Grip wants to bring together the finances of consumers and businesses in Africa

Grip was founded in April 2021 on a defiant mission to simplify payments and transform Africans’ experience of interacting with their money.

For a long time, disruption in the Fintech space meant that startups were nibbling small pieces of the traditional banking pie – an era of unbundling banks. Africa has witnessed the emergence of startups that did an excellent job of taking part of the banking value chain and improving the overall financial experience for users using technology.

However, that soon posed a problem – a highly fragmented financial ecosystem; It turns out that users want more from a single product than having to juggle multiple platforms and financial products.

The great “rebundling” in Fintech has been predicted for some time now, where startups will aggregate the distribution of fintech products and services, making it less fragmented for the market and easier for users.

This prediction has become a reality with the likes of innovative startups like Curve, Revolut, OneCard and others operating in different parts of the world. But Africa is left out, much more so than Nigeria, which has the largest fintech market on the continent.

Juggling multiple payment cards and wallets from different banks and fintech apps is a side effect of a fragmented financial ecosystem. A side effect that greatly affects the majority of the banking population in Africa.

Grip was founded in April 2021 on a defiant mission to simplify payments and transform Africans’ experience of interacting with their money.

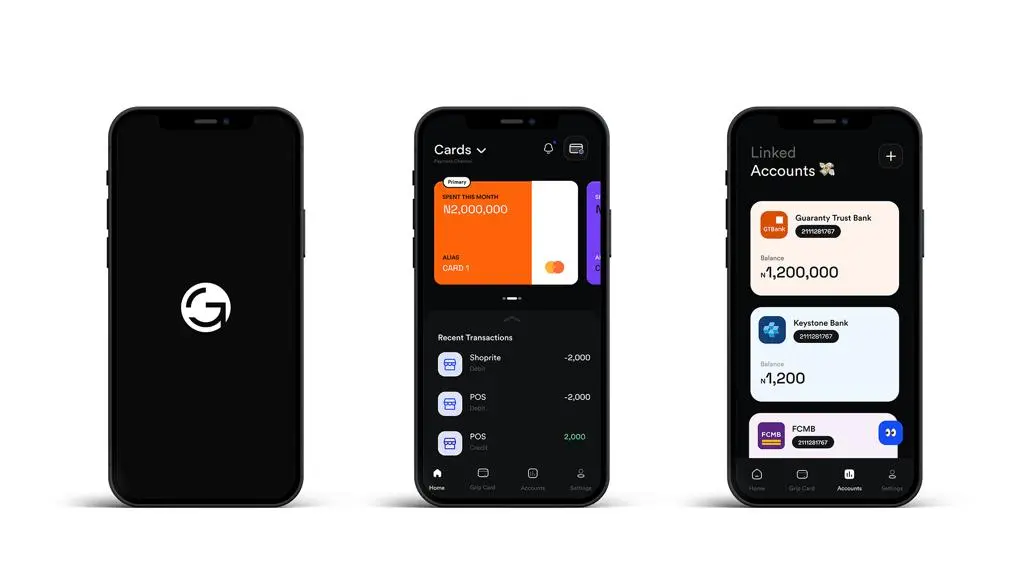

Grip’s unique offering is that it brings together all your credit cards, debit cards, bank accounts and fintech wallets into a single app and card. The Grip card paired with the Grip app enables the user to add all their cards to one debit card. Grip collaborated with award-winning designers such as Renike and Shutabug to design their stylish and unique debit cards that have made a huge impression on the public with many clamoring for a Grip Card.

Grip wants everyone to be able to choose the services and products they want, manage them the way they want, and have the power to change those choices whenever they want.

Grip’s distinct ‘all-in-one’ technology enables customers to interact with their finances in ways that were not possible. Apart from the added benefit of being able to manage all your existing cards and fintech wallets with Grip, you’ll also get access to cutting-edge features that allow you to withdraw from any fintech wallet with your Grip card, make a single payment on multiple cards and wallets, and chose a backup card that is charged automatically if your standard card declines a transaction, among other things. These are important offerings in an ever-accelerating world where our economy is fragmenting with new players emerging and introducing new digital financial services (including payment cards) regularly.

Furthermore, Grip’s offer brings relief to Nigerians who have been struggling with currency restrictions on the Naira card. At Grip, users will have unlimited access to FX to use in online stores and over 200+ countries without ever worrying about borders.

When asked, Founder and CEO of Grip, Nelson Atuonwu simply described Grip as: “When you think about how Spotify combines music that was normally distributed independently into a single platform, and all the benefits that were unlocked for users, Grip aims to achieve the same for your finances.”

“In bundling, consumers are always the winners, because it allows them to interact with services and service providers they’re already used to in new ways that just wouldn’t have been possible before. Many of the things we just announced today are, well, never-before-seen- features, and we’re only just getting started. It’s been 18 months of painstaking research and development work, and we’re incredibly excited to finally let users experience what we’ve been able to achieve as a team ,” Atuonwu added.

Grip launched its app on both App Store and Google Play to over 3000+ people on their waiting list and the general public last week.

This article was written by Ifeoluwa Mibiola.