Higher Than Expected PCE Number Pushes Bitcoin Down

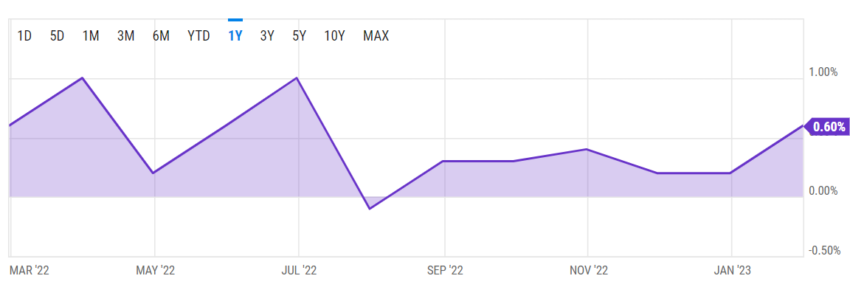

Month-on-month core personal consumption expenditures rose 0.6% in January 2023, higher than analysts’ 0.4% forecast and December’s 0.3% increase.

The latest consumption data confirmed earlier fears of a booming labor market as personal income rose 0.6% after a 0.2% increase in December 2022, while private consumption rose 1.8%.

Stocks and Bitcoin fall as both core and headline PCE rise

Headline PCE, which includes food and energy, rose 5% year-on-year, up slightly from 4.9% in December 2022.

The US Bureau of Economic Analysis reports personal income, personal expenditures, and the PCE price index monthly in its Personal Income and Expenditure Report.

After the news, stock markets took a hit, with the Dow Jones falling 300 points and more pain expected for growth stocks. Nasdaq 100 futures fell 1.7%, while S&P 500 futures fell 1.2%. Marketing strategist Sven Henrich noted that PCE numbers likely present stock buying opportunities.

Bitcoin followed equity markets lower, falling 0.6% to $23,751 and falling further to $23,106 at press time. Ethereum fell from $1,639 to $1,592 at press time, a decline of over 3.4%.

Unlike the popular consumer price index, which measures detailed price changes for everyday items such as cereal, personal consumption captures large changes in consumer behavior based on price; for example, if consumers choose a cheaper cereal because the price of their preferred brand has gone up. In the medical sector, the CPI tracks changes in the price the end user pays, while the PCE measures what the health insurance companies pay for treatment.

The Fed places more emphasis on PCE than CPI

The Federal Reserve, responsible for price stability and maximum employment in the United States, is expected to announce an increase in interest rates at its next meeting, which starts on March 22, 2023.

The central bank has increased borrowing costs since March 2022 to tame US inflation, which reached decade-high proportions in the wake of Covid-19 stimulus checks and low interest rates.

Its open markets place more weight on PCE than CPI in determining changes in monetary policy. Hot PCE numbers point to policymakers raising interest rates at the March meeting, although markets and analysts are divided on the size of the rate hikes.

Analysts agree on future increases while the market prices in 50 basis points

Data from CME Group indicated that futures markets are already pricing in a 50 basis point increase following the news, double the previous general market consensus of 25 basis points.

Analysts and markets agree that the Fed is likely to continue raising interest rates at its next three meetings. Fed chief Jerome Powell said earlier this year that the Federal Reserve is unlikely to end rate hikes before the end of the year to meet its 2% inflation target.

“The Fed has a lot more work to do, and even if they only raise rates a few more times, it is extremely unlikely that they will cut rates this year – as the consensus was and in market-based pricing as recently as a few weeks ago,” noted Chris Zaccarelli, Independent Advisor Alliance’s Chief Investment Officer.

Cleveland Fed President Loretta Mester agreed that the Fed “needs to do a little more” to continue pushing inflation down, and expects interest rates to reach just above 5% and stay there.

Minutes from the last FOMC meeting indicate that most committee members favored reducing the pace by 25 basis points.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.