Get Bitcoin exposure with these ETFs

Although we often think of ETFs as a fund that holds a basket of stocks, they can also be used as a vehicle to gain exposure to the price action of other assets. These can be commodities like gold or oil or even other currencies. As cryptocurrency has burst into the mainstream in recent years, a number of ETFs have focused on giving investors exposure to Bitcoin (BTC-USD) have appeared. Bitcoin is by far the largest digital asset, with a market value of around $480 billion.

Why Investors Like Bitcoin

Investors may be interested in investing in Bitcoin for a number of reasons. Because there is a maximum supply of 21 million Bitcoins, it can be seen as a hedge against the long-term deterioration of fiat currencies.

Some people are also drawn to the decentralized nature of the Bitcoin network. There is no CEO or Board of Directors in charge of Bitcoin; users instead rely on open source. The blockchain technology behind the Bitcoin network, with its high level of security, is also a compelling feature for many users and investors.

Finally, Bitcoin is a borderless, censorship-resistant currency that can be used worldwide. Bitcoin also provides investors with diversification as a new asset class.

After a challenging 2022 in which the price of Bitcoin fell 64%, Bitcoin has rebounded to a 49% year-to-date increase in 2023. Inflation fears are receding, and risk sentiment is returning to the market, which is bullish for Bitcoin. It is important to note that the following ETFs do not invest directly in Bitcoin (more on this later). However, they allow investors to gain exposure to the price of Bitcoin by investing in Bitcoin futures.

Why Consider a Bitcoin ETF?

While some investors may prefer to simply buy and hold Bitcoin directly, there are a number of reasons why others may prefer to use an ETF to gain Bitcoin exposure. First, many investors may feel that it is easier to just buy a Bitcoin ETF and hold it in their brokerage account instead of opening a new account with a crypto exchange. Some may also feel more comfortable doing this, given the high-profile collapses of several crypto exchanges in 2022.

Owning a Bitcoin ETF does not come with the same risks as holding Bitcoin in your own wallet. For example, ETF investors don’t have to worry about managing the private keys of their Bitcoin. Furthermore, there may be institutional investors who are not allowed to buy Bitcoin directly, but who can buy a Bitcoin ETF. Investing in these vehicles also allows individual investors to add Bitcoin exposure to tax-advantaged retirement accounts such as IRAs.

How do these ETFs give investors Bitcoin exposure?

The reason these ETFs offer exposure to Bitcoin by using Bitcoin futures rather than investing in Bitcoin itself is that the SEC has repeatedly rejected “spot” Bitcoin ETFs, but has approved several ETFs that track Bitcoin futures. The SEC rejected spot Bitcoin ETFs because it says they are “susceptible to fraudulent and manipulative behavior.”

Prominent examples of Bitcoin ETFs include the ProShares Bitcoin Strategy ETF (NYSEARCA:BITO), ProShares Bitcoin Short Strategy ETF (NYSEARCA:BITI), Valkyrie Bitcoin Strategy ETF (NASDAQ:BTF), and the VanEck Bitcoin Strategy ETF (BATS:XBTF). Furthermore, Grayscale has repeatedly attempted to convert its Grayscale Bitcoin Trust (OTC:GBTC), a popular vehicle that invests directly in Bitcoin, to an ETF to no avail.

1. ProShares Bitcoin Strategy ETF (BITO)

The ProShares Bitcoin Strategy ETF is an offering from ProShares with $809 million in assets under management (AUM). As noted above, BITO does not invest directly in Bitcoin, but instead “seeks to provide capital growth primarily through managed exposure to Bitcoin futures contracts.”

As a vehicle intended to give investors exposure to the price of Bitcoin, it is not surprising that BITO’s performance is highly correlated with Bitcoin’s. Bitcoin is up 49% year-to-date, less than two months into 2023, and BITO is right next door with a 49.6% gain over the same time frame. One thing investors should be aware of is that BITO has a relatively high expense ratio of 0.95%.

2. Valkyrie Bitcoin Strategy ETF (BTF)

Like BITO, the Valykyrie Bitcoin Strategy is an actively managed ETF that offers investors a way to access the price of Bitcoin by investing in Bitcoin futures contracts. BTF is up 48.6% year-to-date, and that’s much smaller than BITO, with just $28.75 million in assets under management. Like BITO, BTF has a cost share of 0.95%.

3. VanEck Bitcoin Strategy ETF (XBTF)

VanEck Bitcoin ETF uses the same strategy as BITO and BTF and is up 48.5% year to date. XBTF is a small, actively managed ETF with $31 million in assets under management. XBTF offers investors a lower expense ratio than the ETFs mentioned above, with a fee of 0.65%.

4. ProShares Short Bitcoin Strategy ETF (BITI)

While BITO allows investors to go long Bitcoin futures, the ProShares Short Bitcoin Strategy ETF is ProShares’ offering that allows investors to express a bearish view of Bitcoin and profit from it when Bitcoin’s price falls. It does this by seeking “daily investment performance, before fees and expenses, equal to the inverse (-1X) of the daily performance of the S&P CME Bitcoin Futures Index.

With Bitcoin off to a strong start in 2022, BITI has tumbled, losing 35.1% so far this year. Still, BITI could be a useful ETF for investors who feel Bitcoin is overbought after a nearly 50% gain so far this year.

BITI is a much smaller ETF than its bullish ProShares counterpart BITO, with just $96.2 million in assets under management.

Like BITO, BITI has a relatively high cost share of 0.95%. However, this fee can still be cheaper than the cost of shorting Bitcoin on crypto exchanges.

5. Grayscale Bitcoin Trust (GBTC)

Finally, while the aforementioned Grayscale Bitcoin Trust is not an ETF, as discussed above, it seems worthy of inclusion here, and investors can still purchase it using their brokerage accounts.

GBTC is much larger than any of the other instruments mentioned above, with a market cap of $3.57 billion. Like the Bitcoin ETFs mentioned here, GBTC has tracked Bitcoin’s rise this year with a 48.4% year-to-date gain.

What makes GBTC particularly interesting for risk-tolerant investors is the fact that it trades at a large discount to its net asset value (NAV). In fact, GBTC trades at an incredible 46% discount to NAV. This means that GBTC is trading for just over half of what the trust is worth based on just the total amount of Bitcoin it holds.

The large discount is likely due to the fact that GBTC’s application to convert to an ETF has been rejected by the SEC. There may also be some hesitation among investors over the fact that Digital Currency Group, Grayscale’s parent company, has faced new challenges in the form of its lending subsidiary Genesis filing for bankruptcy.

However, it should be noted that Genesis is a separate entity from Grayscale. While a vehicle like the Grayscale Bitcoin Trust is certainly not for the faint of heart, it does give risk-tolerant investors two potential ways to win – a further increase in the price of Bitcoin and the potential for the trust to cap the discount to NAV if Grayscale finds a way to That on.

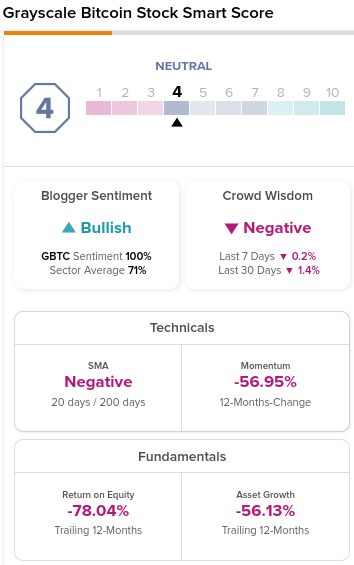

The Grayscale Bitcoin Trust has a neutral Smart Score of 4 out of 10. Meanwhile, blogger sentiment is positive and crowd wisdom is negative.

The takeaway

After Bitcoin’s monster start to 2023, many investors are looking to gain exposure to it. While some investors may choose to invest in Bitcoin directly, investing in Bitcoin ETFs is a sensible option for investors who would rather gain exposure to Bitcoin in ETF form.

Of the vehicles discussed here, my top two picks are BITO and GBTC, based on their larger market caps. GBTC is not for everyone, but it may offer the highest risk-reward profile, while BITO is the strongest choice for the more vanilla Bitcoin futures ETFs.

I’m personally bullish on Bitcoin, so I wouldn’t buy BITI, the ETF that short Bitcoin. But tactically, it can be a good tool to use if and when investors believe Bitcoin is overbought or due for a correction. Nevertheless, it has a very small market value and a relatively high expense fee.

Mediation