How to build a fintech with limited resources

You will be hard pressed to find a young internet-using Nigerian living in Nigeria who does not have at least one Fintech app on their smartphone. Depending on who you ask, there are over 100 fintech startups in Nigeria. Per Statista, 144 fintech startups existed in the country as of 2021. For The Fintech Times, the number is estimated to be 200+.

The point here is that Nigeria has the highest number of fintech startups in Africa, which raises questions about the proliferation of such startups in the country. No wonder the fintech sector accounted for 73.5 percent of the $1.09 billion raised by Nigerian startups in 2021, according to BusinessDay.

Naturally, these numbers will encourage upcoming players in the industry to build a fintech. However, experience has taught some founders who spoke at the Fintech Summit that building a fintech is not easy.

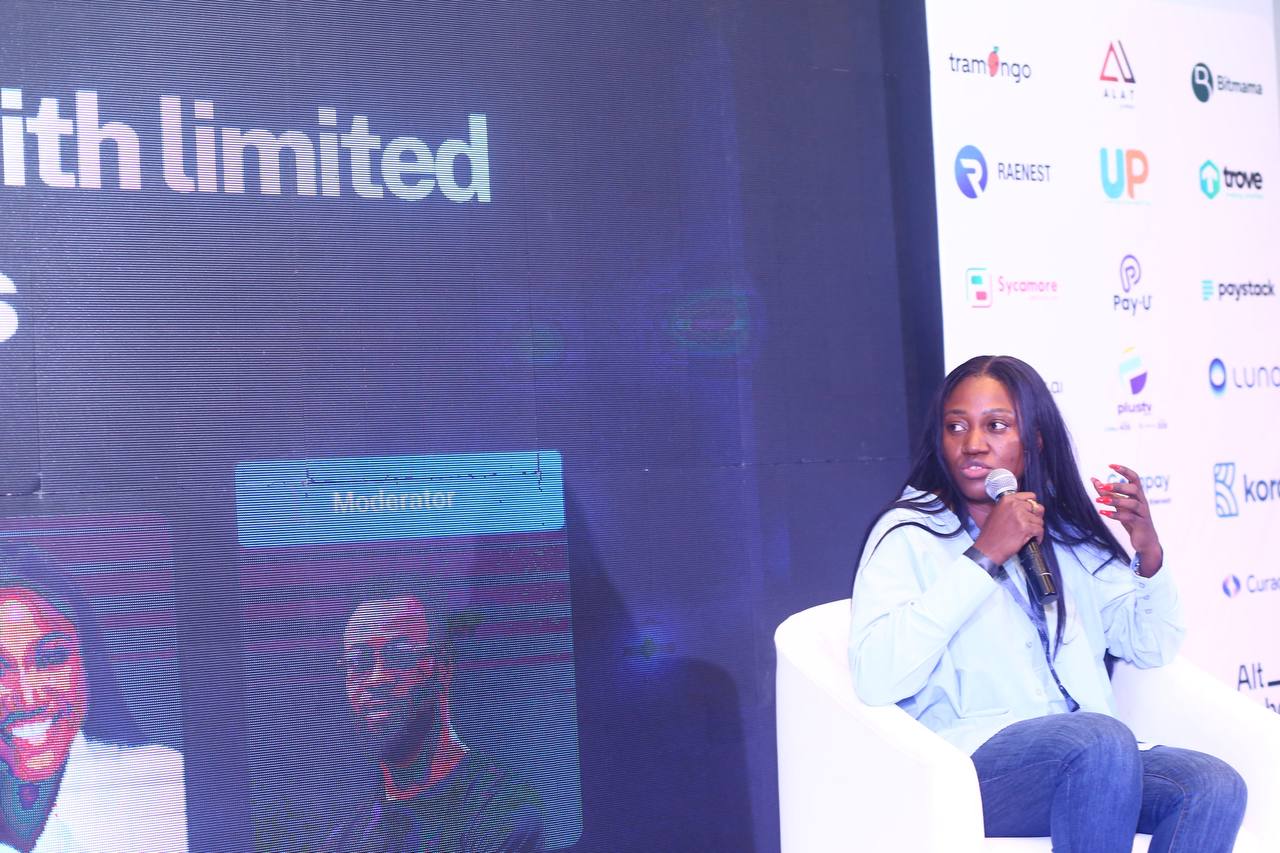

In reality, it is not as easy as it looks on paper, as entrepreneurs have to deal with several challenges at an early stage. So, how do you build a fintech? This came to the forefront of the discourse at the Fintech Summit organized by African technology media company Techpoint last Saturday 26 November.

One of the breakout sessions was tagged ‘Building a Fintech with Limited Resources’ and featured panelists such as Munachi Ogueke, Co-Founder and CEO of Oneliquidity; Adeyemi Adegbayi, Investment Analyst, TLCom Capital; and Yvonne-Faith Elaigwu, COO, OnePipe.

Talking about the question of why someone should build a fintech, Adeyemi says there are still problems to solve in the areas of payments and improving financial inclusion in Africa, citing the need to create new solutions to address different financial services on the continent.

Also read: Editorial: Are there really too many fintech companies in Nigeria?

“Build a business while building a Fintech”

Funding is perhaps the most important issue in building startups – including fintech – in any part of the world. For context, global fintech funding fell 38 percent in the third quarter of 2022, according to the State of Fintech Report for Q3 2022 released by CB Insights.

For Munachi, any founder must ensure that whatever fintech they create is a business first before anything else. “If you don’t have a business that can create value, just forget about raising money because you’re simply building your hobby. Once you’ve figured that out, you can now turn to investors or a bank for a loan ,” he said.

Related Article: Falling investment continues as global fintech funding falls 38% in Q3

Finding the right people

Yvonne-Faith took the conversation on how to build a fintech with limited resources further as she pointed to the need for early-stage entrepreneurs to ‘sell’ the business to their pioneering team, saying: “it’s important to find people who buy into the vision about what you create”.

She also emphasized that Nigerian founders, including but not limited to people who want to build a fintech, need to look at ways to satisfy their employees, such as telecommuting and stock options. But Munachi says that the start-up must make money as a business, so that the employees can be motivated to follow the vision.

“I tell founders, ‘You’re selling to three sets of people: your investors, your employees, and your customers.’ You have to make sure those people buy what you’re selling, or the business will fail” delivered the Oneliquidity boss.

Collaboration is the key

Adeyemi believes Nigerian startups have collaborated in various innovative ways, although the partnerships need to be more strategic and value-oriented for all parties involved.

“You see some decks with a lot of logos on them, but those people don’t affect the bottom line.

Adeyemi Adegbayi

Your income is not growing, but you are integrated every day. Why? It’s because you don’t have the symbiotic relationship you need to make things work. For example, if I’m company X and I have a thousand companies integrated into me to help push their products, I’ll only prioritize companies that have the most value. he said.

When it comes to making sure partnerships work, Yvonne-Faith said many startups are more interested in building all the solutions themselves rather than plugging into existing ones to assess growth opportunities.

However, in Munachi’s words, the Nigerian tech ecosystem is notorious for hoarding ideas and players often view innovations as a competition: “If you are a founder in another market, everyone is willing to help by connecting you with others who are building similar solutions. The case is different here in Nigeria.”

He then advised early-stage entrepreneurs to establish value-based relationships that can create possible partnerships and collaborations, adding that it is important to work with an ethical company.