Fidelity’s crypto platform opens soon. Will it be any good?

Fidelity Investments on Thursday opened the waiting list for its new crypto service for individual investors, a move that could introduce digital assets for the first time to the company’s roughly 40 million individual clients.

Fidelity Crypto can be an attractive proposition for investors who are curious about cryptocurrency and already know and trust Fidelity with their investments.

But if you’re already a hardcore crypto investor, chances are you’re not going to be interested in switching to these new offerings alone. While Fidelity’s low trading costs are competitive with some of the leading ones crypto exchangesthe range and crypto functionality announced by the firm is not yet up to par.

For example, Fidelity will initially offer only two cryptocurrencies: Bitcoin and Ethereum. And users will not be able to send or receive cryptocurrency from their accounts, a must for users who want to use crypto for payments or to access blockchain-based services online. However, you will be able to sell crypto for fiat money.

Why you might want to register

You can join the waiting list for Fidelity Crypto on Fidelity’s website, although the company has not said when it will begin offering the service. Here are some factors to consider while you wait.

Crypto trading fees

Fidelity offers clients what it describes as “commission-free” crypto trading. It does not necessarily mean that trading is free. The company says it will take a spread of up to 1% on crypto trades.

Still, it’s relatively good compared to other crypto services reviewed by NerdWallet. Coinbase, the largest US-based exchange focused exclusively on crypto, often charges a fee of $2.99 on simple transactions, which will exceed 1% on small purchases.

Other crypto services can have significantly higher fees, with some upwards of 10% depending on how you pay.

Financing and minimum requirements

Funding a Fidelity Crypto account can be easy if you already have a brokerage or cash management account with the company. You will be able to move money from Fidelity accounts to Fidelity Crypto.

There is no minimum deposit to open a crypto trading account. And the minimum crypto purchase will be $1, says Fidelity. These factors put the company on an even footing with most other leading exchanges.

If you do not have a Fidelity account, purchases will require you to set up and fund an account, such as a brokerage or cash management account.

Why you might want to use a different exchange

Availability

Fidelity Crypto will initially be available in 35 states. If you cannot access the service in your state, please choose another option.

You can still join the waiting list if your state isn’t included, but you won’t be able to use the service unless Fidelity expands its crypto services.

Encryption options

Fidelity Crypto’s offering will be on the low end among cryptocurrency platforms rated by NerdWallet. Given, Bitcoin and Ethereum are the two most valuable cryptocurrencies, meaning they are widely used and relatively well established in this emerging sector.

However, cryptocurrency traders often look at multiple options when buying and selling. Crypto.com, another major cryptocurrency exchange, has more than 250 cryptocurrencies for sale. Other brokerages also have several crypto options. Webull, for example, has around 40.

It could turn out that Fidelity is following the path of other brokerages, such as Robinhood, which started with limited crypto offerings, then expanded over time.

It is not immediately clear whether Fidelity will allow users to trade cryptocurrencies for each other, a feature that leading competitors typically offer.

Functionality

Fidelity Crypto will not offer any of the advanced features available on competing exchanges. It will not allow staking, a process that allows owners of some cryptocurrencies to earn rewards similar to interest.

And unlike some other crypto exchanges, Fidelity Crypto will not offer 24/7 crypto trading, with trading limited to 4:00 a.m. to 12:00 p.m. Eastern Time.

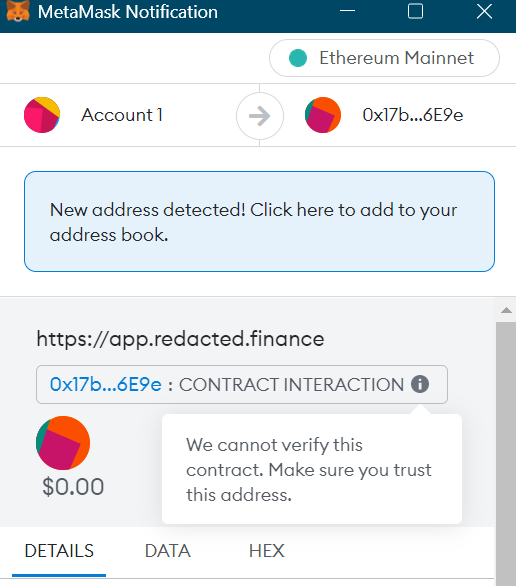

Finally, the company says it will not allow customers to transfer cryptocurrency out of their accounts or to external crypto wallets.

Transfers are essential if you want to do anything with cryptocurrency other than hold it in the hope that it will increase in value. You will not be able to use crypto purchased through Fidelity on decentralized financial productsfor example.

The bottom line

While Fidelity’s first stab at a consumer crypto product isn’t the most robust on the market, the firm’s brand name and track record may give some clients a level of comfort in moving into a new and risky asset class like crypto. And the company has left the door open to expand the functions and possibilities later.