Crystal Blockchain, a company that provides blockchain data and analytics, published a study covering security breaches, scams and scams related to cryptocurrency and decentralized finance (defi). According to the study, approximately $16.7 billion in crypto assets have been stolen since 2011. Last year, Crystal’s intelligence team documented 199 incidents that resulted in the theft of $4.17 billion in crypto assets. So far this year, there have been 19 different incidents that have resulted in the theft of $136 million.

Top countries targeted by crypto-related events: US leads in frequency, China tops in value

On Tuesday, Crystal Blockchain released a report that provides a comprehensive analysis of fraudulent activities and security vulnerability attacks since 2011. The report reveals that over the past 12 years, there have been 461 incidents that took place in 45 countries, resulting in $16.7 billion in stolen crypto. assets.

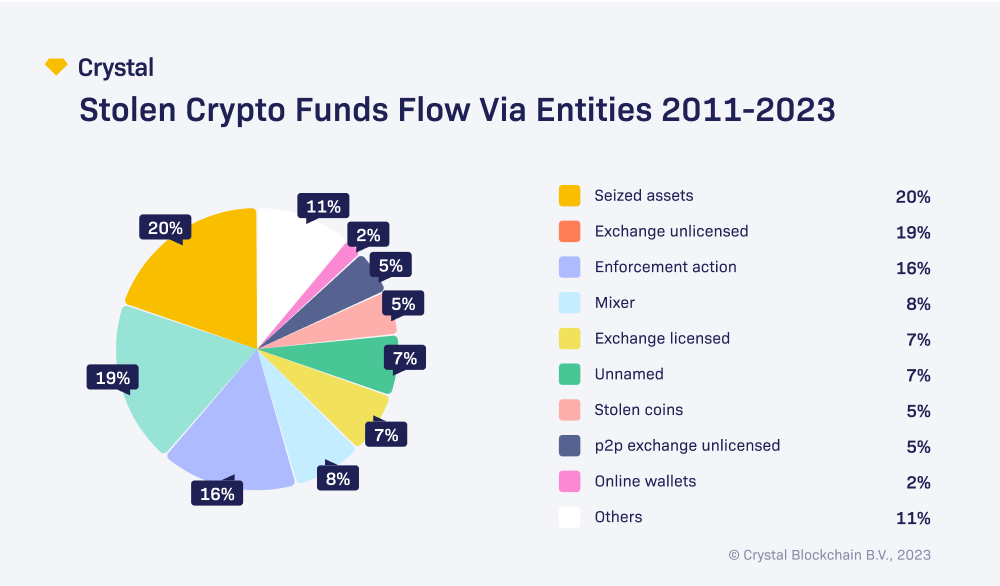

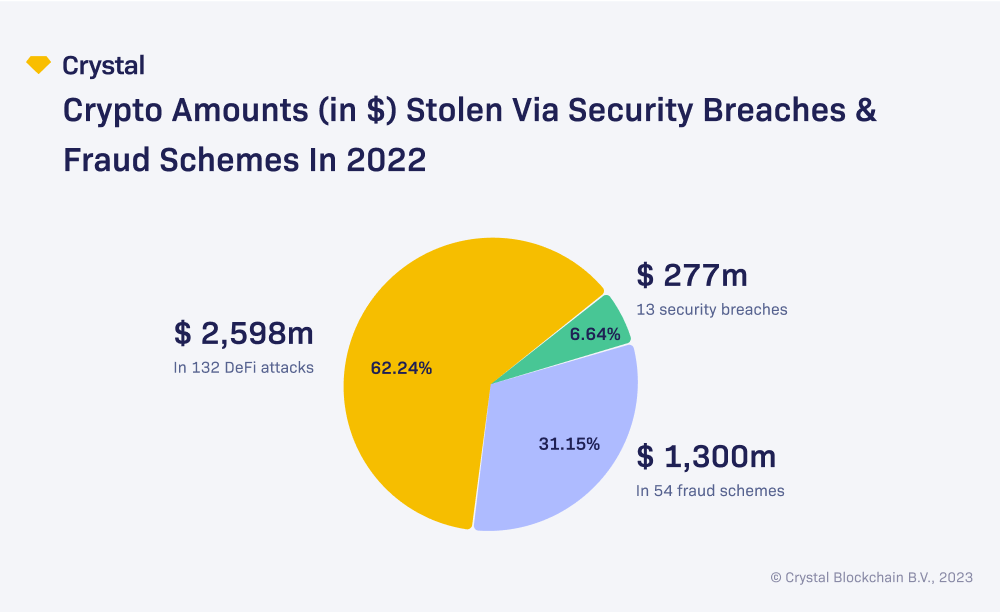

According to Crystal’s intelligence report, 231 defi-hacks, 135 security attacks and 95 fraudulent schemes were reported during this period. Defi-hacks ranked second in terms of value, with $4.81 billion stolen, while fraud resulted in more than $7.5 billion in stolen crypto assets.

According to the study, the United States has the highest number of incidents against crypto companies and bad actors. However, in terms of total value, China ranks highest due to Plus Token Ponzi Scam in 2019 and Wotoken Ponzi in 2020.

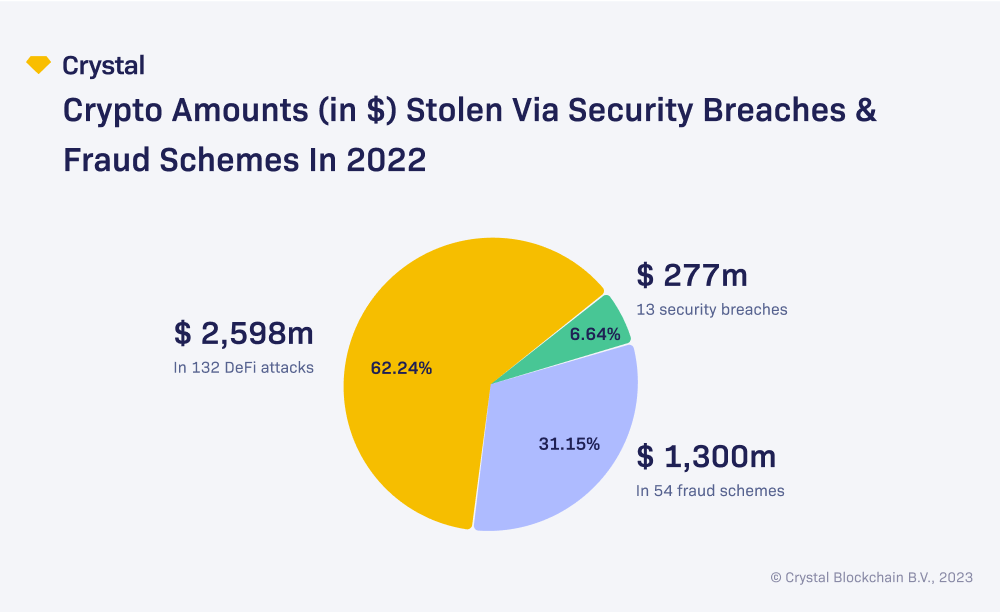

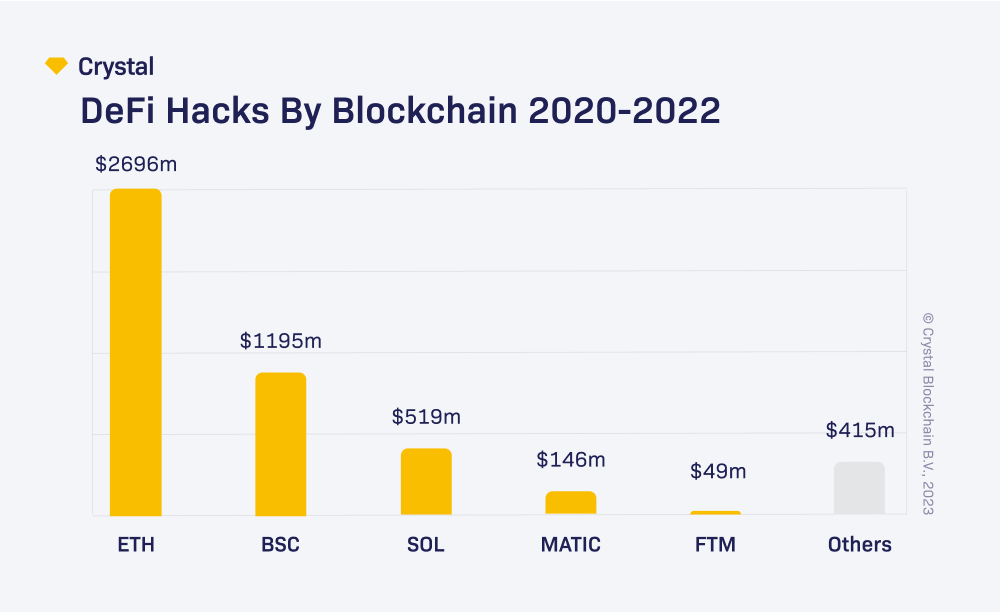

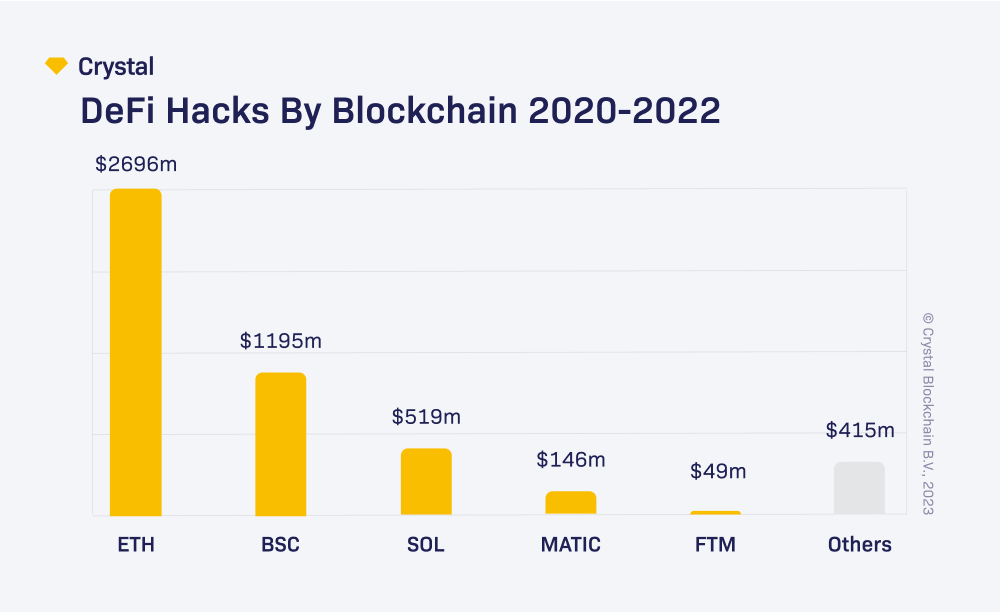

Crystal researchers state that until 2021, the most popular attacks against security systems were for crypto exchanges, but since then attackers have shifted to decentralized finance hacks. For now, Crystal reports that centralized exchange (cex) hacks cause the least possible financial damage. “In 2022, the relationship between sex versus [decentralized exchange (dex)] the hacks were as high as 1:13,” Crystal’s researchers note.

The largest defi hack to date was the Ronin network bridge hack in March 2022, which resulted in over $650 million in losses. The majority of the funds stolen in the Ronin hack were transferred to Tornado Cash, a cryptocurrency mixing service.

Crystal researchers note that “Tornado Cash remains the most popular money laundering service on the Ethereum Blockchain.” The report says that last year, stolen crypto assets from the top 10 defi exploits exceeded $2.61 billion. In addition, non-fungible token (NFT) rugs became popular in 2022, with Crystal counting “48 successful scams” during the year.

Crystal Blockchain’s report in its entirety can be read here.

Tags in this story

Analytics, Blockchain, Blockchain Analysis, China, Crypto Exchange, Cryptocurrency, Cryptocurrency Mixing Service, Cryptocurrency Theft, Crystal Blockchain, Cybersecurity, Cyber Attacks, Cybercrime, Decentralized Finance, DeFi, Digital Assets, Ethereum blockchain, Financial Harm, Financial Technology, Fraud, Hackers, Money Laundering of money, nft, Ponzi scam, Ronin network bridge hack, rye move, fraud, security breach, stolen assets, Tornado cash, USA

What do you think should be done to improve security measures in cryptocurrency and decentralized finance (defi)? Share your thoughts and ideas in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons, Crystal Blockchain,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.