Kevin Helms

An Austrian economics student, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of economics and cryptography.

all about cryptop referances

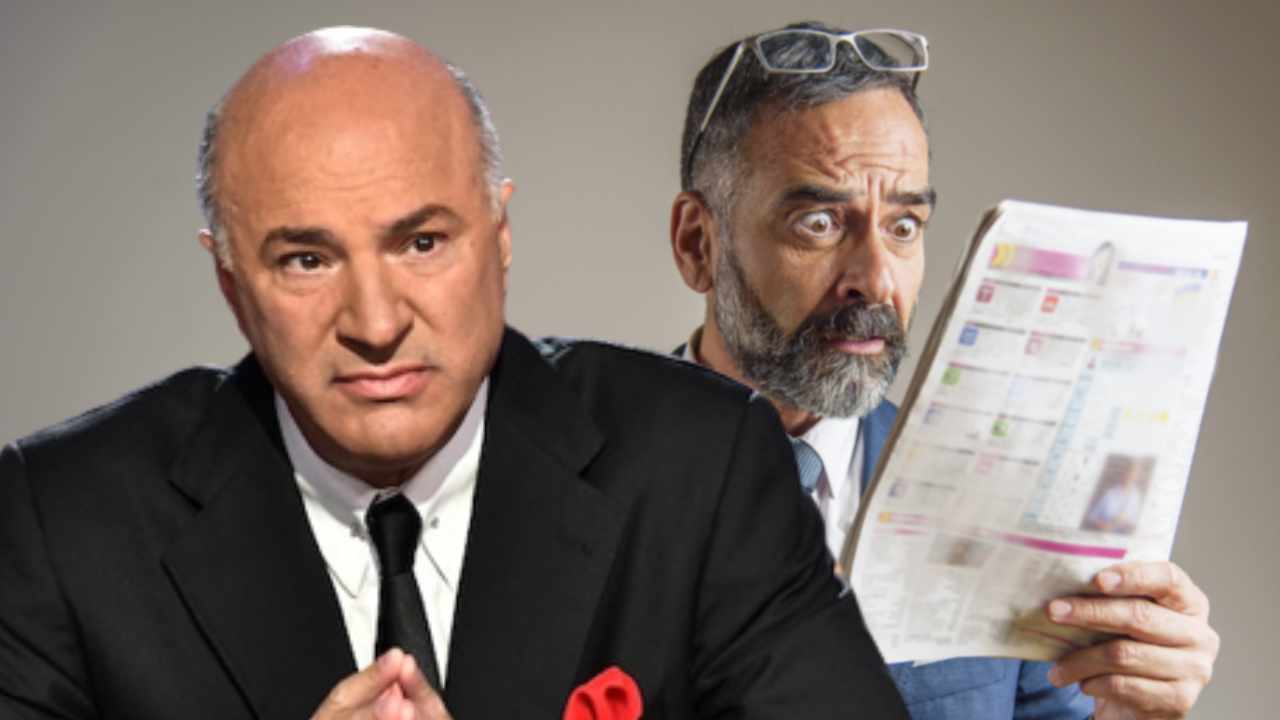

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, has warned of an impending “major panic incident” in the crypto room. “I do not think we have seen the bottom yet, and I have a different view on it,” he said.

Shark Tank star Kevin O’Leary shared his crypto views in an interview on the Youtube channel Meet Kevin last week.

He was asked how far the price of bitcoin could fall and whether BTC could fall to $ 13K, as some have predicted. “It’s impossible to know where the bottom is,” O’Leary replied, adding:

I do not think we have seen the bottom yet, and I have a different view on it.

Referring to his previous experience, the Shark Tank star said: “I return to other asset classes that I have invested in for decades. In all cases – traditional bonds, traditional stocks, real estate, alternative asset classes – the bottom is reached with an event, a panic event as I call it, and you can find it in all asset classes. “

O’Leary notes:

We have not seen it yet in crypto countries. There’s no big guy who’s gone to zero yet, and I think it’s still coming.

He added that it is difficult to predict who will fail next “because it will be due to influence and a kind of relationship in a counterparty that they have not revealed.”

He said Voyager, the cryptocurrency lender that filed for Chapter 11 bankruptcy last week, is too small to be significant. “The rest of these guys were kind of irrelevant in terms of overall market value,” he said.

The Shark Tank star pointed out that the crypto market, including bitcoin, “is almost halved in total market value, so you’d think we’re on the bottom.”

However, he stressed: “I like a big, big panic incident. It has always been a great way to bottom out – there is towel throwing, there is capitulation, there is massive volume, there is total panic in the streets – and always a great buying opportunity. ” He elaborated:

I have no idea who’s next. [It] may be tomorrow early, may be a month from now, but it comes to a theater near you.

Mr. Wonderful concluded: “It will definitely be a very good thing for this industry. It will be a great thing because it will remove all the bad, broken business models, the heavy influence, the speculation that was too risky.”

The Shark Tank star has predicted that trillions of dollars will flow into crypto from institutional investors when regulators adopt a crypto policy. He believes that crypto will be the 12th sector of S&P. In June, O’Leary revealed that he holds 32 positions in the digital assets area and does not sell any despite the sale of the crypto market. «I do not sell anything… Long-term, you just have to endure it. You have to understand that you will get volatility, and that some projects will not work, he emphasized.

What do you think of Kevin O’Leary’s predictions? Let us know in the comments section below.

Photo credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the Company nor the author is liable, directly or indirectly, for any damage or loss caused or alleged to have been caused by or in connection with the use of or reliance on the content, goods or services mentioned in this article.