FISV vs. SQ: Which Fintech Stock Is Better?

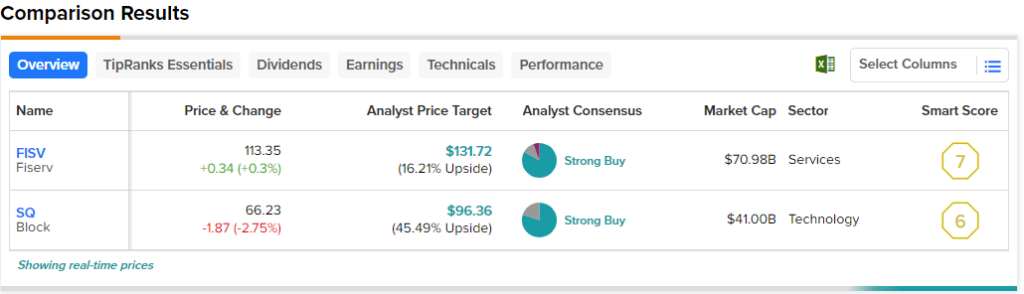

In this piece, I used TipRanks’ comparison tool to evaluate two fintech stocks — Fiserv Inc. (NASDAQ: FISV) and Block Inc. (NYSE:SQ) — and decide which stock is better. While both are in the green so far this year, Block has fallen over the past 12 months, down 47% versus Fiserv’s 12.3% gain. Some investors may wonder if there is further upside for Fiserv, and if Block offers a buying opportunity. Meanwhile, a closer look suggests that FISV is the best stock. Let’s examine the two companies.

Fiserv (NASDAQ:FISV)

A quick review of Fiserv’s financials indicates that this is a high-quality stock with a decent valuation relative to the rest of its industry and to its own five-year history. Thus, a bullish view seems appropriate, although Fiserv looks more like a long-term buy-and-hold position rather than a tradable stock with short-term goals in mind.

Fiserv trades at a price-to-earnings (P/E) ratio of around 28.8 times. While that is higher than the three-year average of 18.7 times for the diversified financial industry, it is far lower than the industry’s current P/E of 263 times. Also, Fiserv’s average P/E over the past five years is about 49.7 times.

The company also trades at a price-to-sales (P/S) ratio of approximately 3.95 times, higher than the industry’s current P/S of 3.4 times and the three-year average of 2.1 times. However, Fiserv’s current P/S is lower than its average P/S over the past five years of about 5.6 times.

Although Fiserv’s revenue growth has slowed significantly, it still has a robust gross margin of 55% and a solid net income margin of 14%. The company also generates plenty of cash — $4.6 billion in cash from operations and $3.1 billion in free cash flow over the past 12 months. Fiserv also generates stable income and earnings

Overall, Fiserv looks like a high-quality company, and high-quality stocks tend to do remarkably well during a recession. Fiserv stock could hold up quite well, given that a recession could be right around the corner. Of course, recessions tend to be a challenge for fintech stocks in general. Thus, a better entry point may appear, but Fiserv’s stability points to long-term persistence.

What is the price target for FISV shares?

Fiserv has a moderate buy consensus rating based on 15 buy, two hold and one sell rating assigned over the past three months. At $131.72, Fiserv’s average share price implies an upside potential of 16.2%.

Block (NYSE:SQ)

The first thing investors will notice about Block is that it is unprofitable, which is a big problem in today’s investment environment because the market has punished unprofitable companies. A closer look also reveals other potential problems, suggesting a bearish view may be appropriate.

Block trades at a P/S of about 2.3 times, versus its average P/S of about 7.5 over the past five years. Although Block looks undervalued based on P/S, fundamental analysis reveals why it may deserve a lower valuation than its peers.

For example, Block’s revenue was similar to Fiserv’s in 2022, with $17.5 billion for the former and $17.7 billion for the latter. However, Block failed to turn a profit, recording a net loss of $540.8 million for 2022. The company was profitable in 2019, 2020 and 2021, but it turned unprofitable again in 2022 despite only returning for 2021’s 17 .7 billion dollars. revenues.

Another problem is that Block is exposed to crypto, with one estimate suggesting that the company owns over 8,000 bitcoins (BTC-USD). In fact, CEO Jack Dorsey has emphasized that cryptocurrency will play a significant role in Block’s future, including plans to sell bitcoin mining kits announced last month.

Finally, there are some worrying trends regarding Block’s business mix. One analyst noted that volume comparisons with Fiserv, Clover and Toast suggest that Block is losing market share to its competitors. Other concerns include an increasing reliance on payday loans for CashApp.

Block’s gross margin of 35% is also weaker than Fiserv’s. Finally, Block was barely positive on free cash flow ($5.1 million in 2022), and it generated just $175.9 million in cash from operations.

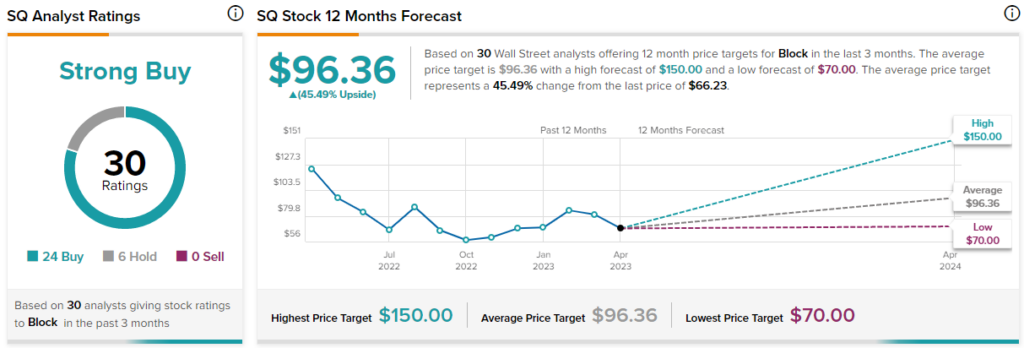

What is the price target for SQ shares?

Block has a strong buy consensus rating based on 25 buy, five hold and zero sell ratings assigned over the past three months. At $96.36, average Block share price implies upside potential of 44.33%.

Conclusion: Long-term Bullish on FISV, Bearish on SQ

Fiserv is clearly a high-quality stock based on its fundamentals, strong margins and free cash flow, among other factors. Meanwhile, Block’s lack of profitability and general weakness leaves little to appreciate.

In short, Fiserv offers persistence and a lot to like, while it’s virtually impossible to find anything to like about Block. In particular, Fiserv looks like a long-term buy and hold with the caveat that a better entry point may emerge. Therefore, investors may consider establishing a small position at current levels while looking for a better entry point to add to that position.

Mediation