Do crypto trading fines make sense in 2022?

Disclaimer: The text below is an advertisement article that is not part of Cryptonews.com editorial content.

Eating healthy food and drinking clean water makes sense for the body, but are crypto trading robots a good idea for financial portfolios?

It is the year 2022. If anyone grew up watching the TV show The Jetsons, they would have reason to believe that flying cars would be launched by now. Although George Jetson hasn’t quite entered reality, great strides have been made in the technology sector to improve the human experience.

Cryptocurrencies have created a major step forward in the future of finance, and in how individuals and companies interact on a financial level. In fact, cryptocurrency and blockchain technology have impacted sectors such as music, gaming, fundraising and real estate, just to name a few.

If Rosie the robot rings a bell from The Jetsons, think of her when crypto trading bots are mentioned. Although not physical robots, these robots act as software that manages users’ financial portfolios, offering a form of automation that is unique to the industry.

What about crypto trading? Is this article in English?

Yes, this article is actually in English, not Greek. Traditionally, crypto trading is done manually, spending hours per day in front of a computer screen using your fingers to tell the exchanges what to do.

Crypto trading bots, on the other hand, don’t need physical fingers to push them into action. Instead, each bot is designed to work on its own and is based on specific code built into the software.

As for manual involvement, it is only necessary during the initial setup. After the bot runs, the rest of the trading process is hands-free, allowing users to spend time elsewhere or on another project.

The regulations have not been fully established

Institutional and retail investors considering the lack of regulation regarding crypto see the issue as a major weaning moving forward. Government agencies, such as the US Securities and Exchange Commission, are working to achieve regulatory clarity, but are doing so by labeling certain tokens in the crypto space as securities.

Many would argue that this method of enforcement will not result in a well-regulated ecosystem and may instead harm it.

As a result of the lack of regulatory clarity, some are skeptical of using crypto trading robots. Questions arise such as, “How will crypto trading bots affect taxes?”, or “What legal ramifications must be kept in mind when using crypto trading bots?”.

These questions enter people’s minds, especially experienced investors who have also invested in other asset classes like real estate or stocks in the past. At this point, a trade is a trade, whether it’s done by a human or by a bot.

Crypto trading bots for diversification

Despite government regulation, crypto trading bots are good at diversifying capital among many different cryptocurrencies, allowing an investor to gain exposure to several different assets in a short period of time.

Since these bots are designed to give users a positive experience, the diversification is quite significant and therefore does not put all the eggs in one basket so to speak.

Diversification is essentially spreading the risk across different assets in case one ends up tanking or another ends up shooting for the moon. Diversification is not a new concept and has been a long-standing method of investing, especially within the stock market.

Automation as a way of life

Giving up complete control over life is not always a good thing. But putting certain areas into automation mode can free up more time and reduce stress. Areas such as billing, driving and now crypto trading are areas worth considering taking the leap.

Technology is here to make life easier, not more burdensome. With that, however, comes a level of caution that is healthy to use, but also a level of curiosity that can help overcome mental obstacles.

Many would argue that freedom of time is what they are looking for, not necessarily more possessions. Time is the most limited resource that humans have, which is why it is valued at such a high level. Automation can help in everyday or routine situations to indicate time elsewhere.

Automated crypto bots make sense

It is up to the individual investor whether crypto trading robots are the right choice. Remember that it is not the fine itself that can cause a legal problem, but actions the bot brings a specific portfolio.

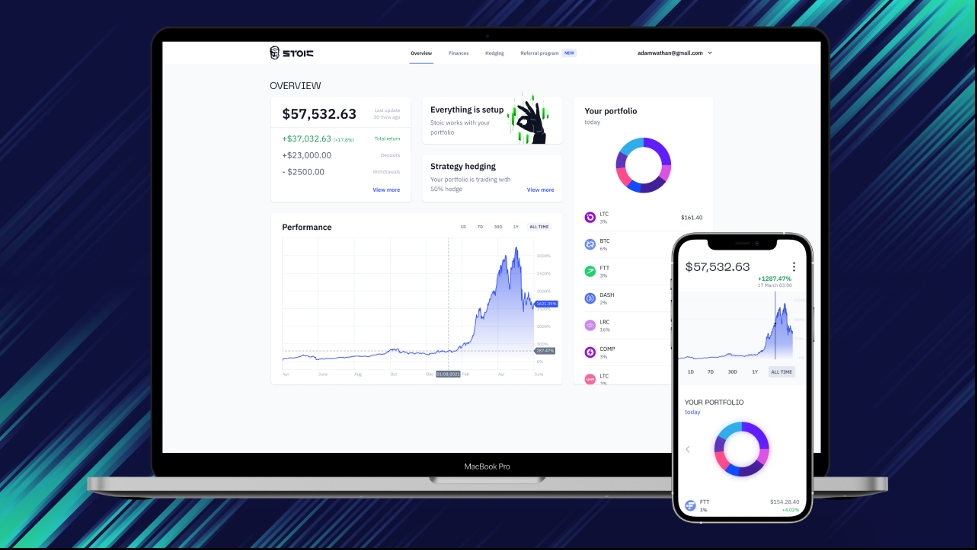

When you decide to use a crypto trading bot such as Stoic AI, make sure it has a proven track record and works hand-in-hand with a world-renowned exchange with high security measures. Cryptocurrencies are not backed by central banks, and if they are stolen, there is little chance of getting them back.

Stoic has been operating as an automated trading app since 2020 with a pioneering Long-only option for crypto investors. From October 2022, Stoic now has a new, market-neutral alternative that delivers results regardless of fluctuating market conditions.

Stoic is an official Binance broker, and uses Binance security measures when integrating via the API of the leading exchange. Only account holders are able to initiate withdrawals to maintain a high level of security.

As time goes on, and as the crypto space matures, more investors will explore crypto trading robots as a solution to their timing dilemma. Finally, be smart, vigilant and willing to explore all options when it comes to automated crypto investing.