Ethereum outpaces Bitcoin 2X in compound annual growth rate over the past 4 years

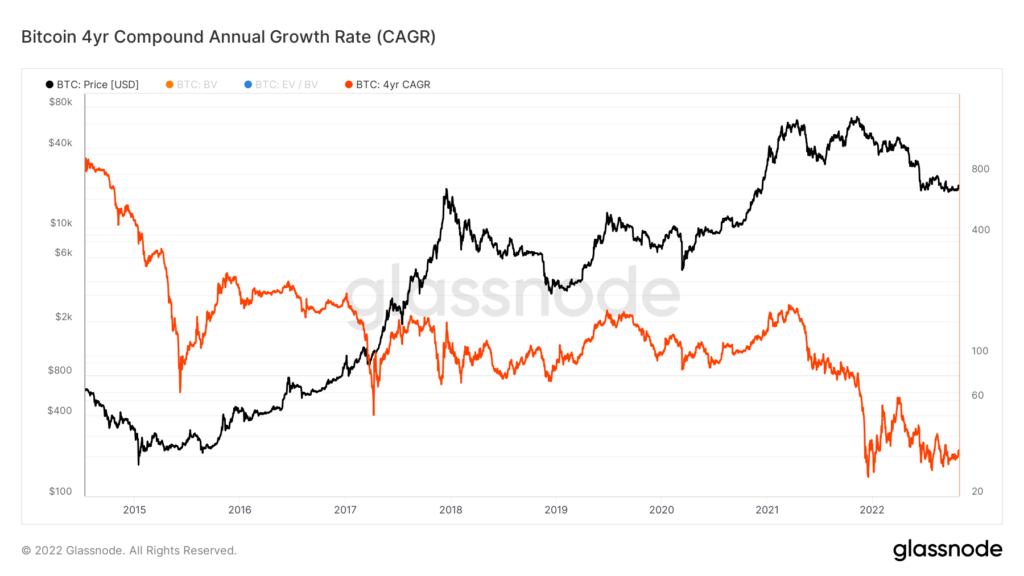

Data on the four-year compound annual growth rate of Ethereum and Bitcoin from on-chain analytics platform Glassnode shows that ETH has outperformed Bitcoin since October 2019. The data is available via the two charts below, which show the CAGR of both Ethereum and Bitcoin over the past four years.

The period was chosen to capture both the classic Bitcoin halving cycle, while also accounting for the typical bull/bear cycle, which tends to be of similar duration. Bitcoin recorded a CAGR of 34.1%, but Ethereum returned almost double that at 66.3%

Ethereum CAGR data started in July 2019, and since then the correlation between Ethereum and Bitcoin has been relatively low. Bitcoin’s peak CAGR was back in 2014, while Ethereum peaked on October 20, 2019.

Bitcoin’s peak CAGR was close to 800%, while Ethereum’s all-time came in around 350%. Both currencies have seen a decline in CAGR as market capitalization increased and markets matured. But while Bitcoin has been on a downward trend in CAGR since 2016, Ethereum has seen growth in 2019 and 2021.

Furthermore, the CAGR of Ethereum has risen steadily since June, but Bitcoin has been limited to between 36% and 61% throughout the year. A crucial divergence between the Bitcoin price and the four-year CAGR occurred around July 2021. The CAGR of Bitcoin had been relatively correlated with the price until this time. However, as Bitcoin’s price returned to near 2017 highs, the CAGR fell off a cliff in November 2021, just after Bitcoin recorded its all-time high.

After the significant upgrades to the Ethereum network that occurred due to The Merge, could CAGR indicate that it will lead the next bull run? The fundamentals of Ethereum and Bitcoin have changed more than ever, heading towards the 2024 halving of Bitcoin.

Ethereum’s maximum supply has been slowly falling since the merger, and an increase in activity on the chain could accelerate this process. Bitcoin’s maximum supply is fixed, and emissions will be halved during the next halving. However, Ethereum has just undergone what became known as a “triple halving” as the effects of The Merge reduce ETH emissions by a factor of three halving events.

The previous two Bitcoin halvings occurred around 18 months before a new all-time high was recorded. Could the same delayed effect play out for Ethereum after The Merge to ignite the next bull run?

CryptoSlate publishes daily research reports on data covering events like these. Be sure to bookmark our Research category to stay updated on developments in the data included in this article.