Despite Slow Crypto Market, DeFi Yearn Finance’s YFI Gained 7%

As the crypto industry gradually recovers from the woes of crypto winter, DeFi protocol Yearn Finance’s token YFI surged 7%. The token managed to swim against bearish waves in the last 24 hours. This can be attributed to attempts by investors to capitalize on the supposed rollout of liquid stake derivatives or LSDs.

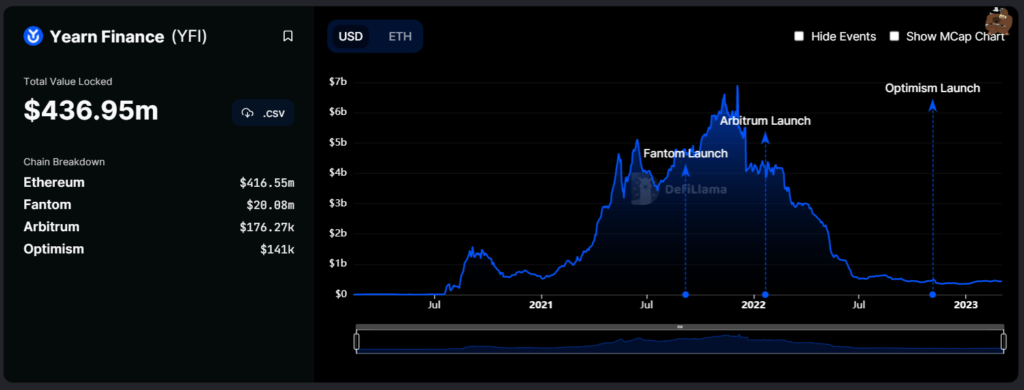

Over the past 48 hours, YFI has gained 23% against market leader Bitcoin (BTC). At the time of writing, BTC was trading at $22,316.94. And managed to rise by 19% against tether (USDT). At the time of writing, YFI was trading at $10,478.46. At the same time, Total Value Locked (TVL) at Yearn Finance was $436.95 million.

The reason behind this rally can be attributed to last month’s announcement by the company that Yearn Finance is expanding into liquid stake derivatives. These tokens expose investors to an underlying asset while providing stake rewards. This is part of Ethereum’s Proof-of-Stake (PoS) network.

Liquid Staking is the exchange of staked ether accumulated by PoS or other staking methods with a tokenized version of ETH. This can be further used in a number of Decentralized Finance (DeFi) applications. Major use cases can be collateral for loans and margin trading for returns.

Yearn Finance announced Liquid Staking Derivatives (LSDs) on February 24, 2023. The stock rose 39% weekly through Friday just after the announcement. Trading volumes shot through the roof, rising five times the level before the announcement. The introduction of the LSD curve was enough to get the necessary attention.

The hype behind the LSD curve can also be referred to what analysts believe. They believe this can expose active investors to more underlying tokens, thereby diversifying their portfolio while better managing risk. The tweet also referred to the launch of yETH, also called the LSD of LSDs.

Liquid Staking Derivatives (LSD) was priced at $0.7157 with a jump of 32.62% at the time of writing. At the same time, its value against Bitcoin increased massively by 36.64% to 0.00003195 BTC. There was also a massive increase in volume (25.10%) to $249,336.

The impact of the announcement and the buzz it created can be seen on the price chart of YFI. A visible bullish continuation pattern is rising above the immediate support zone, slowly moving north to respect the $12,406 resistance point.

If the bullish trend continues, it could touch R1 and go above $12,500. However, things could turn south at any time given the trademark volatility of the crypto market. Even if it does happen, the possibility of it breaking the immediate support zone is quite rare. It can consolidate there for a while before popping up.

Disclaimer:

The views and opinions expressed by the author, or any person mentioned in this article, are for informational purposes only and do not constitute financial, investment or other advice. Investing in or trading crypto assets comes with a risk of financial loss.