Global Blockchain-as-a-Service Market Report: A Roadmap for

WHAT WE HAVE ON THIS SITE

Market overview

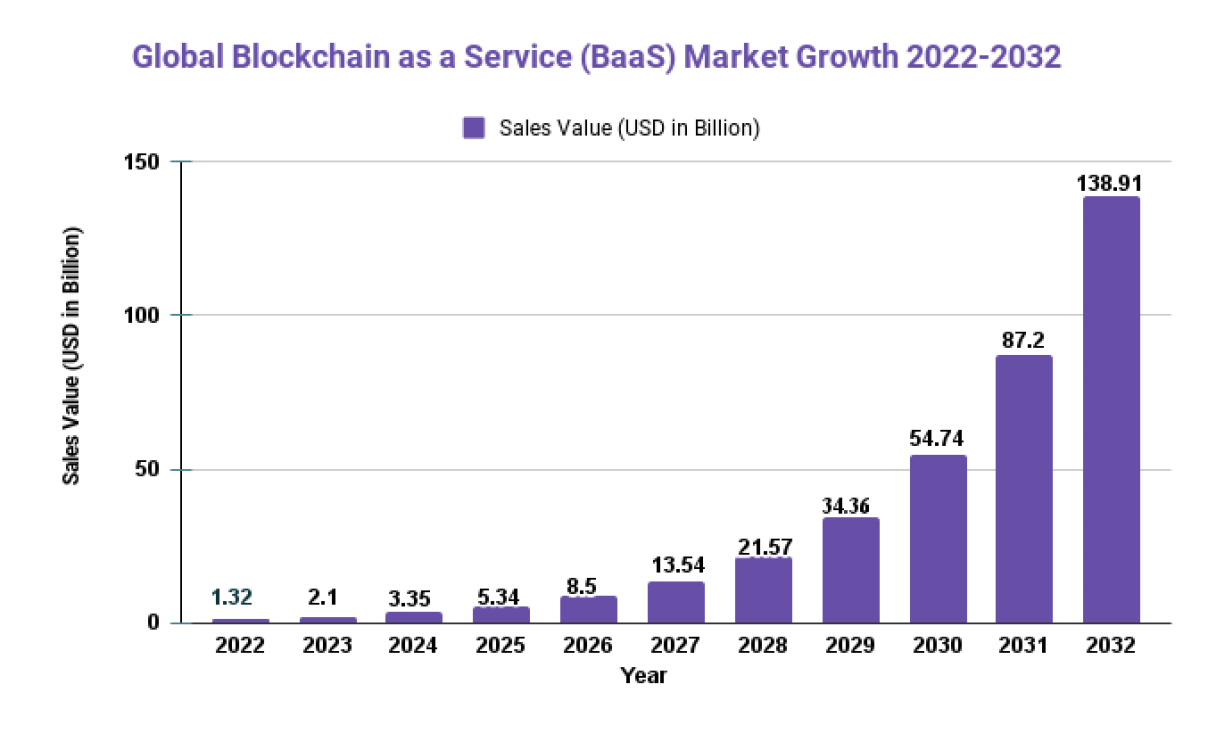

In 2022, the global blockchain-as-a-service market was valued at USD 1.32 billion and is projected to reach USD 138.97 billion by 2032, growing at a compound annual growth rate (CAGR) of 59.3% from 2022 -2032.

The global Blockchain as a Service (BaaS) market refers to the market for cloud-based blockchain services that allow businesses and individuals to create, host and use their own blockchain applications without the need for extensive technical knowledge. BaaS providers offer pre-built blockchain frameworks, tools and APIs that can be used to develop, test and deploy blockchain applications quickly and easily.

Increased use of blockchain technology: Blockchain technology is being adopted by more and more businesses across various industries, including finance, healthcare, supply chain management and more. BaaS providers offer an easy way for these businesses to implement blockchain technology without the need for extensive technical knowledge.

Cost savings: BaaS solutions can help businesses save money by eliminating the expenses associated with creating and maintaining their own blockchain infrastructure. Many BaaS providers offer scalable solutions that can be customized according to individual business requirements.

We have recent market updates in sample copy @Download our updated trial now

Regional snapshot

- North America:

North America dominated the global BaaS market due to a large number of established blockchain technology vendors such as IBM, Microsoft, and Amazon Web Services. Furthermore, the advanced technological infrastructure has supported the introduction of BaaS solutions across various industries. Furthermore, this region’s regulatory environment was highly favorable to blockchain-based businesses. - Europe:

Europe has emerged as a key market for BaaS solutions, with several countries such as the UK, Germany and France showing great interest in blockchain technology. The region already has an established fintech sector which has been one of the primary driving forces behind BaaS adoption. Furthermore, the EU has taken a number of initiatives to promote and facilitate blockchain development and adoption – creating an encouraging atmosphere for BaaS providers. - Asia Pacific:

The Asia Pacific region is expected to experience the highest growth rate for BaaS solutions due to the increasing adoption of blockchain technology across industries such as banking, healthcare, and supply chain management. Countries such as China, Japan and Singapore are leading this adoption with significant investments in research and development in this field. Furthermore, due to their large populations and growing e-commerce industry in this region, there are good opportunities for BaaS service providers. - The rest of the world:

Latin America, the Middle East and Africa have all expressed growing interest in blockchain technology and BaaS solutions. Countries such as Brazil, South Africa and the United Arab Emirates have explored the potential across various industries; However, the adoption rate of BaaS solutions there is still relatively low compared to other regions due to a lack of infrastructure and regulatory hurdles.

Are you interested in obtaining this data? Contact us here: Get request form

Market dynamics

Drivers

- Adoption of blockchain technology: The growing demand for secure and transparent transactions has accelerated the adoption of blockchain technology across a range of industries, driving the expansion of the BaaS market.

- Growing interest in decentralized finance (DeFi) and cryptocurrency applications BaaS providers have a chance to offer their solutions and satisfy this growing need as interest in cryptocurrency and DeFi applications grows.

- Favorable regulatory environment: In some areas, a favorable regulatory environment has provided the perfect conditions for BaaS providers to operate and grow their companies.

Limitations

- Lack of knowledge and understanding: The adoption of BaaS solutions and blockchain technology has been hampered by a lack of knowledge among organizations and consumers.

- Security issues: Data breaches and hacking incidents have made organizations wary of implementing blockchain technology and BaaS solutions.

- High implementation costs: Small and medium-sized organizations are severely hampered by the high implementation costs associated with blockchain technology and BaaS systems.

Possibilities

- Extension of blockchain technology to new industries: The expansion of blockchain technology to various sectors such as healthcare, logistics and real estate creates new business opportunities for BaaS providers.

- Emerging markets: With the growing interest in blockchain technology among emerging economies such as India, China and Brazil, BaaS providers have an excellent opportunity to expand their business.

- Integration with other technology: Blockchain’s connection to other technologies such as artificial intelligence (AI) and the Internet of Things (IoT) gives BaaS providers new opportunities to offer creative solutions.

Challenges

- Scalability Issues: Scalability is a major challenge for blockchain technology, and BaaS providers must address this issue if they want to offer their solutions to large enterprises.

- Interoperability issues: Lack of interoperability between different blockchain networks poses a major obstacle for BaaS providers, preventing data transfer between different networks.

- Regulatory challenges: As blockchain technology and BaaS solutions evolve, providers of these services must stay abreast of changes to comply with regulations in different regions.

Important market segments

Type

application

- Banking, financial services and insurance

- Health Service

- Telecom and IT

- Government and public services

- Aviation and defence

- Retail

Key market players included in the report

- Microsoft

- SAP

- Deloitte

- Accenture

- Oracle

- AWS

- Acknowledging

- Infosys

- PwC

- Baidu

- Huawei

- HPE

- IBM

- Capgemini

- NTT data

- TCS

- Mphasis

- Wipro

- Waves platform

- KPMG

Industry development

- May 2019: Microsoft and JP Morgan have announced their collaboration to accelerate the development and adoption of enterprise blockchain. Through this arrangement, JP Morgan’s distributed ledger platform Quorum will be made available via Microsoft’s Azure Blockchain Service so that customers can create cloud-based blockchain networks.

- April 2018: Huawei unveiled its Blockchain Service solution, built on the Linux Foundation’s Hyperledge Fabric 1.0. This solution is intended to help companies create smart contracts for supply chains, securitized assets and public services on top of a distributed ledger network.

Scope of the report

| Report attribute | Details |

| The market size value in 2022 | USD 1.32 billion |

| Revenue forecast by 2032 | USD 138.97 billion |

| Growth rate | CAGR of 59.3% |

| Regions covered | North America, Europe, Asia-Pacific, Latin America and the Middle East and Africa, and the rest of the world |

| Historic years | 2017-2022 |

| Foundation year | 2022 |

| Estimated year | 2023 |

| Short-term assessment year | 2028 |

| Long-term projected year | 2032 |

Frequently Asked Questions

1. Question: What was the global market size of the blockchain as a service market in 2022?

ONE: According to a report by Market.us, the global blockchain as a service market size was valued at USD 1.32 billion in 2022.

2. Question: What is the expected market size of the blockchain as a service market by 2032?

ONE: According to a report by Market.us, the global blockchain as a service market is expected to reach USD 138.97 billion by 2032, growing at a CAGR of 59.3% from 2022 to 2032.

3. Q: What is driving the growth of the blockchain as a service market?

ONE: The growth of the blockchain as a service market is primarily driven by factors such as increasing adoption of blockchain technology across various industries, growing interest in cryptocurrency and decentralized finance (DeFi) applications, and a favorable regulatory environment in some regions.

Prudour Private Limited

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers at the forefront of the markets. They can fluctuate up or down, but we help you stay ahead of these market fluctuations. Our consistent growth and ability to deliver in-depth analysis and market insights has engaged real market players. They trust that we can provide the data and information they need to make balanced and decisive marketing decisions.