Fintech and Crypto Careers: Looking Back to 2022

Let’s face it, 2022 has been tough for fintech… really tough. It’s not the end of the world (for everyone, at least), but silver linings are hard to come by.

Crypto may be the main stealer, but there have been a number of developments in the industry. Here are some of the big takeaways from the year:

SBF and FTX TKO Crypto

They say death comes in threes. We have seen the death of one of the biggest crypto marketplaces and the career suicide of the “next Warren Buffet”, Sam Bankman Fried. Now many are wondering if the crypto industry in general is casualty number 3.

Just in case you missed the biggest financial horror story of the last decade, FTX appears to have given Alameda Research, a crypto hedge fund within the FTX group, free rein to spend client funds on risky investments.

Bankman Fried is accused of lying to investors and funneling hundreds of millions into luxury Bahaman offices and political donations. When these risky investments resulted in zilch, the company imploded.

The story is almost too wild to be believed. A saga of siphoning, (alleged) sex, board games and stimulants. The new CEO, who also happened to work in damage control for Enron in 2001, testified this month, saying, “Never in my career have I seen such a complete failure of corporate controls at every level of an organization.”

Layoffs, layoffs, layoffs

Everywhere you look, you’ll see fintech firms making cuts, especially crypto. In San Francisco, industry firm Coinbase cut 18% of its workforce in the summer, while competitor Kraken cut 30% of its workforce in early December. The Australian firm Swyftx and the Chinese firm Bybit also shed employees before the turn of the year.

However, it’s not just crypto. One of the newer fintechs to make the cut is B2B software provider Plaid. It cut 20% of staff this month, while BNPL firm Klarna laid off 10% of its workforce in the summer.

Banks are known for making big cuts. But with the team spirit, startup culture and camaraderie, the fintech cuts can’t help but feel more personal. For example, Plaid said it was laying off “260 talented Plaids”; you would never expect to hear that Goldman Sachs fired the “Goldies.”

Valuations crash down to reality and hit alternatives

Hand in hand with the dismissals was a mass reduction in valuations. As the downturn in the market discourages investment, funding rounds have been lackluster and fintech firms have been hit… hard.

One of the most terrible examples was Klarna. The BNPL decacorn downgraded to a unicorn in July as it lost 85% of its value this year. In the same month, the value of the digital bank Stripe also fell by 28%.

It’s not just private firms either; listed firms have seen share prices fall. At the time of writing, Coinbase stock has fallen over 85% year-to-date. In the same time frame, payments provider Adyen had a 35% decline in its share price, and financial services provider Robinhood has seen its share price fall by 51%

Why such a big drop? Beyond the obvious lack of available venture capital, it seems like a case-by-case scenario. Coinbase was hurt by the crypto crash, while the cuts showcased ineffective leadership. Klarna appeared to be overvaluing themselves and as the inevitable regulation of the BNPL sector approaches, their valuation is becoming more realistic.

None of this bodes well for employees with stock in these companies, whose net worth is now significantly lower than it used to be. A grateful coinbase employee at Blind said “I’m just glad my stock resets every year”, while another was critical, saying “Millions for VPs and execs. 🥜for ICs.”

The tough get started

Do you think all fintechs have faltered in this difficult market? Think again. There are a number of companies that are doing very well in this cold economic climate.

While the biggest companies have had a reality check, it has been an opportune time for the smaller fintechs to stand out and get the funding they need.

Not only that, but they have more opportunities to invest it in talent. Crypto headhunter Rob Paone says that “Larger firms soaked up all the talent, and with them slowing hiring or cutting back, the smaller or mid-sized companies missed an opportunity.”

Tracxn reports that 62 fintech companies achieved unicorn status by 2022. Not only that, the average funding a fintech received before reaching the $1 billion valuation rose by $57 million. This indicates that the new grants to the club have been more even and more legitimate in their growth.

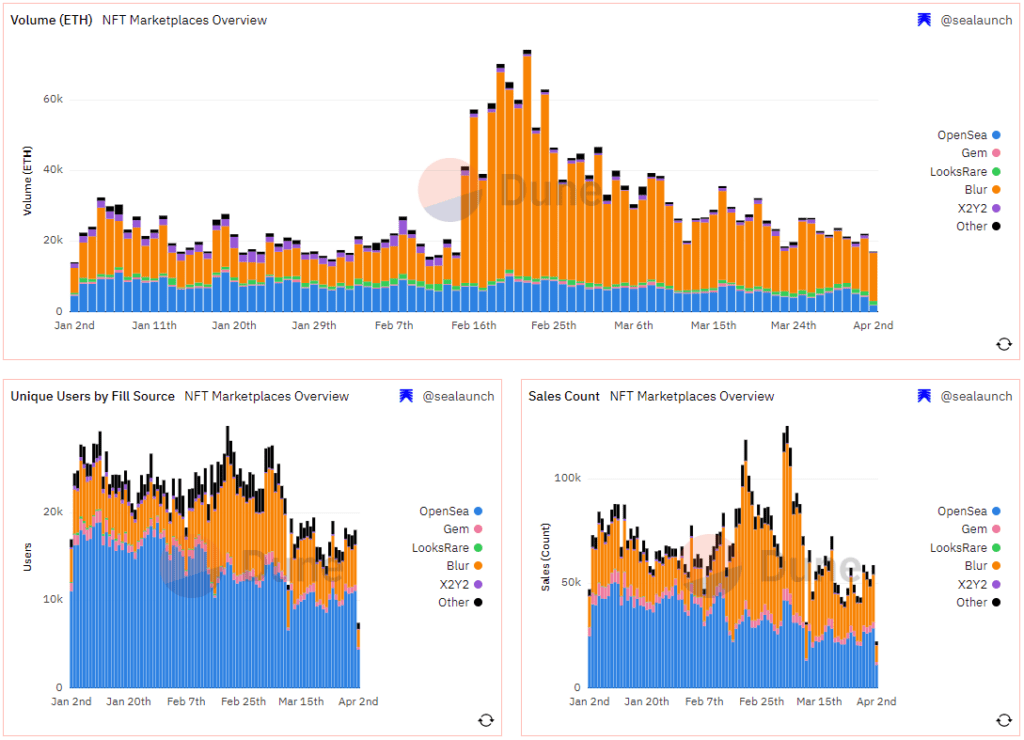

Recent unicorns in New York include NFT marketplace Magic Eden and cloud services company Alphasense. GoCardless and Paddle are among the best in London.

London is calling

London is setting the pace for fintech jobs into 2023, with a Dealroom report claiming it is the biggest city for fintech VC funding in the world. This time last year, the English capital was third behind New York and San Francisco, but now leads the way with £7.8B ($9.5B) raised since the start of the year.

What makes this even more impressive is the comparative lack of major fintechs to the other cities. San Francisco and New York have 50 and 39 unicorns respectively, while London only has 24.

This leans into the idea that financing for smaller businesses may be more accessible. As investors avert their eyes from cash cows and look towards real innovation, the UK stands out.

Digital banks look set to be a big winner in the UK market. London is of course home to industry leader Revolut, but smaller banks are still achieving success such as Allica Bank which raised £100m this month. Even outside of London, digital banks are raising respectable amounts, such as Atom Bank in Durham which raised £75m in February and £30m in November.

Click here to create a profile on eFinancialCareers. Comment ANONYMOUSLY on articles and make yourself visible to recruiters who are hiring for top jobs in technology and finance.

Have a confidential story, tip or comment to share? Contact: [email protected] in the first instance.

Please join us if you leave a comment at the bottom of this article: all our comments are moderated by humans. Sometimes these people may be sleeping, or away from their desk, so it may take a while for your comment to appear. Eventually it will—unless it’s offensive or libelous (in which case it won’t.)

Photo by Mariia Shalabaieva on Unsplash