How Bitcoin and Crypto Prices Will React to FOMC Minutes, CPI Inflation – Is the Market Bottom Near?

Bitcoin, and crypto prices more generally, have been treading water this week, but that could change starting today as Producer Price Index (PPI) inflation data and FOMC minutes are released.

First to disturb the market from its slumber is the US PPI data, a measure of factory-gate inflation.

Any sign of cooling will be treated as confirmation of the need for the Fed to ease rate hikes. Such an outcome would light a fire under stocks and crypto prices.

Conversely, if producer price inflation continues to heat up, then expect risk assets to resume their sell-off.

PPI inflation will be lower than in August

Well, the data is in and Core PPI month-on-month rose to double the expected level, coming in at 0.4% against the 0.2% forecast.

Meanwhile, year-on-year headline PPI was 8.5%, warmer than the forecast of 8.4%, although down from 8.7% last month (August) – and the latter point looks basically to be the key for market.

As such, the reaction so far is quite positive – Bitcoin remains largely unchanged, but could move higher if stocks can pick up some positive momentum.

The S&P 500 is up 0.2% to 3,595, the Dow 61 points higher and the Nasdaq 0.38% better at 10,468.

Elsewhere, sales of UK 30-year government bonds have picked up, with yields accelerating upwards of 23 basis points to 5.00% (more on the UK financial crisis below)

But the PPI data is the warm-up act for the main show, which is the US consumer price index (CPI) inflation data released on Thursday.

FOMC minutes could stir up the crypto market

But even before the much-anticipated numbers are released, market participants will have plenty to think about when the Federal Open Market Committee (FOMC) releases the minutes of its meeting on September 21 at 18:00 UTC.

The minutes will probably show that there is a confirmatory consensus around the need for an interest rate increase of 75 basis points in November.

Fed watchers will be watching for any language changes that could be interpreted as either a hardening of hawkishness or a willingness to veer away from such a path, should incoming data indicate that inflation may begin to weaken.

One area of possible disagreement, or at least a lack of adjustment, will be over the terminal rate – in other words, the rate that will mark the top of the hike cycle.

According to Refinitiv data, the consensus forecast for the terminal rate is now 4.45%, a far cry from previous estimates made in August which targeted 3.7%. The terminal price date is assumed to be March 22, 2023.

Any hint of the terminal price coming later than expected and at a higher level will lead to selling in both the stock and crypto markets.

Some economists believe the terminal interest rate will be closer to 5%. Regardless, the FOMC minutes may shed some light on the minds of its members.

Bitcoin is holding its value better than UK government bonds with inflation-linked values right now

Perhaps the most striking observation made on market conditions in crypto in recent weeks has been its relative stability, especially when considered alongside other asset classes.

Take UK government bonds for example, where the trauma in these markets continues, perhaps coming to a head on Friday when the Bank of England says – although the signals confuse the market – that it will end its bond buying at the long end of the curve (30 year bond maturity).

Take a look at this chart from a recent Financial Times story:

The chart shows that the bitcoin price is down 67% since November 2021, but the UK inflation-linked one due in 2073 is down almost 80%.

It’s a fantastic juxtaposition. It underlines how a maturing bitcoin market actually competes well in terms of volatility against previously solid asset class instruments such as UK inflation-linked government bonds, or “linkers” as they are called.

Bitcoin volatility may rise soon, but overall volatility is on a downward trend

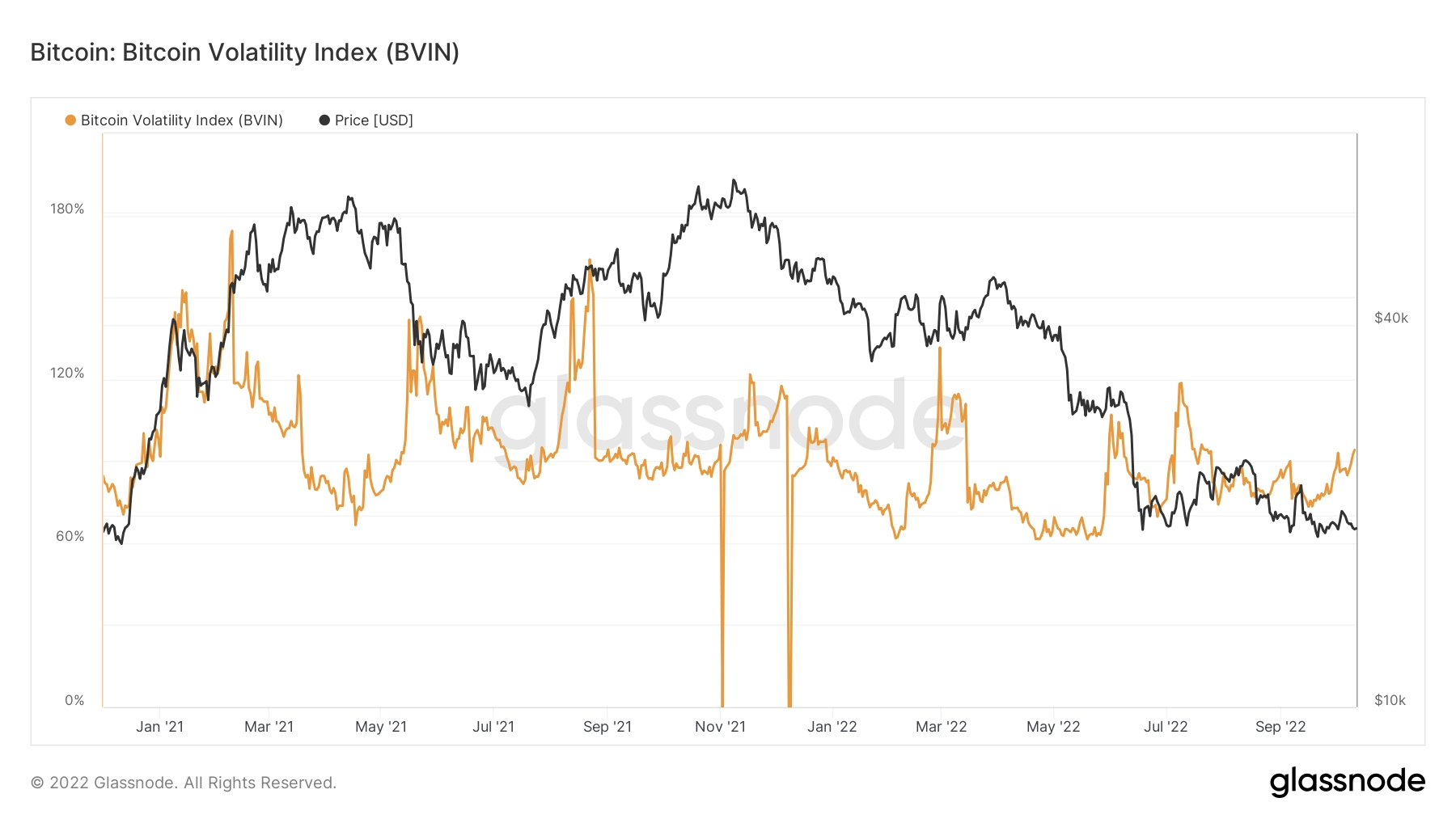

Our second point to consider is the weakened volatility of the bitcoin price.

Of course, this matters because volatility is another way of expressing risk – and it becomes less risky to hold bitcoin.

We can see this in the descending peaks of the Bitcoin Volatility Index illustrated by the orange line on the chart below (the two descents are explained by missing data):

How will the FOMC minutes and inflation data play into bitcoin’s ongoing bottom formation?

And what we all want to know is how does the news from the economic statisticians and the Fed factor into the calculations of whether the bitcoin price is near the bottom?

On that, the bitcoin accumulation trend score can help clarify matters.

It’s a relatively new (March 2022) Glassnode calculation, and here’s a useful definition:

The Accumulation Trend Score is an indicator that reflects the relative size of entities actively accumulating coins on the chain in terms of their BTC holdings. The Accumulation Trend Score scale represents both the size of the entities’ balance (their participation score), and the amount of new coins they have acquired/sold over the past month (their balance change score). An accumulation trend score closer to 1 indicates that, overall, larger units (or a large portion of the network) are accumulating, and a value closer to 0 indicates that they are distributing or not accumulating. This provides insight into the balance sheet size of market participants, and their accumulation behavior over the past month.

If you want to go a little deeper into the calculation, watch this video:

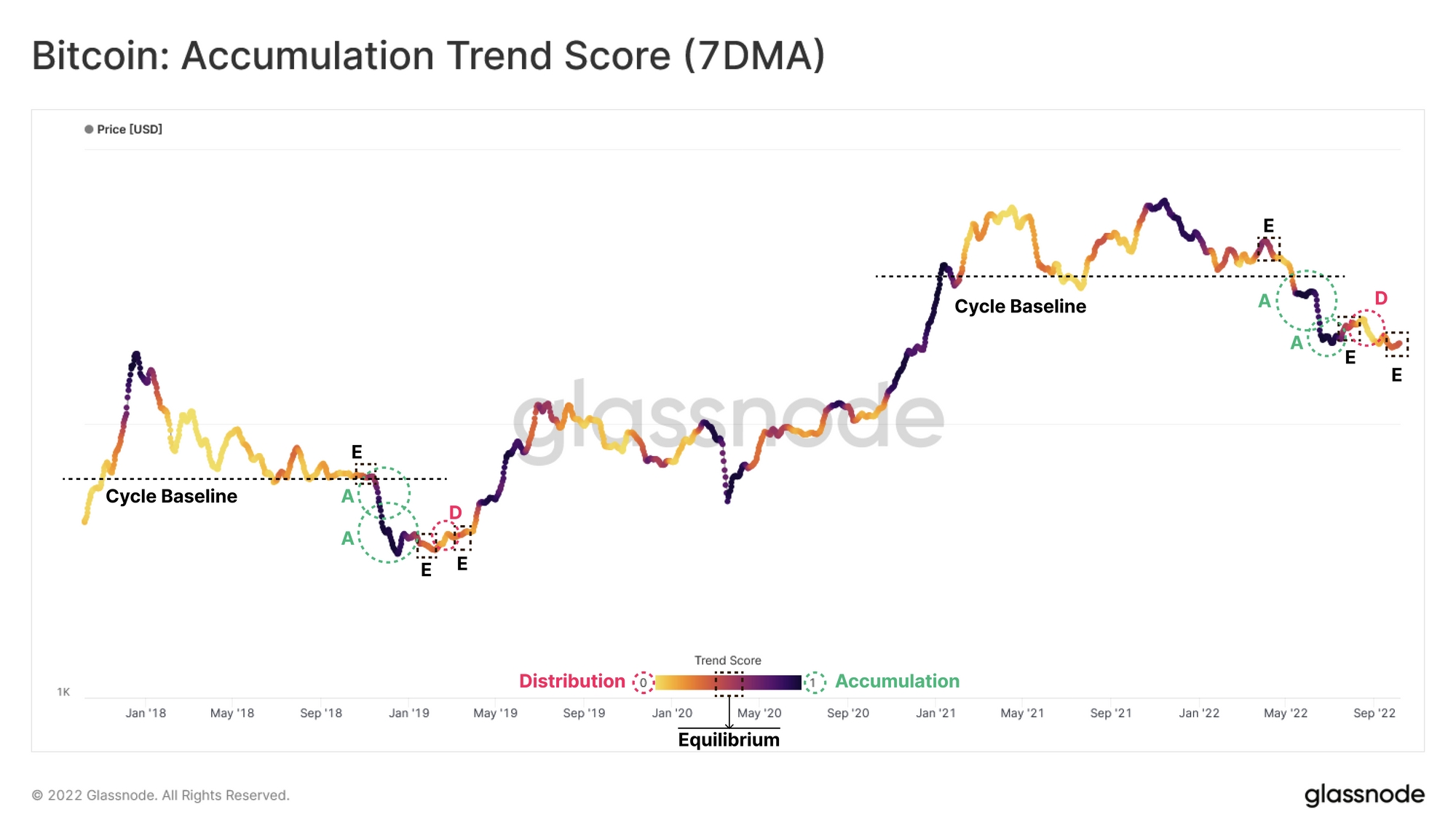

What is notable about the chart is the possible repeat today of the bottom formation pattern seen in late 2018 and the first quarter of 2019.

Here is the annotated Glassnode diagram:

Among other things, Glassnode highlights how “accumulation trend score for whales holding 1k-10k BTC highlights aggressive accumulation since late September”:

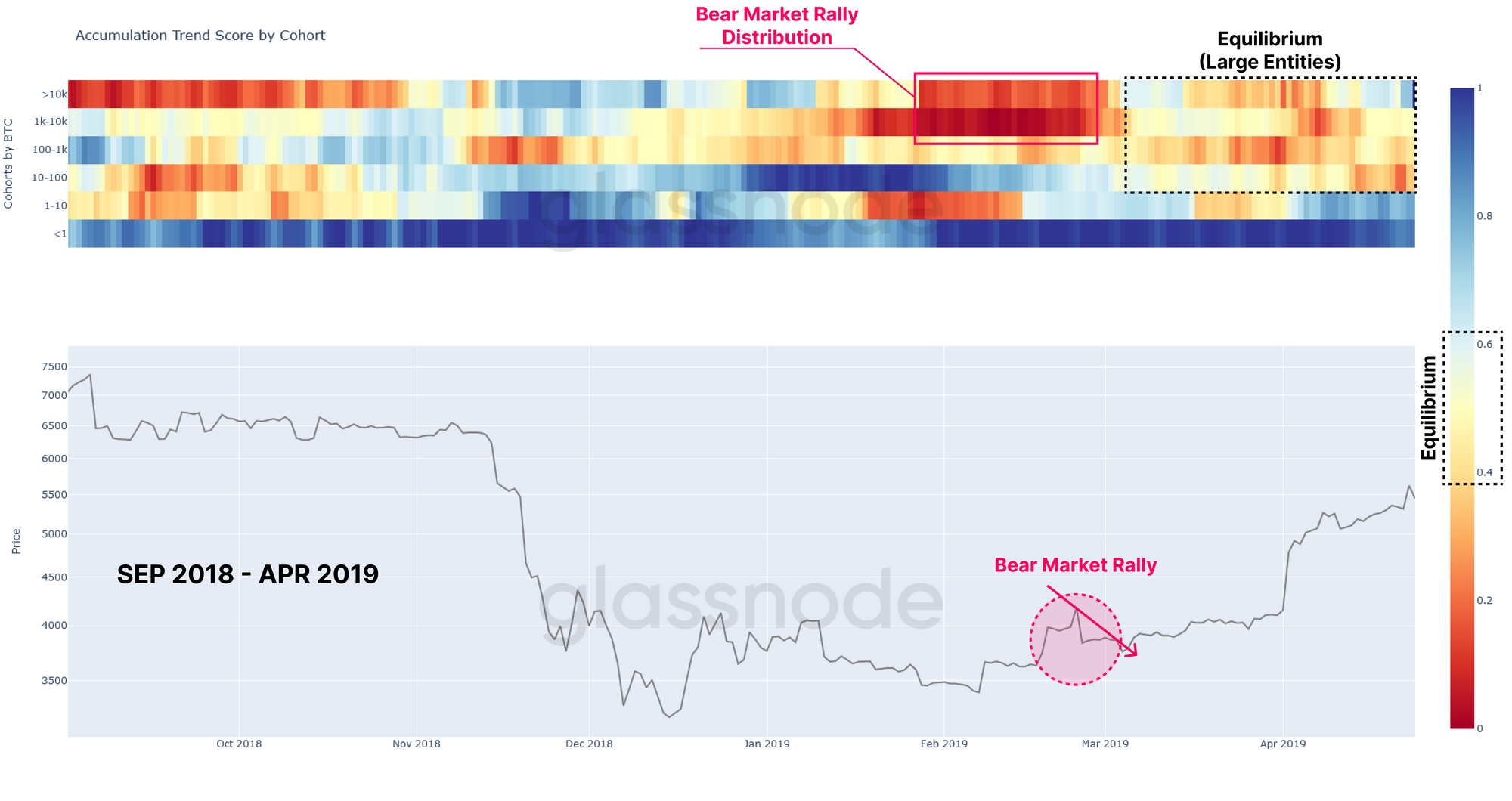

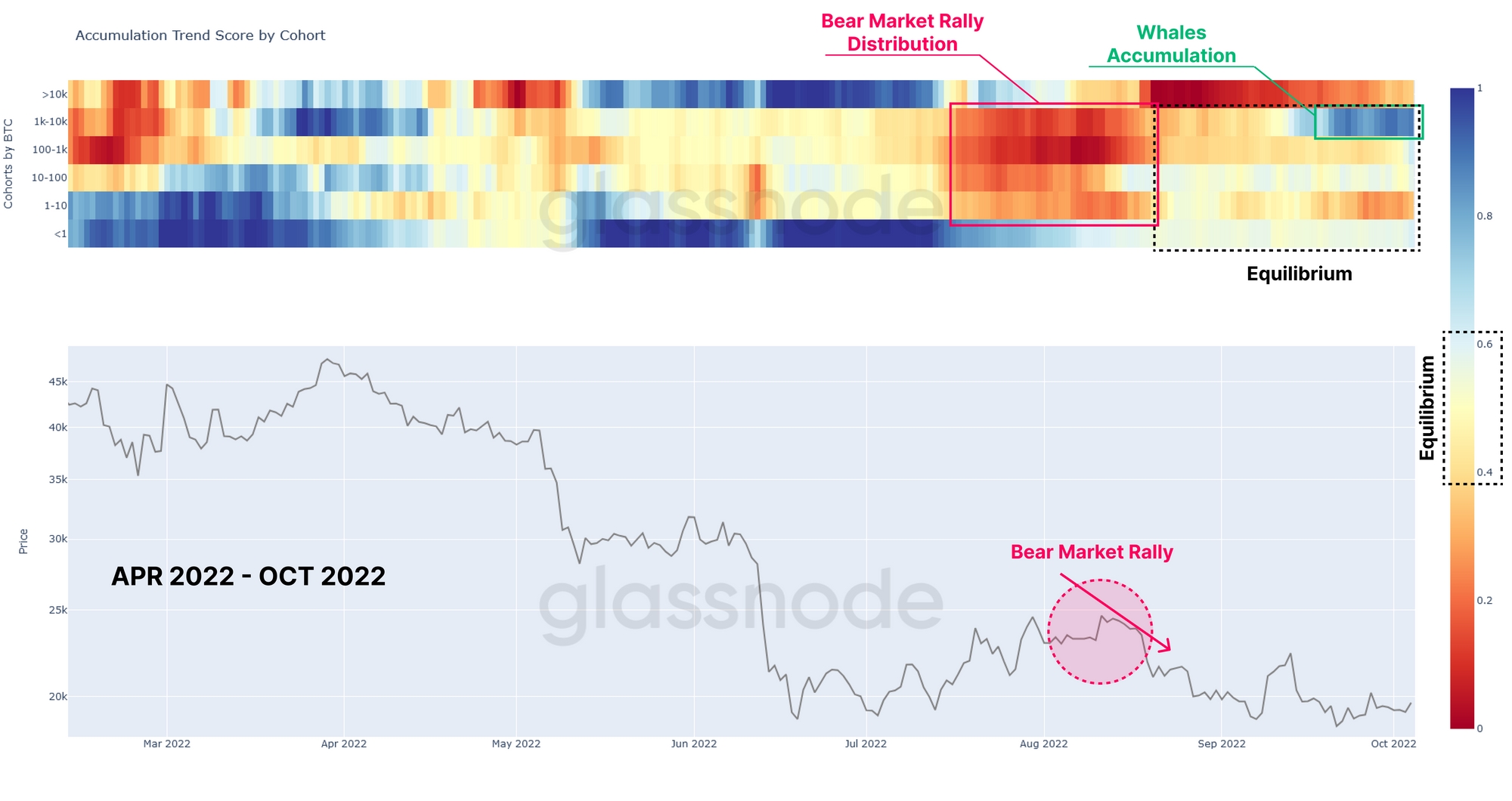

In our current market structure, and with an approximate 10x in BTC prices, we can see very similar behavior occurring in large units, but driven more by the 100-1k BTC cohort during the August rally.

In addition to the relative neutrality across small to medium address cohorts, the accumulation trend score for whales holding 1k-10k BTC highlights aggressive accumulation since late September. Whales owning >10K BTC have been biased towards weak distribution in recent months.

A closer look at the two periods is shown below:

If the apparent fractal is the correct interpretation, regardless of what happens in terms of near-term volatility, bitcoin is in a good place.

Cost averaging into the market below the $20k level can be a relatively good entry point, especially if you are buying the BTC/GBP pair.

Portfolio diversification – go green

And if you feel like fishing among some of the upcoming altcoins, a good diversification if you already have bitcoin could be a green eco-friendly crypto like IMPT, which is currently on presale.

It is worth mentioning because it is the only coin out there that targets customers by enabling them to offset their carbon footprint.

The pre-allotment is selling at an impressive clip, with $3 million worth of tokens snapped up in a week, but do your own research.