Crypto Winter brings bad news for sports sponsorship

Crypto winter(s) may have several market implications for retailers and institutions. This article focuses on how the crypto winter affects sports sponsorships and advertising deals.

Crypto companies increasingly invested in sports sponsorships and advertising to promote their brand and products. The growth of the cryptocurrency industry and the increasing mainstream acceptance of digital assets have fueled this trend.

Crypto companies have sponsored various sporting events and teams, including football clubs, basketball and auto racing. Some examples of cross-genre sponsorships that created publicity waves for crypto are mentioned below.

Big crypto deals in recent years

Cryptocurrency tokens helped the National Basketball Association (NBA) collect $1.64 billion in annual sponsorship fees for the 2021-2022 season. According to a report, this represented a year-over-year (YoY) increase of 12.50%.

Five brands – Crypto.com, Webull, Coinbase, FTX and Socios – are responsible for 92% of the spending of the cryptocurrency sector in the NBA. Includes some of the most high profile fixtures in the league such as naming and sponsoring jersey patches.

Crypto.com won the naming rights to the Los Angeles Lakers’ home arena in a deal reportedly worth $700 million over 20 years. In addition, crypto played a role as nine new jersey patch sponsors, including the Philadelphia 76ers’ deal with Crypto.com, worth more than $10 million a year.

Reputable teams have even integrated digital currencies into payment systems. In 2021, the NBA’s Dallas Mavericks announced that they would accept Dogecoin as payment for tickets and merchandise. The team’s owner, Mark Cuban, is a vocal supporter of cryptocurrencies.

Other sports rode the same wagon

In 2020, the English Premier League football club Southampton signed a sponsorship deal with cryptocurrency betting platform Sportsbet.io. In 2019, the Formula 1 racing team Red Bull Racing entered into a partnership with the cryptocurrency company FuturoCoin. Other groups such as Ferrari and Mercedes collaborated with Vela’s blockchain and FTX.

In addition to sports sponsorships, crypto companies have invested in advertising through sports media. For example, during the 2022 Super Bowl, crypto exchange platform FTX ran a commercial featuring NFL stars Tom Brady and Patrick Mahomes.

There were Super Bowl ads, an arena and celebrity endorsements. TV commercials landed during the nightly news.

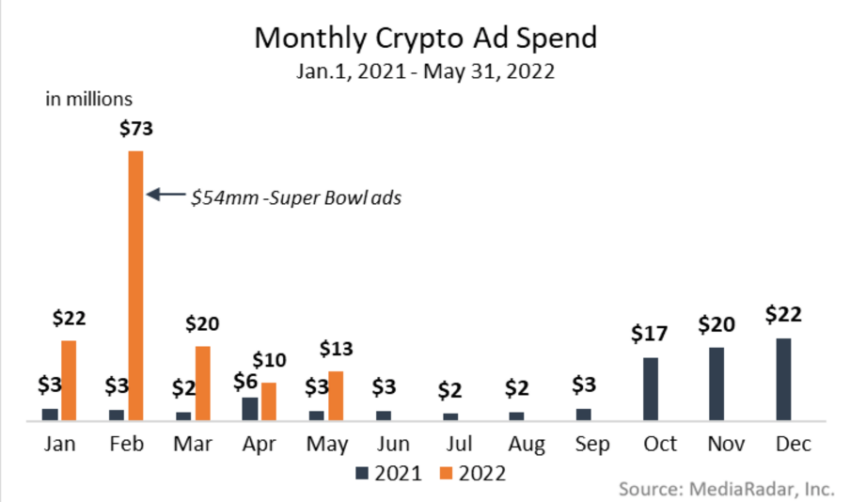

Crypto companies used anywhere and everywhere. In fact, through October 2022, crypto-related brands paid out $223 million on ads in the United States. This was up 150% from $89 million for all of 2021, according to MediaRadar.

The sports industry has become an important target for crypto companies as they seek to reach new audiences and market their products.

2022: The year of more collapses

Many of the many collapses within the crypto domain have already been covered. The latest was the collapse of FTX, one of the largest crypto exchanges. Given the severe contagion effect, the industry witnessed a significant market cap that fell below $1 trillion.

The so-called ‘crypto winter’ combined with a broader economic downturn, which sees the cost of living rise as inflation rises, injected a lot of fear into the domain. Crypto institutions such as Coinbase, Crypto.com and Binance suffered. Senior executives scrutinized ad spend in this setting, which made it more challenging to secure marketing dollars.

In the third quarter of last year, top crypto advertisers spent just $35 million on ads, according to MediaRadar. This represented an 80% decline from the first quarter, which received a huge boost from the nation’s biggest sporting event – the Super Bowl.

Speaking to BeInCrypto, Grant Harbin, CEO of performance marketing firm Headlight, stated:

“Crypto winter is a crypto advertising winter. There is probably very little consideration for scaling ad budgets right now.”

The unfavorable market conditions led several crypto cohorts to withdraw their marketing budget.

No crypto names visible

The start of the Super Bowl in 2023, called Super Bowl LVII, saw a completely different scenario. As BeInCrypto covered, the majority of the sporting event’s ads came from alcohol and food companies.

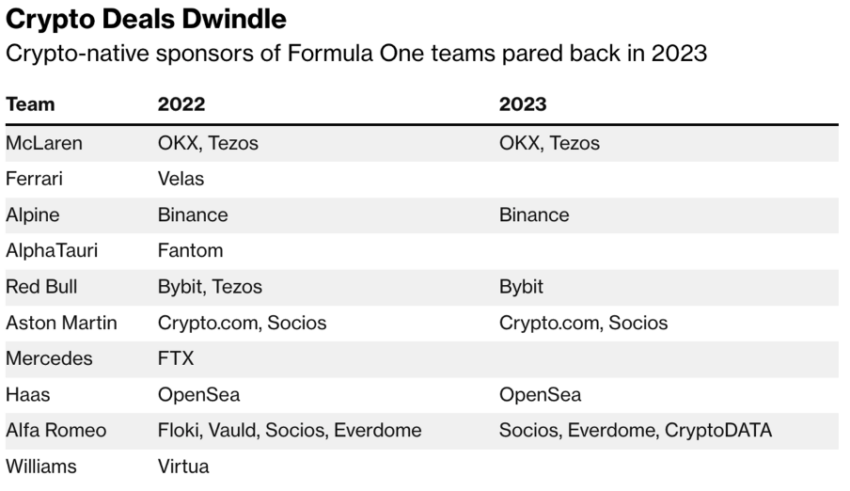

Other events also witnessed the same scene where the big names in the crypto domain disappeared. For example the Formula 1 event. A very different picture emerged when the team revealed its 2023 cars at this season’s debut race last weekend. While all teams had at least one crypto sponsor the year before, this number is now down to 60% – and it looks set to drop further.

Big names such as Mercedes, which represents seven-time world champion Lewis Hamilton, were the first to remove (collapse) FTX’s sponsorship. Mercedes may have a claim in FTX’s bankruptcy proceedings, filings show, and into 2023 it has no other crypto-native sponsors.

Notably, Ferrari parted ways with a multi-year partnership with Velas Blockchain. Similarly, the Red Bull racing team ended its relationship with Tezos.

The major bankruptcies and crashes in 2022 have cast an ominous shadow over our industry. Sponsorship costs vary from team to team, depending on the size. Per one researcher would cost area from $500k to $750K for smaller companies to millions for more giant companies.

“With token prices down so much, it’s no wonder some crypto companies are pulling back.”

Countries like Singapore have even banned crypto ads altogether.

Stopping advertising can affect a brand

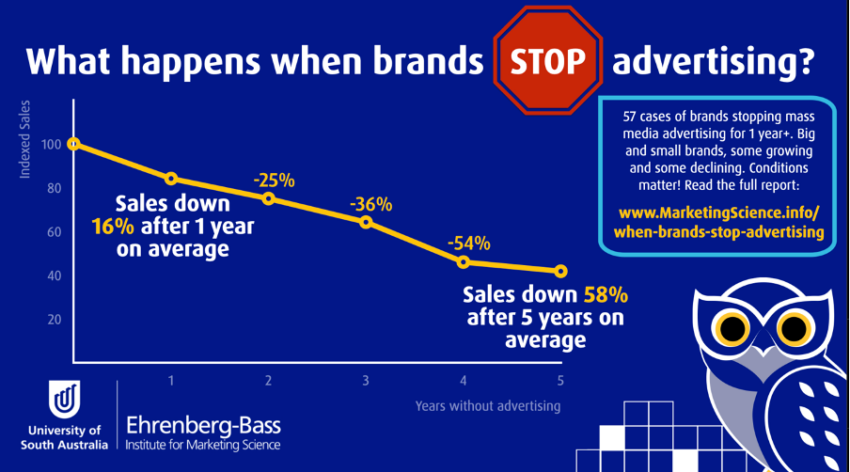

Whether in the crypto domain or the traditional sector, groups take a hit when they stop advertising. Brands can face sales problems when they stop advertising.

Advertising is essential for creating awareness, building brand recognition and shaping consumer perception of a product or service. When a brand stops advertising, it risks losing visibility and top-of-mind awareness among consumers.

With advertising, a brand can maintain its market position and compete against other brands that continue to advertise. Over time, consumers may forget the brand or lose interest in the products or services. This can result in falling sales and market share. Moreover, stopping advertising can also affect a brand’s reputation and image.

If a brand suddenly includes advertising, it may be seen as less stable, prosperous or committed to its customers. This can create a negative brand perception and undermine its appeal to consumers. In short, while other factors can affect a brand’s sales, stopping advertising can undoubtedly lead to sales problems and other negative consequences.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.