Overview

Unfamiliar with how these new financial technologies work? You are not alone. Fintech firms require more than just good technology to be compliant and enforce their rights. To ensure sound legal representation, creditor rights attorneys require an understanding of the laws and regulations applicable to their clients’ business and procedures.

Nicole Strickler and Luke Chamberlain of Messer Strickler Burnette sat down with National Creditors Bar Association members to share the basics of online lending and analyze common types of transactions and loans that creditor rights attorneys need to understand when enforcing their clients’ rights. What follows is a brief summary of the discussion, the first of a two-part series related to fintech, online lending, defense and counterclaims.

What makes Fintech unique?

Just as Henry Ford’s automobile caused disruption and threatened the carriage and wagon business, digital banking has also the traditional lending process. Simply put, digital banking is disrupting the way consumers access capital. Look no further than the data showing the rise of digital banking. According to InsiderIntelligence.com, there are currently 5.6 million Gen Z-only digital bank account holders in the US, up by more than 4.1 million account holders since 2020 and projected to increase to 10.8 million by 2025.

New financial technology leverages non-traditional behavioral data, artificial intelligence and machine learning to create new credit models and faster insurance. Today, perfect credit is not necessarily required, as alternative lenders use other data sources to assess how likely a borrower is to repay. Examples include real-time cash flow, Yelp reviews, and/or other readily available data that can be leveraged and studied over time as an indicator of financial health. The use of checking accounts, average deposits, tools have replaced the conventional credit score to assess the likelihood of repayment by individuals or companies.

How Fintech transactions differ from traditional lending

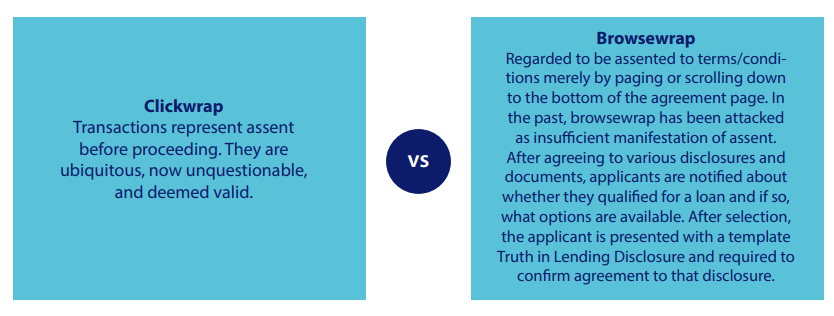

Also, the transactions are different, the loan experience is different, and so is the registration process. Traditionally, we see consumers fill out a loan application in writing and present it to a loan officer. In contrast, with the use of online lending, we have a “borrower registration agreement”, usually the first document presented as electronic consent mechanisms, in one of two different options – Clickwrap or Browsewrap.

Example: Jones v. Prosper Marketplace

To better illustrate these transactions, it is helpful to review a good citation, in this case, Jones v. Prosper Marketplace, Inc., Civ. No. GJH-21-1126, 2022 US Dist. LEXIS 49616, 2022 WL 834210, at *17 (D. Md. Mar. 21, 2022) (citing cases). The Prosper Marketplace case provides a good recitation of the loan process and support for the validity of clickwrap agreements.

With the Prosper Marketplace lending transaction as a backdrop, as they move through these transactions, consumers are presented with a statement that clicks a box agreeing to accept a payment authorization. Consumers cannot continue unless they check the box. This is important because from an evidentiary perspective, lawyers will need proof the consumer agreed. It is achieved through testimony, that the process cannot continue unless the button is clicked.

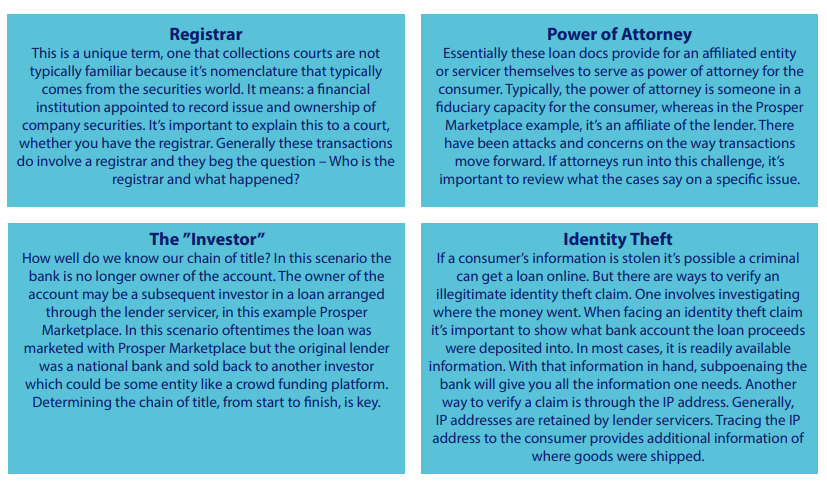

In this example, the consumers are then given a promissory note which makes the consumers responsible for the debt. However, the note is empty. It is not an executed copy. It’s just an example. What consumers do throughout the process is to give Prosper Marketplace, through their borrower registration agreement, several different rights and obligations.

Example: Jones v. Prosper Marketplace (continued)

First, Prosper has the right to change the agreement, terms and conditions, and will give notice of any material changes. The document also contains standard clauses authorizing Prosper Marketplace to execute the loan on behalf of the borrower. Second, the borrower registration agreement, in this example, contains a clause authorizing Prosper Marketplace to execute promissory notes on behalf of borrowers, including language authorizing Prosper Marketplace to act as attorney-in-fact to execute on a blank promissory note—pretty much a lot to delegate.

Typical attacks on the model

Now that we’ve reviewed the transaction, let’s look at some typical attacks on the model.

It is very important to understand these transactions. The asset chain must be clear because, for example, at the state’s case processing level, there are attempts to increase the level of information for consumers. In the past, the application requirements were not as burdensome. As lawyers, we need to be clear about when these transactions take place, because if not, we may come across these actions that could lead to liability to our clients, which could lead to claims against us.