Least Volatile ‘Uptober’ Ever – Five Things to Know in Bitcoin This Week

Bitcoin (BTC$19,398) starts the last week of “Uptober” in a firm average mood as the trading range to end all trading intervals continues to hold.

After a welcome attempt to break out, BTC/USD remains bound to a narrow corridor now in place for several weeks.

Some of the lowest volatility in history means that Bitcoin has found a temporary function as a stable coin – even some major fiat currencies are currently more volatile.

The longer the status quo drags on, the more convinced the commentators are that a major trend change will occur.

This week is as good as any, they argue – macroeconomic data, geopolitical instability and classic month-end volatility are all factors in shaking up a decidedly dull Bitcoin market.

The bulls have worked to ensure that such an outbreak is on the upside. Multi-week trading intervals provide stiff resistance, while behind the scenes miners suggest that a capitulation could still surprise everyone sooner rather than later.

Cointelegraph takes a closer look at the current market setup and highlights five topics to keep in mind while tracking BTC price action this week.

Highest weekly closing time since the beginning of September

Bitcoin offered some interesting price behavior into the weekly close on October 23, with BTC/USD seeing its biggest “green” hourly candle in days before peaking at $19,700.

A retracement was already underway at the close, which still managed to become Bitcoin’s highest since early September at around $19,580, data from Cointelegraph Markets Pro and TradingView show.

BTC/USD 1-week candlestick chart (bitstamp). Source: TradingView

Optimism followed the move, which by October 24 had petered out to leave Bitcoin more or less where it had been before.

For Michaël van de Poppe, founder and CEO of trading company Eight, the time has come to say goodbye to rangebound BTC.

“Bitcoin is still stuck in this range,” he told Twitter followers the day before:

The coming week is big with all the events, which almost makes it inevitable that we will break out of the selection. I look at this last resistance. It has to break, and then the party can start.

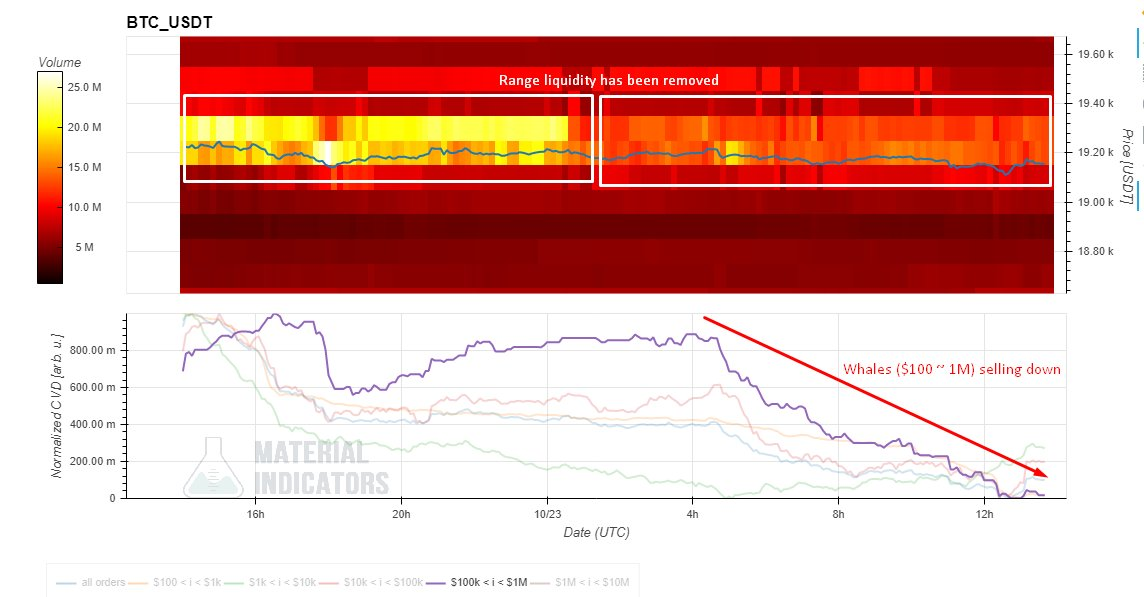

Order book data told a similar story. By analyzing trading behavior on the major exchange Binance, Maartunn, a contributor to the analysis platform CryptoQuant on the chain, flagged whales that were draining liquidity from the established price corridor.

“Liquidity from the series has been removed, or at least significantly reduced,” he summarized, adding that “Whales ($100k ~ $1M) are selling down.”

BTC/USD order book (Binance) annotated chart. Source: Maartunn/Twitter

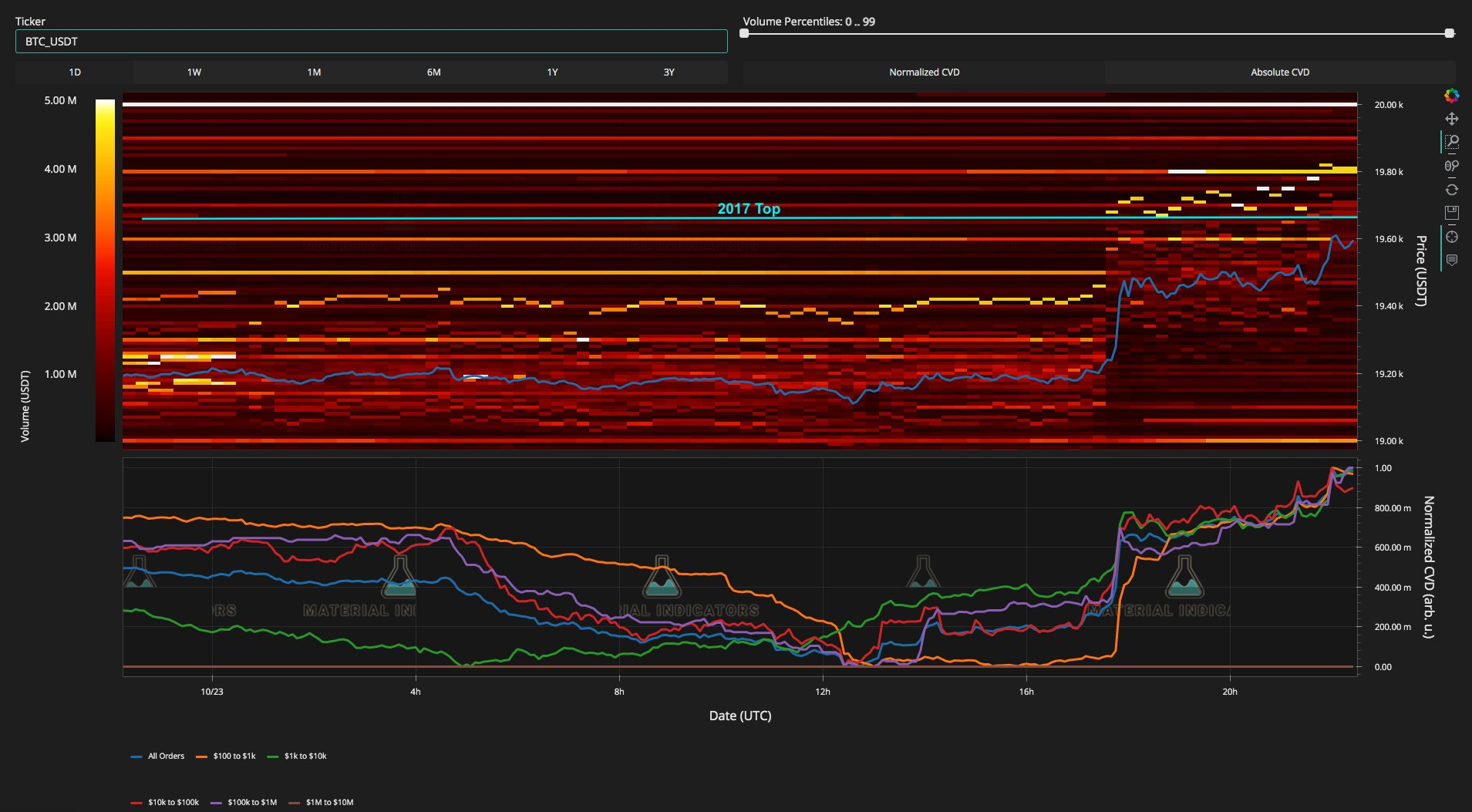

Material Indicators, which tracks the order book’s liquidity changes, further noted that the resistance level corresponding to Bitcoin’s old all-time high from 2017 had softened.

“First retest of the 2017 peak failed, but the selling wall that formed resistance at that level has been diffused into an upward ladder,” it explained just before the weekly close.

BTC/USD order book (Binance) annotated chart. Source: Material Indicators/Twitter

Popular trader and analyst Jackis, meanwhile, predicted a “wild” November for Bitcoin, while not being drawn on whether the move would be up or down.

“Bitcoin price has found an equilibrium around 19K. After a prolonged EQ there always comes a time of displacement,” he wrote over the weekend:

Look for a longer period of price acceptance above/below 19.5K/18.5K and place accordingly.

Fed, ECB in focus in the run-up to a decision on raising interest rates

Van de Poppe’s promise of a “big” week in macroeconomic events is likely to bear fruit on October 28 with the release of the US personal consumption expenditures (PCE) index for September.

Although it doesn’t traditionally have as much of an impact on crypto markets as the Consumer Price Index (CPI), PCE is still hitting a critical point this time around.

The following week, the Federal Reserve will meet to decide on rate hikes based on specific data, including PCE and CPI.

The market is currently overwhelmingly expecting a 75 basis point hike – which keeps pressure on risk assets including Bitcoin – but last week saw rumors of a softening of the Fed’s stance to come.

Any easing of policy will be a boon for stocks, which highly correlated crypto markets will naturally benefit from.

“The average Bitcoin bear market lasts 12.5 months. This is called the Golden Bull Cycle ratio,” aspiring developer James Bull commented over the weekend:

We are now in month 11 and the FED is considering stopping the interest rate increase.

Bitcoin price cycle comparison chart. Source: James Bull/Twitter

Summarizing expectations from the Fed, Charlie Bilello, founder and CEO of Compound Capital Advisors, confirmed that 75 basis points were not tipped to reappear after early November.

“Rate cuts start in December 2023, continue in 2024,” he added.

CME Group’s FedWatch Tool had the chance of 75 basis points in November at 90.5% at the time of writing.

Fed target rate probability chart. Source: CME Group

Outside the US, October 27 will see a press conference from the European Central Bank, along with a speech from President Christine Lagarde.

The Eurozone currently has record high inflation, which has exceeded 20% in some EU countries. However, the ECB has been decidedly slower than the Fed to respond with rate hikes.

“The ECB expected on Thursday to deliver a 75bps increase. However, postpone balance reduction QT until when they reach neutral rate from 1.5 to 2% against 0.75 current (at least second half of 2023),” tweeted economist Daniel Lacalle about the status quo:

The ECB is still behind the curve. It does not achieve its mandate or calm markets.

Ripping” hash rate leads to Russia question

Back to Bitcoin, and a sense of unease is growing over basic networks and the health of the mining sector.

A look at the data yields unusual, but not entirely welcome, conclusions – the hash rate may be at all-time highs, but the growth is likely unsustainable and will come at a cost.

Despite spot price action slowing down overall, miners are dedicating more and more computing power to the blockchain.

This means that already thin profit margins are further squeezed, with less miners at risk of having to abandon ship due to lost financial incentives.

The entity adding hash rate can also be assumed to have a large enough capitalization to still make money despite the current state of the network.

“Bitcoin hash rate is absolutely ripping,” William Clemente, co-founder of research firm Reflexivity Research, wrote over the weekend:

Wondering who this entity(ies) is that feels its beneficial to mine with BTC price down 70%, energy prices high and hash prices at rock bottom. Wondering if there is a large player with excess energy or access to cheap energy.

With that in mind, commentator Steve Barbour came to an unusual conclusion.

“Guys, it’s Russia. Russia is where the hashrate goes,” he argued:

Manufacturers have admitted to selling more ASICs to Russia than the US recently, and guess what happens when you blow up pipelines and bottleneck energy? bitcoin fixes that.

While the device or devices remain a mystery, the numbers speak for themselves. According to monitoring resource MiningPoolStats, the hash rate is currently over 270 exahashes per second (EH/s), while BTC.com offers an estimate of 259 EH/s.

Thanks to the extra hashrate, the difficulty increased by another 3.44% on October 24th, reaching another all-time high of 36.84 trillion.

So far, however, the old adage of “price follows hashrate” has yet to prove itself as concerns mount over sustainability.

Basic overview of Bitcoin network (screenshot). Source: BTC.com

Supply in shocks

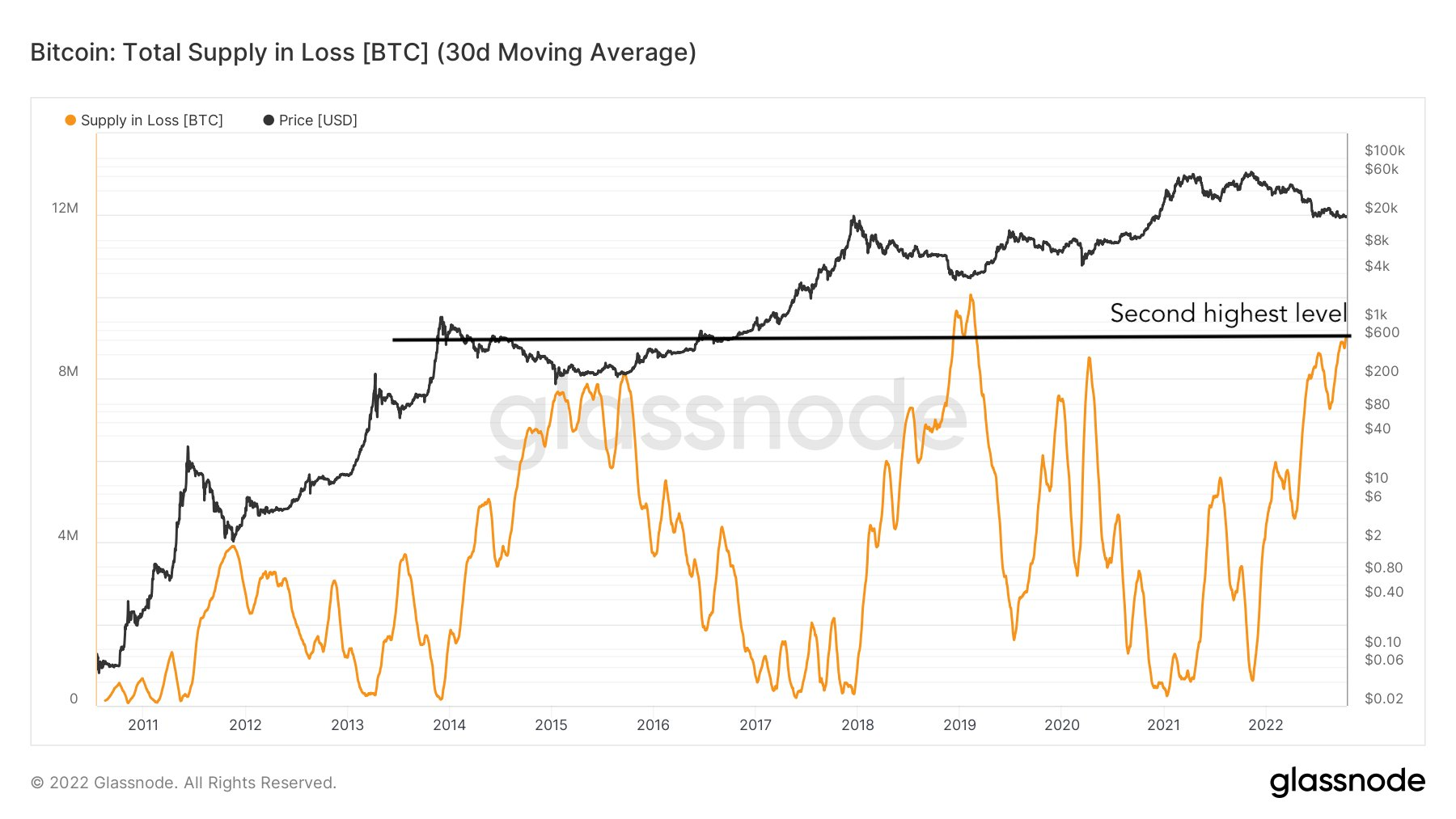

If miners haven’t yet delved into the world of capitulation, it’s already “here” for the average Bitcoin holder, an analytics unit believes.

Looking at data covering BTC supply losses, trading resource Game of Trades concluded that the pain of the bear market had already set in.

The 30-day rolling moving average of BTC held at a loss, not taking into account lost or long-term holed coins, is now near all-time highs.

“Capitulations are here,” Game of Trades summed up on Twitter:

BTC’s total supply in loss 30-day moving average is now at its second highest level ever.

An accompanying chart from on-chain research firm Glassnode estimates the loss figures at over 8 million BTC.

Bitcoin supply in loss (30-day moving average) annotated chart. Source: Games of Trades/Twitter

The responses highlighted that the number is lower if one uses circulating supplies, with Game of Trades also acknowledging that the June lows of $17,600 still constituted the “main capitulation event.”

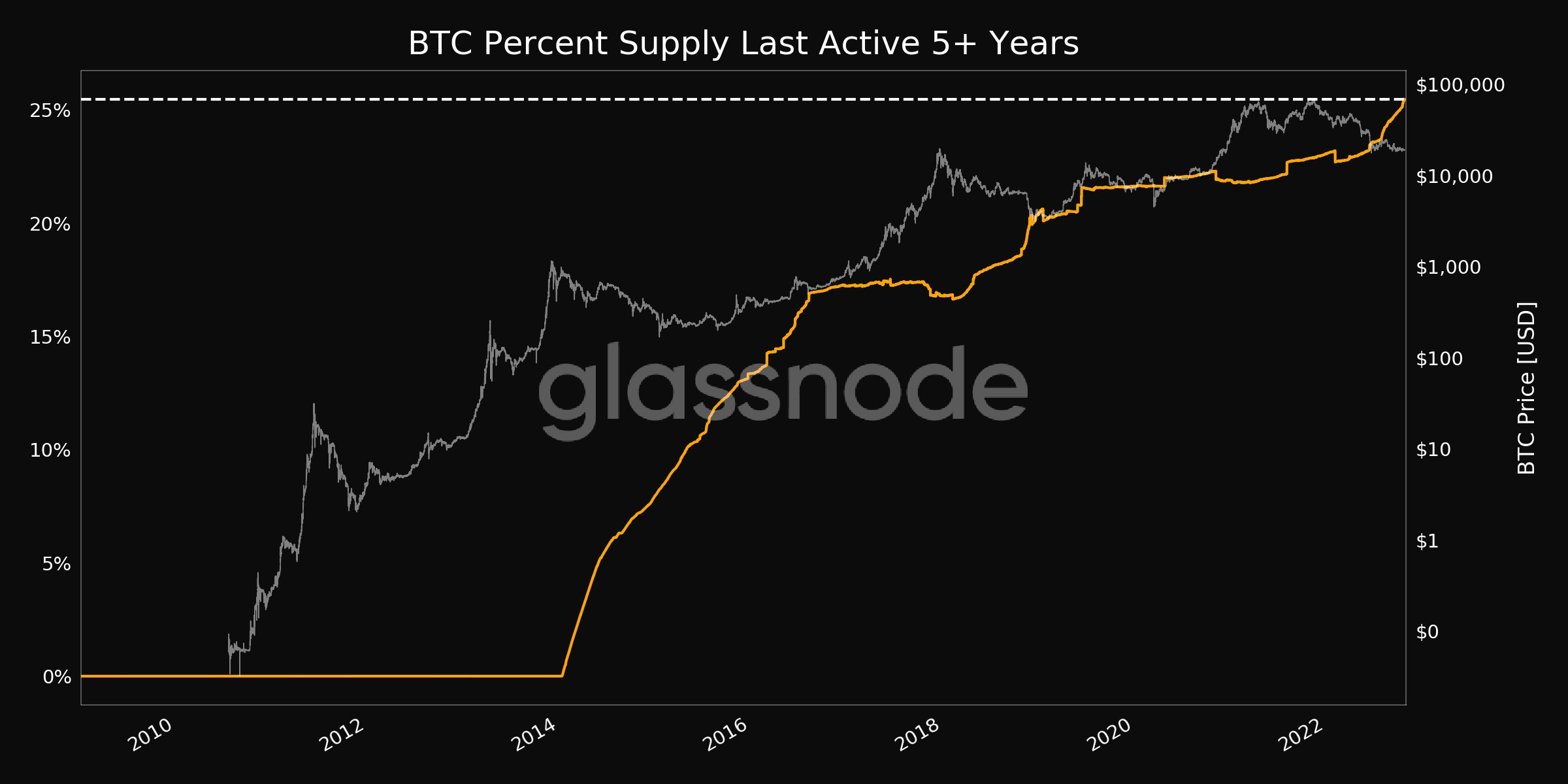

The supply issue becomes more predictable – Glassnode also confirms that the amount of BTC supply that has now been dormant for at least five years is now higher than ever at 25.47%.

BTC supply last active 5+ years ago chart. Source: Glassnode/Twitter

up to? Until what?

There is still little interest in “Uptober”, which by comparison has not delivered compared to October 2021.

At current prices, BTC/USD is only 0.36% away from the start of the month – an expression of how non-volatile Bitcoin has become.

Data from the data resource Coinglass shows that October 2022 is the flattest October on record in percentage terms and a shadow of last year, which produced a 40% gain.

Those hoping for a dramatic turnaround in November have their work cut out – last year saw a new all-time high, but the month ultimately ended with Bitcoin down 7.1%.

2020, on the other hand, saw BTC/USD rise 43% in November, with the krona matching 2017’s 53.5% increase.

Bitcoin historical return chart (screenshot). Source: Coinglass