Four Potential Catalysts for the Next Crypto Bull Run

Important takeaways

- The cryptocurrency market is currently caught in a downturn amid global macroeconomic pressures.

- Increasing fintech adoption could attract the next wave of crypto users, potentially helping prices rise.

- Bitcoin could rise if the Federal Reserve changes its hawkish stance or people lose faith in central banks altogether.

Share this article

Crypto Briefing looks at four potential events that could revive interest in digital assets.

A Fed pivot that reduces pressure on Crypto

One of the most discussed catalysts that could give crypto and other risk assets a boost is an end to the Federal Reserve’s monetary tightening policy. Currently, the Fed is raising interest rates to fight inflation. When the prices of goods, raw materials and energy reach unsustainable levels, central banks step in to bring prices down to avoid long-term damage to their economies.

In theory, raising interest rates should lead to the destruction of demand. When the costs of borrowing money and repaying debt become too high, it prices less viable and efficient businesses out of the market. In turn, this should reduce demand and lower the prices of essential raw materials such as oil, wheat and timber.

But even if the Fed aims to raise interest rates until the target of 2% inflation is reached, that may be easier said than done. Every time the Fed raises interest rates, it makes it harder for those who have debt like mortgages to repay. If interest rates rise too high or stay too high for too long, it will eventually cause mortgage holders to default en masse, resulting in a collapse in the housing market similar to the Great Financial Crisis of 2008.

Therefore, the Fed will need to swing away from its monetary policy tightening before too long. And when it does, it should relieve much of the downward pressure and keep risk assets like cryptocurrencies subdued. Eventually, the Fed will also start lowering interest rates to stimulate economic growth, which should also act as a significant tailwind for the crypto market.

When the Fed is likely to swing is up for debate; However, most pundits agree that it will be difficult for the central bank to continue raising interest rates beyond the first quarter of 2023.

Fintech Crypto Adoption

Although cryptoassets have made great strides in recent years, their benefits are still quite inaccessible to the average person. Use cases such as cross-border transfers, blockchain banking and DeFi are in demand, but the simple, user-friendly infrastructure for mass users on board has yet to be developed.

As it stands, using crypto is complicated – and far from what most people are used to. Managing private keys, signing transactions, and avoiding fraud and hacks may be intuitive to the average crypto-dough, but it remains a significant barrier to adoption for more casual users.

There is a huge gap in the market to take the average person into crypto. If fintech companies start integrating crypto transfers into their offerings and make it easier for users to use their money to work with the blockchain, crypto could see a new wave of adoption. As crypto infrastructure becomes easier to use, more people are likely to recognize its utility and invest in the space, creating a positive feedback loop.

Some companies have already recognized this vision and are working on products that make it easier for everyone to start using crypto. Earlier this year, PayPal integrated cryptocurrency deposits and withdrawals into personal wallets, marking a significant first step toward wider use of crypto payments. Last month, Revolut, one of the biggest digital banks, was granted registration to offer crypto services in the UK by the Financial Conduct Authority.

However, the most important development may be yet to come. Robinhood, the free trading app that fueled the so-called “meme stock” craze in early 2021 and the subsequent Dogecoin rally, is preparing to launch its own non-custodial wallet. Last month, the wallet’s beta version went out to 10,000 early adopters, and a full release is planned for late 2022. The Polygon-based wallet will allow users to trade over 20 cryptocurrencies through decentralized exchange aggregator 0x, without fees. The wallet will also allow users to connect to DeFi protocols and monetize their holdings.

At its core, crypto bull runs are driven by adoption, and products like Robinhood’s new wallet could become the killer app for the next generation of users.

The Bitcoin Halving

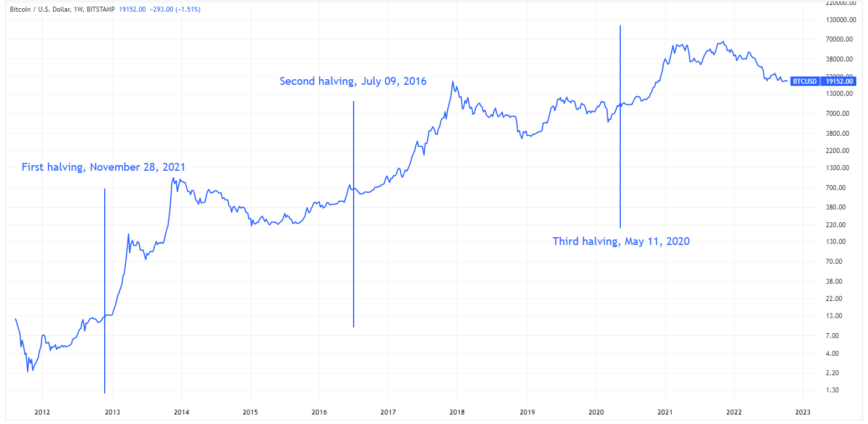

Coincidence or not, a new bull rally has historically started shortly after the Bitcoin protocol halves mining rewards every 210,000 blocks. This catalyst has predicted every major bull run since the first Bitcoin halving in late 2012 and will likely continue to do so well into the future.

After the first halving on November 28, 2012, Bitcoin rose over 7,000%. The next halving on July 9, 2016 saw the top cryptocurrency soar around 2,800%, and after the last halving on May 11, 2020, Bitcoin surged more than 600%.

The most likely explanation for the halving rallies that have occurred roughly every four years is simple supply reduction. Economic theory suggests that when the supply of an asset decreases but the demand remains the same, the price will increase. Bitcoin miners usually sell a large portion of their Bitcoin rewards to cover the cost of electricity and maintenance of their mining machines. This means that when the rewards are halved, this sales pressure is drastically reduced. While this initial supply reduction serves as the ignition, bull rallies often take crypto much higher than can be attributed to just the halving.

At the current block production rate, the next Bitcoin halving is set to take place sometime in late February 2024. It is worth noting that with each subsequent halving, the amount of Bitcoin rally decreases and the time between the halving and the bullrun peak increases . This is probably due to the fact that liquidity in the Bitcoin market is increasing, which dampens the effect of the supply reduction. But if history is any precedent, the next halving should propel the top crypto significantly higher than its previous record high of $69,044 reached on November 10, 2021.

A caveat to the halving task is that the upcoming halving in 2024 may be the first to take place against a gloomy macroeconomic backdrop. If the world’s central banks cannot fix the current inflationary crisis while maintaining economic growth, it may be difficult for risky assets like crypto to rise even with the halving of the supply reduction.

Loss of confidence in central banks

The last potential bull run catalyst is the most speculative of the examples listed in this article, but one that is definitely worth discussing.

In recent months, the deficiencies in large central bank-run economies have become increasingly apparent. Most world currencies have fallen against the US dollar, bond yields have risen significantly as confidence in national economies wanes, and central banks in Japan and the UK have resorted to buying their own sovereign debt to prevent defaults in a policy of Yield Curve Control.

The current debt-based financial system relies on constant growth, and when this stops, unbacked fiat currencies suffer a very real risk of hyperinflation. Even before the current spike in inflation due to supply chain issues, an extended period of low interest rates likely caused irreparable damage to the US economy. The cost of living, house prices and company valuations rose while wages stagnated. Instead of using cheap debt to grow businesses and create real economic value, many borrowed money to buy real estate or invest in stocks. The result is a massive asset bubble that may not be able to unwind without collapsing the world economy.

When fiat economies show weakness, gold and other precious metals have often been seen as safe havens from financial collapse. However, investing in gold-based financial products such as gold ETFs is not a viable option for most people. Even those who do can still be caught in the maelstrom whose contagion affects the wider financial markets. This leaves Bitcoin and other hard, decentralized cryptocurrencies with fixed supplies as obvious candidates to replace gold as store value if the public loses confidence in national currencies.

Before the current financial crisis, investors had begun to recognize Bitcoin as a hard currency due to its fixed supply of 21 million coins, earning the top crypto the title of “digital gold” among its followers. Recently, top hedge fund managers such as Stanley Druckenmiller and Paul Tudor Jones have offered similar views. In a September CNBC interview, Druckenmiller said that crypto could have a “renaissance” if confidence in central banks wanes. Likewise, Jones has stated that cryptocurrencies such as Bitcoin and Ethereum could go “much higher” in the future due to their limited supply.

Disclosure: At the time of writing this piece, the author owned ETH, BTC and several other cryptocurrencies.