Just over two weeks have passed since Ethereum’s Shapella upgrade on April 12, 2023, which occurred at block height 6,209,536, allowing stakers to withdraw for the first time. At the time of the upgrade, just over 8 million Ethereum were locked in floating staking protocols. Since then, over 400,000 Ether, worth $763 million, have been added to 17 floating staking platforms.

Ethereum Liquid Staking Platforms Continue to Swell

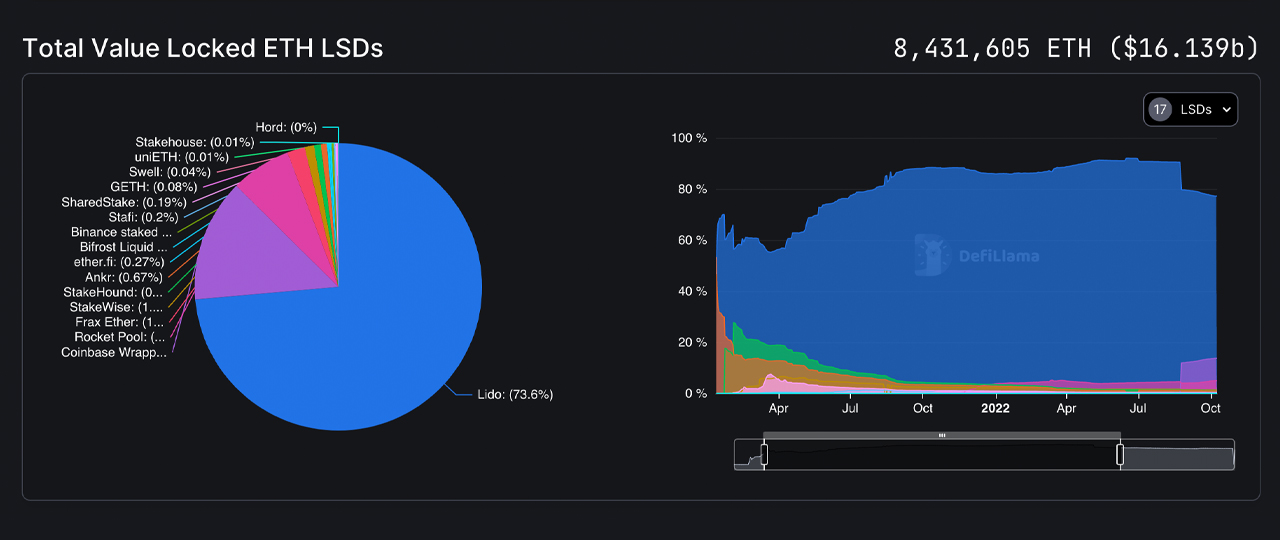

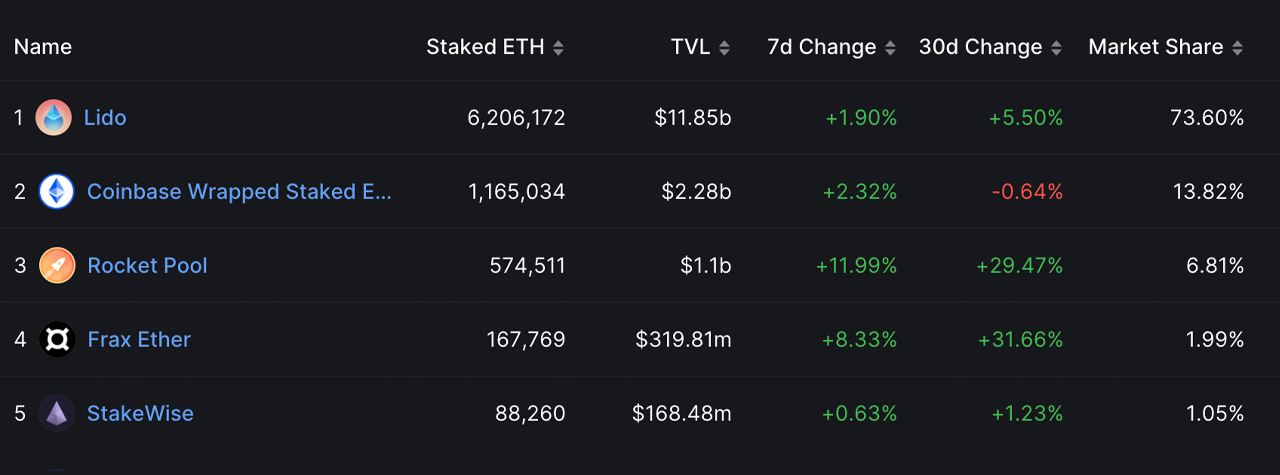

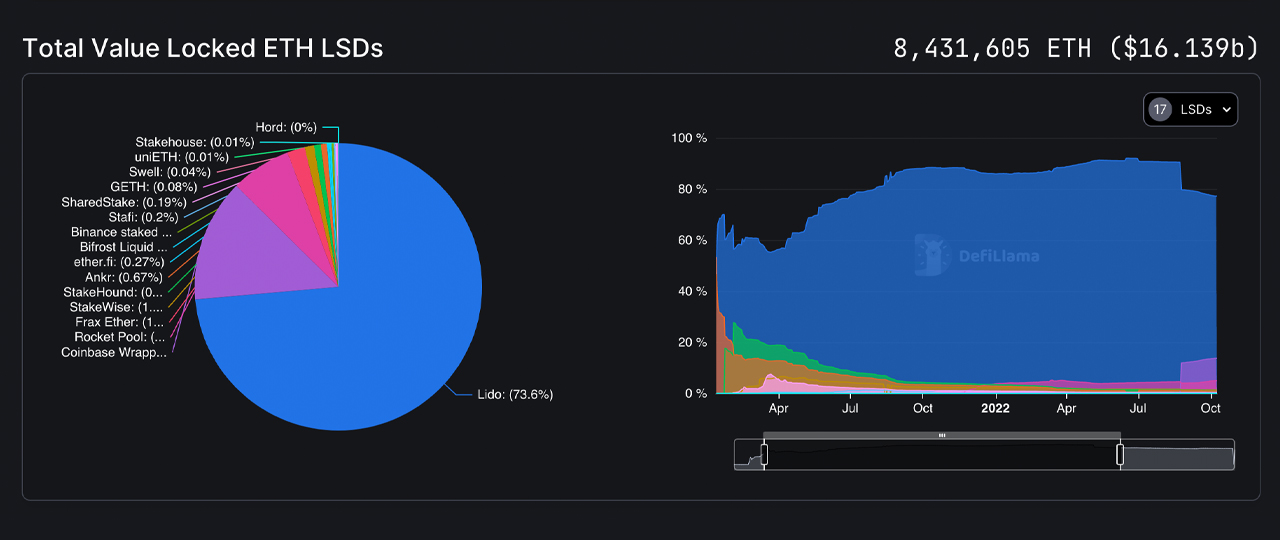

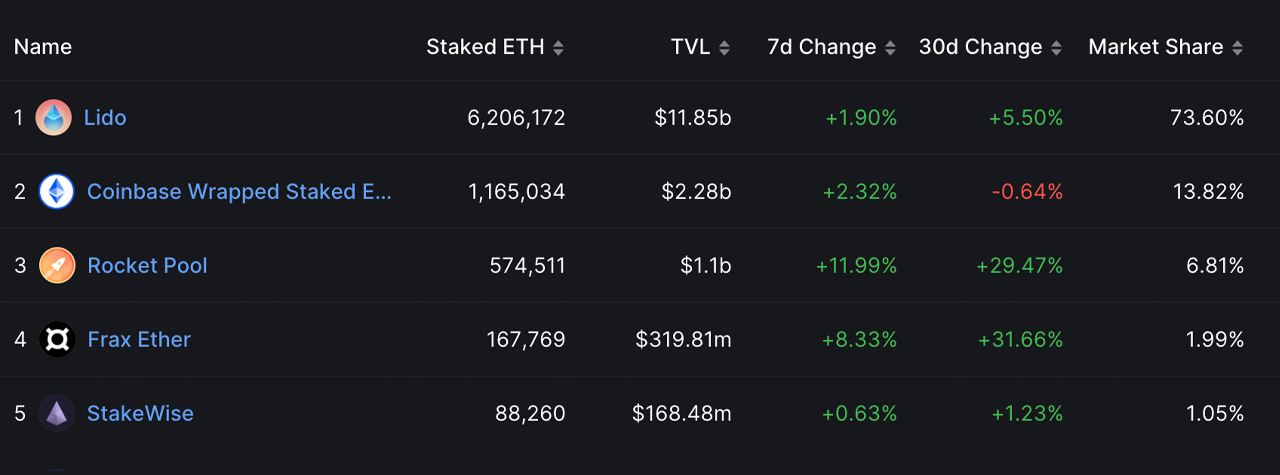

As of today, April 30, 2023, the total value locked in liquid staking protocols such as Lido Finance, Coinbase’s Wrapped Staked Ether, Rocket Pool, Frax, Stakewise, Stakehound, Ankr, Ether.fi, and Bitfrost is just over $16 billion.

According to 30-day statistics, six of the top ten protocols, ranked by value lock, have experienced gains in the past month, with four of them showing double-digit growth. Lido currently dominates the $16 billion market, holding 73.6% or 6,206,101 of the 8,431,605 Ethereums locked in floating stake protocols.

Data shows that just after the Shapella upgrade, 400,735 ethereum worth $763,600,542 using today’s ether rates have been added to the floating stake buffer. Lido’s 30-day metrics show a gain of 5.50% while Coinbase’s liquid staking platform saw a loss of 0.64% over the past month.

Rocket Pool’s Total Value Locked (TVL) jumped 29.24% in 30 days while Frax’s TVL rose 31.65%. Like Lido, Stakewise, the fifth largest liquid stake protocol, saw a modest 30-day gain rising 1.23% higher.

Recent data reveals that after the Shapella upgrade, a remarkable 400,735 ethereum, totaling $763.6 million in value, has been added to the floating stake buffer. While Lido’s 30-day metrics show a gain of 5.50%, Coinbase’s floating stake platform has seen a loss of 0.64% over the past month.

In the same period, Rocket Pool experienced a significant jump of 29.24% in total value locked (TVL), while Frax’s TVL rose by 31.65%. Similar to Lido’s slight rise, Stakewise, the fifth largest liquid stake protocol, has witnessed a modest increase of 1.23% over the past 30 days.

Binance has thrown its hat in the ring and is entering the fray with a newly launched liquid staking product, which now stands as the tenth largest platform under Bitfrost. As of now, the protocol’s total value locked (TVL) is approximately $38.69 million, with 20,305 Ether deposited into the application.

Floating staking protocols have gained significant traction in recent months, giving users the benefit of earning passive staking rewards while still retaining control over their assets. The addition of 400,000 Ether to floating stake TVL within just two weeks of the Shapella upgrade underlines the growing interest and attention this sector is receiving.

Tags in this story

Ankr, Binance, Bitfrost, Coinbase’s Wrapped Staked Ether, Crypto, DeFi, Ether.fi, Ethereum, FRAX, Lido Finance, liquid staking protocols, passive rewards, Rocket Pool, Shapella upgrade, Stakehound, stakers, Stakewise, TVL, value locked , Withdrawal

How do you think floating staking protocols will affect the overall cryptocurrency market and the future of staking? Share your thoughts on this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 7,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.