the same country. That calculation reported a steady 5% year-over-year growth to $2.252 billion. “Other revenue,” which includes cyber intelligence and data solutions, rose a solid 17% year over year to $1.8 billion. Revenue was offset by a number of rebates and incentives that increased by a negative 20% to $3.4 billion. The total number of Mastercards grew by 5% year-on-year to just over 3 million. While swapped transactions increased 9% year over year to $32.4 billion. With contactless payments now representing 54% of all in-person purchases.

Mastercard gross dollar volume (Q3 22 Revenues)

Like Visa, Mastercard has acquired many smaller entities to strengthen its offerings. For example, in 2021 Mastercard acquired Arcus, a payments-as-a-service platform that is expected to accelerate Mastercard’s penetration across Latin America, which is a major fintech growth market since the region has a large unbanked population.

In 2021, Mastercard also acquired “CipherTrace,” a crypto intelligence company that helps customers improve security and fraud monitoring across the crypto ecosystem. This is part of Mastercard’s strategy to position itself as the “trusted” party in the cryptocurrency market. For example, in October 2022, the company launched “Crypto Secure” which uses the CipherTrace data to help card issuers stay compliant across the complex regulatory landscape. The platform also makes it possible to assess the risk profile of crypto exchanges more accurately. In addition, the company announced Crypto Source, a platform that will enable the implementation of “crypto trading” by banks.

Expenses and profitability

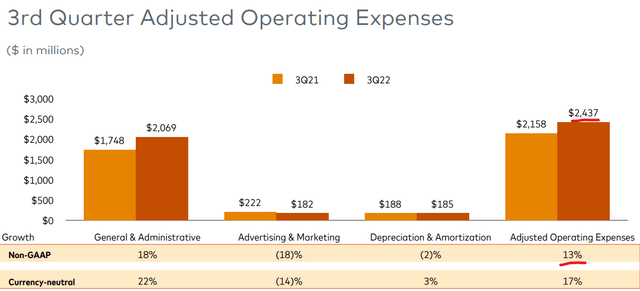

Mastercard reported a 17% increase in operating expenses or 13% on an adjusted basis. This was primarily driven by higher personnel costs and investments across payments, services and networks. Overall, I don’t consider these costs to be negative, as I believe paying employees well encourages strong long-term retention. I also highlighted a similar trend during my analysis of rival Visa, so this is not out of the ordinary. Platform investment is also necessary to continuously innovate, especially given the rapid development of fintech and the number of competitors on the rise.

Despite the increase in operating expenses, earnings per share still rose 22% year over year to $2.68, which beat analysts’ expectations by $0.11.

Operating costs (Mastercard)

Management bought back $1.6 billion worth of shares in the third quarter and another $505 million through October 2022. Mastercard has a dividend yield of 0.6%, which isn’t incredibly high, but is incredibly consistent and safe.

Mastercard has a solid balance sheet with $8.045 billion in cash and short-term investments. The company has a fairly high long-term debt of $13.6 billion. However, “only” $957 million is in debt (due within the next two years) and is thus manageable.

Advanced valuation

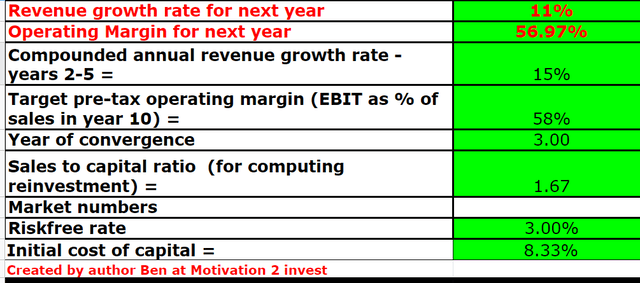

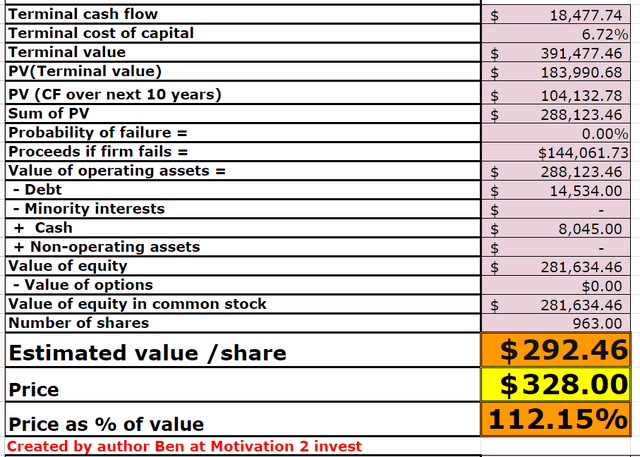

To value Mastercard, I plugged the latest economics into my advanced valuation model that uses the discounted valuation method. I have forecast 11% income growth for next year as recessionary pressures are likely to lead to a slowdown in spending. However, for years 2 to 5, I have predicted a conservative growth rate of 15% per year.

Mastercard share valuation 1 (created by author Ben at Motivation 2 Invest)

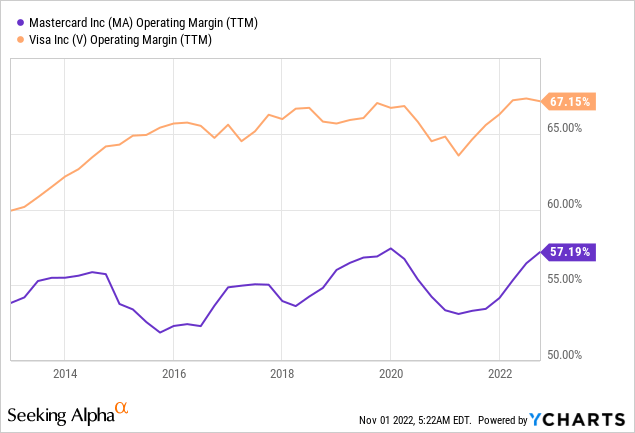

I have predicted that the business will increase its operating margin slightly to 58% over the next three years as economic headwinds are expected to diminish. Mastercard and its rival Visa have exceptionally high and consistent profit margins, although Visa’s margin has historically been slightly higher.

Mastercard stock rating 2 (created by author Ben at Motivation 2 Invest)

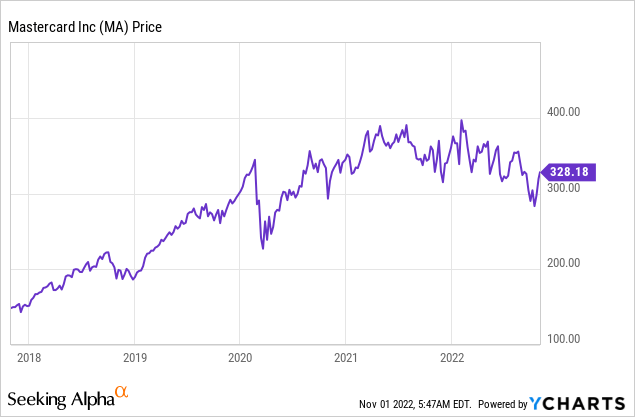

Given the economics and forecasts, I get a fair value of $292 per share, the stock trades at $328 per share at the time of writing and is thus ~12% overvalued, as the share price has risen ~12% over the past few weeks in October 2022 .This gives me confidence in my valuation model and due to the high quality of Mastercard, the company is rarely undervalued. In addition, the financial estimates are quite conservative, and should the exchange rates be correct, Mastercard could easily increase earnings by over 20%, which would make the stock “fairly valued” at these levels.

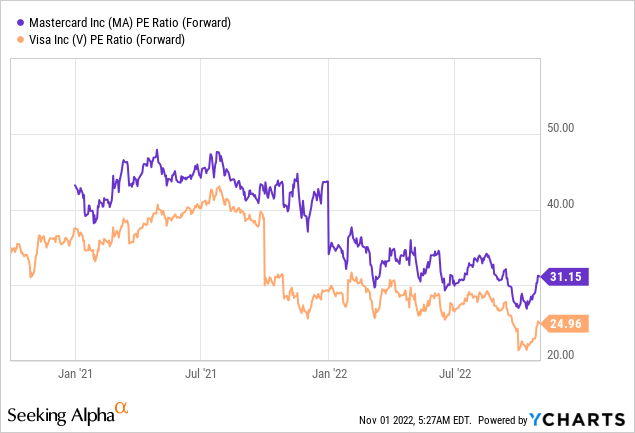

As an additional data point, Mastercard trades at a P/E ratio = 31, which is 16% cheaper than the 5-year average. Although this is slightly more expensive than rival Visa.

Risks

Recession/lower payment volume

The high inflation and rising interest rate environment has led many analysts to predict a recession. In recessions, both consumers and businesses are squeezed by higher input costs, and transaction speeds tend to slow. This is a risk for Mastercard, but only a temporary problem as economic conditions tend to be cyclical.

Final thoughts

Mastercard is one of the biggest companies that has ever existed. The company has strong competitive advantages, a dominant market position and is constantly innovating. The stock itself is slightly overvalued at the time of writing, but given more optimistic estimates it is “quite valued” with Crypto tailwinds. Therefore, the share can be a great long-term investment.