Crypto-mixing activity reaches all-time high: chain analysis report

Bitcoin and crypto-mixers have seen an increase in use this year as cybercriminals and sanctioned entities seek ways to hide their bad profits.

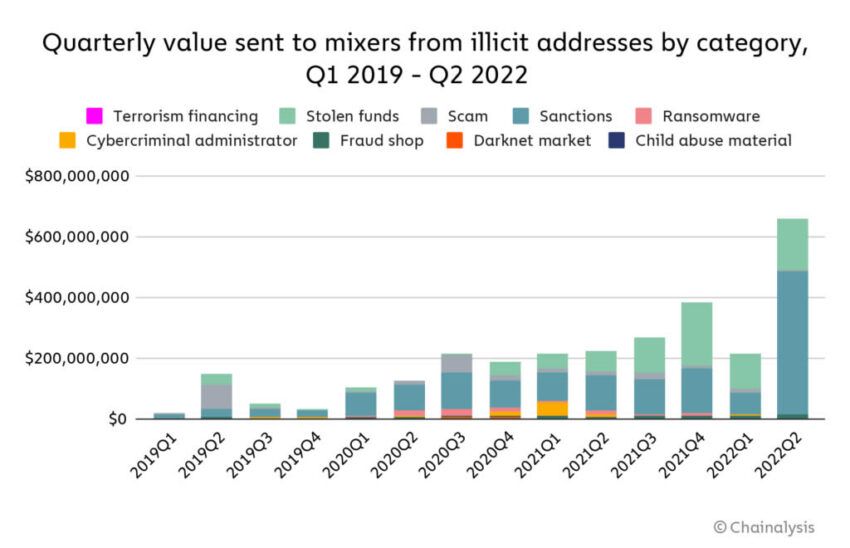

Cryptocurrency sent through mixed services has risen to its highest levels ever, according to a July 14 report from blockchain analysis firm Chainalysis.

Mixers have gained a bad reputation as they have become the preferred method for cybercriminals and rogue states to launder digital assets. Chainalysis reported that almost 10% of all funds sent from illegal crypto addresses are sent to mixers.

It added that the 30-day moving average of crypto sent to mixers reached a record high of $ 51.8 million in April. The amount sent to mixers in the second quarter of 2022 peaked at $ 600 million, but the vast majority of it came from sanctioned entities and stolen funds.

It will be safe to conclude that the war in Ukraine and global sanctions imposed on Russia have had a major impact on mixer use in the first half of this year.

“What stands out most is the huge volume of funds being moved to mixers from addresses linked to sanctioned entities, especially in Q2 2022.”

Mixes legalities

Mixers are not illegal and offer legitimate services for those who need some financial privacy for whatever reason. The US Financial Crimes Enforcement Network (FinCEN) has clarified that mixers are money senders that require registration under the Bank Secrecy Act (BSA). Of course, this is not going to happen, as it negates their purpose.

By exploiting this legal loophole, addresses linked to sanctioned entities such as the Russian darknet market Hydra and the North Korean hacker group Lazarus accounted for 80% of the funds sent to mixers in 2022.

The report added that hackers affiliated with the North Korean regime have stolen more than $ 1 billion in cryptocurrencies, mainly from DeFi protocols, so far this year. The rest consists of crypto derived from protocol exploits, scams, ransomware and other malicious sources.

In April, Be[In]Crypto reported that Ethereum mixer Tornado Cash had agreed to block sanctioned addresses.

How do cryptomixers work?

Mixers obscure transactions using a variety of methods. They break the connection between the sender address and the recipient, making assets very difficult to track.

Crypto sent to mixers is collected or “mixed” at random before being sent to the recipient, making it very difficult to trace the origin address. Additional anonymity can be achieved by shifting the times of transactions and changing the fees and types of deposits.

Their weak point is large transactions that overwhelm the mix basins, making it easier for blockchain seekers to track.

Another major problem is that ill-informed politicians associate mixers with the entire crypto industry, but illegal activity accounts for around 0.62% of all crypto transactions, according to a Chainalysis report earlier this year.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action taken by the reader on the information contained on our website is strictly at your own risk.