Ebix stock: Reasonable bet on the fast-growing Fintech industry

Melpomenem

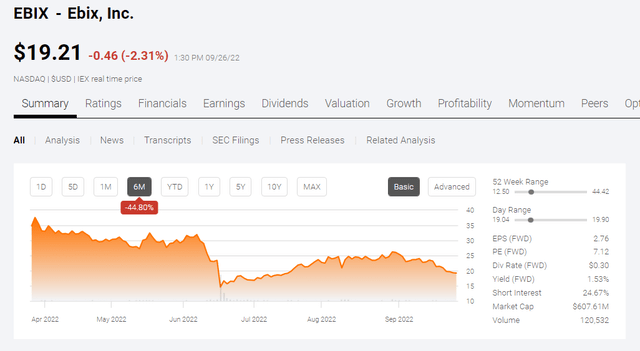

If you want to profit from the rapidly growing $160 billion fintech industry, consider continuing with Ebix, Inc. (NASDAQ:EBIX). The price drop of -44.80% has made EBIX very affordable. It now trades for less than $20 – well below its 52-week high of $44.42.

Seeking Alpha

The market value of Ebix is now less than 610 million dollars. Just over four years ago, the market capitalization of EBIX was greater than $2.7 billion. Ebix is a fallen angel, it could become a future takeover target for larger fintech companies.

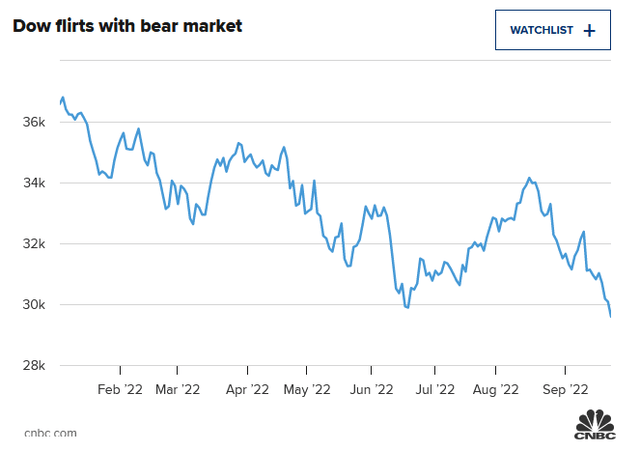

Yes, EBIX can be a falling knife along with many tickers. The Dow chart below illustrates that Ebix’s business performance may not be the problem. Emotional investors drag down the stock market in general. Even the largest fintech company, Visa ( V ), has a -18.21% six-month price return.

CNBC.com

Don’t be intimidated by big falls

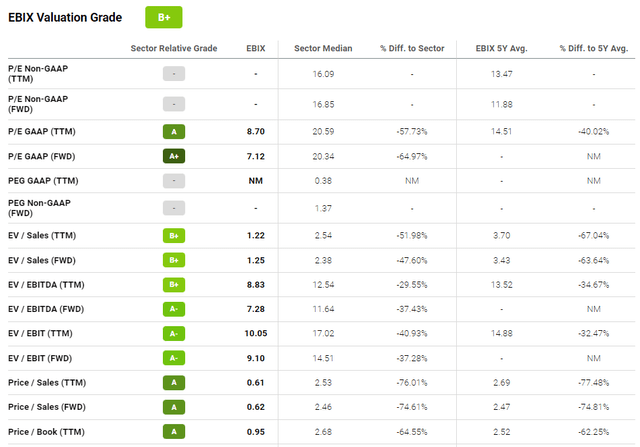

Thanks to the universal stock market fear and panic, EBIX could be bought at just 7.12x forward P/E. The opportunity here can be seen by studying the diagram below carefully.

Looking for Alpha Premium

EBIX is a perfect value play because the forward valuation is 65% lower than the average for its industry peers. The TTM price/sales valuation of software solutions provider Ebix is just 0.61, 77% lower than its peer average.

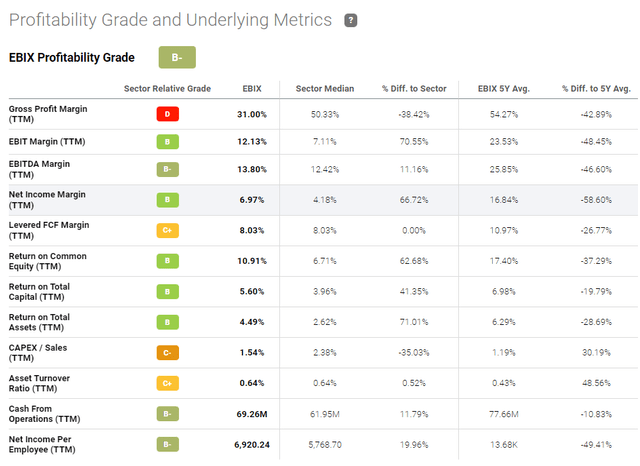

I think the significant undervaluation of EBIX is unfair. This company’s net income margin is 6.97%, 66.7% higher than similar sectors. Ebix Inc. has been consistently profitable since 2010. Consistent profitability in a highly competitive and crowded industry should be rewarded.

Looking for Alpha Premium

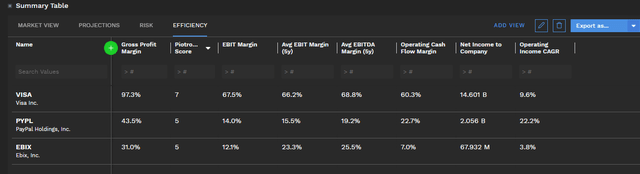

The negativity over EBIX could be because its 5-year net income margin used to be 16.84%. My takeaway is that fierce competition forces it into a price war to get more customers. Lower fees for its fintech software solutions are underlined by Ebix’s gross profit margin of 31% TTM. This is again significantly lower than the 5-year average of 54.27%. These drops in the margins are forgivable. Sacrificing gross/net margins to gain or protect market share is a valid business tactic in my opinion.

Ebix is a small fish competing against giants such as Visa or PayPal (PYPL). Lower prices are an easy way for Ebix to attract customers away from its much larger competitors. Furthermore, growth-focused investors probably know that smaller companies have greater growth potential than firms like Visa. Consequently, Ebix outpacing the growth rates of its larger rivals should attract more bulls.

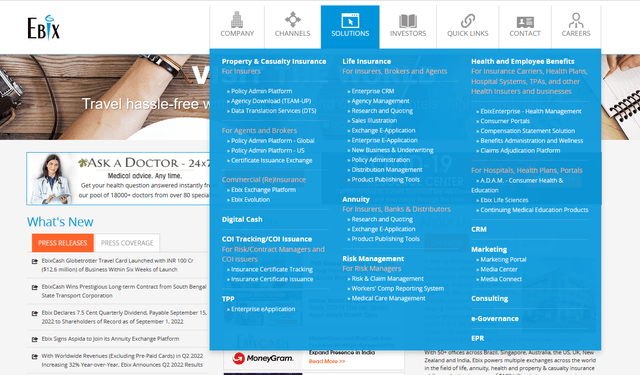

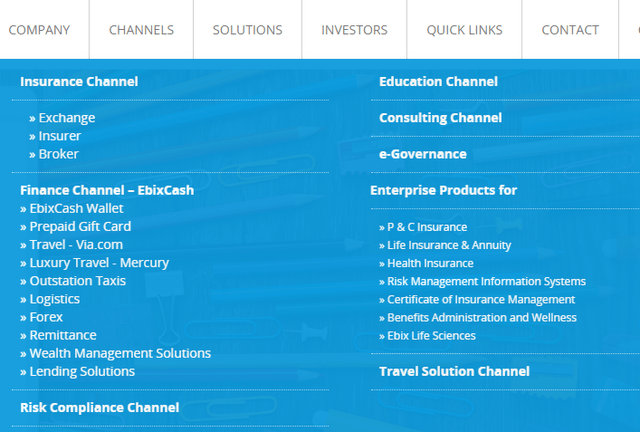

Too many business segments is not ideal

The extremely varied software solutions of Ebix are confusing. A small company dipping into so many pies is probably not very attractive to defensive investors. However, I believe the varied services and partners of this company mean that growth is all but assured.

ebix.com

Ebix can likely return to a revenue CAGR of over 15% if only management starts focusing on its most promising channels. My decades as a freelance multimedia artist have taught me that focusing on 2 or 3 markets is the best way to make money.

EBIX has a median 5-year earnings CAGR of 25.39%. Unfortunately, it’s now just 9.07% – lower than Visa’s 24% and PayPal’s 10.66%. The fault in EBIX’s star may be an over-diversified product line. This company was founded in 1976 and yet it never became a $5 billion company. We can partly blame too many business segments in my opinion.

ebix.com

The R&D and marketing costs of so many services/solutions may also be the reason for the low gross margin of 31%. A laser focus on insurance and financial channels is desirable. There is no urgent need for that travel solution and educational channels. I think they should be sold to strengthen the insurance, finance and consulting channels.

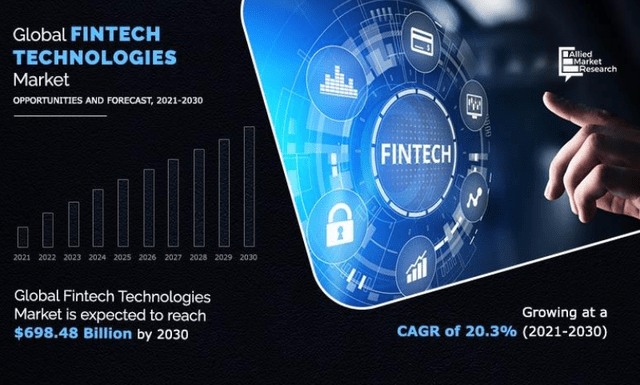

On the other hand, having so many business segments may also be the reason it continues to survive. My takeaway is that a streamlined product portfolio can increase Ebix’s market share in the fintech industry. The 20.3% CAGR of this particular business may continue to attract large firms and start-ups.

Allied Market Research

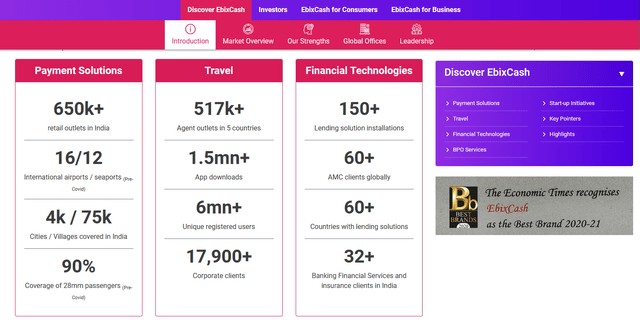

EbixCash is very promising

My favorite reason to back this stock is EbixCash. Low fees for digital transactions/remittances add up to a significant amount in the end. EbixCash just needs to attract enough of a variety of customers.

EbixCash is big in India. This is very important because India is experiencing exponential growth in fintech services. It is estimated that India’s fintech technology services market will generate revenues of US$200 billion and US$1 trillion (assets under management by 2030).

ebixcash.com

These 650,000 points of sale in India make EbixCash a very important player in India’s local and cross-border money transfers and digital payments. India continues to be the world’s No. 1 country in terms of international remittances. It received 89 billion in remittances.

Ebix Payment Services Pvt. Ltd is the money transfer technology partner of Western Union (WU), MoneyGram (MGI), Ria Money, Transfast and Xpress Money. Ebix is also the in-house money transfer technology facilitator for all of the above partners in other countries.

Conclusion

EBIX is grossly undervalued compared to its industry peers. Bargain hunters looking for growth stocks should consider EBIX. My reservations about the many business channels of Ebix do not diminish my conviction that it is a worthwhile investment in fintech.

Technical indicators say that EBIX is headed for more falls. Better to wait and let it bottom out before it’s too long.

Ebix Inc. has a Piotroski score of 5. It can therefore be a safe long-term investment. This company’s stock could bounce back next year if it shows double-digit revenue growth. Going forward, Ebix will always have a handicap of lower gross margins compared to giants like PYPL and V. Its small size means it has to use lower prices to retain and attract customers.

Finbox.io Premium

Going long on EBIX while it is trading below $20 can turn out to be very profitable. Ebix’s huge presence in India and low valuation make it a very attractive takeover premium. PayPal has $9.31 billion in cash. It can afford to offer $1.5 or $2 billion to buy 100% of Ebix Inc. Even a $2 billion price tag, PayPal only pays at 2x P/S value. Adobe (ADBE) acquires Figma at 50x P/S value.