If Bitcoin can’t handle a few JPEGs, how can it handle the world?

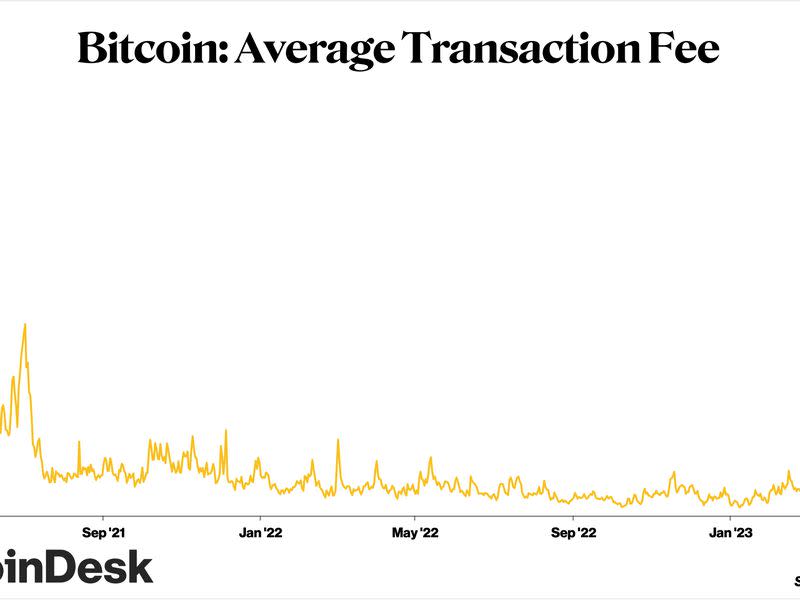

Many bitcoiners have been up in arms about high fees amid a surge in new activity on the original blockchain. The fees, set dynamically by a competitive bidding process, rose to a staggering $30.19 for a single bitcoin transaction on May 8, after hovering around $2 since July 2021 – nearly two years.

The situation is serious enough that some bitcoiners, especially so-called “maximalists”, have gone as far as suggests censorship of BRC-20 tokens and other assets based on the “ordinals” issuance method. These assets use new features to enter data into bitcoin transactions, and appear to be driving the price increase. There is a great deal to be said for the moralistic debate surrounding the BRC-20 issue, but in a surprising development, maximalist figurehead Michael Saylor (the former CEO of MicroStrategy) has now declared their rise “bullish”.

This article is taken from The Node, CoinDesk’s daily roundup of the top stories in blockchain and crypto news. You can subscribe to get the whole newsletter here.

Leaving aside the “what is Bitcoin for” question, there’s a much simpler solution here: Bitcoin doesn’t scale, and blaming ordinals doesn’t change that fact.

The chain would face the same scaling problems if only a slightly larger part of the world used it for monetary transactions. That means the BRC-20 kerfuffle is, ironically, ultimately a blow to the very “maximalist” vision held by those who currently object to the non-monetary use of bitcoin.

Overflowed mempool

The explosion of interest in BRC-20 tokens on Bitcoin has led to a huge increase in transaction volume on the base layer network, in turn driving up transaction prices. There are many different ways to put this congestion into context, but a very good metric is Bitcoin mempool congestion. The mempool is where transactions wait to be validated, and are ordered according to the fee bid associated with them. A fuller mempool means more competition to get your transaction into the next block.

Reviewing the data is eye-opening in many ways. (I used this simple but awesome mempool visualization tool by Jochen Hoenicke, a researcher at smart contract security firm Certora.)

First, due to the sheer volume of transactions, Bitcoin’s mempool has apparently never been so full—not by a long shot. The last major peak in April 2021 saw 200,000 transactions queued, but yesterday that number peaked at 450,000. (Hoenicke’s node only dates back to 2017, but before that bull market, Bitcoin congestion and fees were negligible.)

Just as remarkably, these transactions are often small. You can also see, courtesy of bitinfocharts, that the average bitcoin transaction size has dropped in recent days.

The exploding volume of small transactions seems to confirm that the increase in demand has been driven by speculators (and/or future carpet pullers) feverishly. issuance and embossing tokens using the experimental “BRC-20” standard. There is hype around tokens right now and apparently degens wants $pepes and other casino tokens right now, not in 12 or 14 blocks. Coinmarketcap claims that a staggering 8,500 tokens have been issued on Bitcoin in the mere weeks since the BRC-20 standard was first launched.

Given that these are mostly “memecoins” that amount to little more than gambling, the bidding war looks set to be short-lived. And in fact, by May 10, fees had already fallen slightly from the May 8 peak.

But here’s the thing: If even a few million people actually wanted to use Bitcoin to send money peer-to-peer on a regular basis, we’d be in the exact same position. And it would be permanent, rather than transient. The calls for Bitcoin censorship by maximalists are arguably incoherent for a number of philosophical reasons, but this practical incoherence is most striking. Bitcoiners upset about a temporary fee increase driven by degenerates may be better off focusing their energies on solutions to the looming problem of persistently higher fees driven by everyday users.

See also: The Rise and Fall of Bitcoin Maximalism | Opinion

Most fundamentally, as Castle Island Ventures co-founder Nic Carter pointed out in these pages yesterday, “high prices are the cure for high prices.” We are seeing this in real time, especially with Binance integrating the layer 2 “Lightning network” into its bitcoin withdrawal flow. Lightning is purpose-built to remove the burden of smaller transactions from the base chain, but it requires a rather arcane setup for peer-to-peer use. At the same time, Lightning service companies, like David Marcus’ Lightspark, have a sudden goal-rich environment to make Lightning easier for average Joes.

In that regard, the BRC-20 tax spike appears to be a blessing in disguise: a warning shot that should trigger a frenzy of preparation for a sustained boom.

There is a final, hypothetical irony here. The actual viability of both ordinals and fungible tokens on Bitcoin remains extremely unclear – one considerable error in inscriptions was identified just last week, for example. But if you squint, it’s not impossible to envision some kind of mainstream technology that enables entirely new approaches to scaling Bitcoin, perhaps including “layer 2” technology closer to what Ethereum can achieve.

That might prove even more distasteful to the maximalist crowd than sharing their mempool with JPEGs and degens. But if you’re actually committed to scaling Bitcoin, it might be time to think bigger.