Crypto Giant Binance Moved Over $400 Million From Silvergate In 2021

Binance, the largest crypto exchange by volume, is facing increased scrutiny over a secret channel it used to transfer funds. Within a few months, more than $400 million from Binance.US was moved between accounts controlled by CEO Changpeng Zhao.

The cryptocurrency industry is often associated with secrecy and anonymity, and the movement of money by crypto firms is no exception.

While traditional financial institutions must adhere to strict regulations and reporting requirements, the decentralized nature of cryptocurrencies and the lack of a central authority make it easier for crypto companies to keep their financial dealings hidden.

Crypto institutions that engage in questionable practices

One of the main reasons crypto firms engage in secretive money movements is to avoid regulation. Since cryptocurrencies are not recognized as legal tender in many countries and their regulatory framework is still evolving, companies often prefer to keep their financial transactions away from the prying eyes of the authorities. This allows them to avoid compliance costs and restrictions, giving them more flexibility to operate in a rapidly evolving industry.

Another reason for the secrecy is to prevent competitors from gaining an advantage. The crypto industry is highly competitive, with many players fighting for market share. Companies often use opaque financial practices to keep their strategies and positions hidden from rivals, preventing them from gaining a foothold or using the information to their advantage.

Furthermore, crypto companies also engage in secret money movements to avoid public scrutiny. Many cryptocurrency businesses operate in a legal gray area and their activities can be controversial. They may be involved in activities that some consider unethical or illegal, such as money laundering or the financing of terrorism. By keeping their financial dealings private, these companies can skirt negative publicity and potential legal action.

Mysterious movements

Despite its advantages, secretive money movements by crypto firms also have significant disadvantages. They can undermine transparency and accountability, making it easier for regulators and other stakeholders to monitor and assess the risks associated with the industry. Moreover, they can increase the potential for fraud and other criminal activity, harm consumers and damage the industry’s reputation.

Currently in trouble with crypto exchange, Binance is facing regulatory heat. Binance allegedly transferred $400 million from its Binance.US account to a company allegedly linked to CEO Changpeng Zhao.

Even the former CEO of Binance.US was left in the dark about the concerned outflows. This has caused concern and scrutiny in the cryptocurrency community.

According to a Reuters report on February 16, an examination of Binance’s bank records and company filings showed that more than $400 million was sent in a series of transactions in 2021 from an account controlled by Binance.US to trading company Merit Peak.

“During the first three months of 2021, more than $400 million flowed from the Binance.US account at California-based Silvergate Bank to this trading firm Merit Peak Ltd, according to quarterly reports reviewed by Reuters.”

Silvergate, a massive crypto-friendly bank, has recently come under regulatory scrutiny, given its links to collapsed crypto exchange FTX.

This uncertainty and distrust has taken a toll on the stock price, which is currently at long-term lows below $20 per share.

George Soros’ fund even bought put options (shorts) on 100,000 shares of Silvergate, worth $1.74 million as of Dec. 31, according to a 13F filing.

Contradictory concept of openness

Last February, the United States Securities and Exchange Commission (SEC) launched an investigation into potential connections between Binance.US and two specific trading firms – Sigma and Merit. The transfer has raised further questions about Binance’s transparency and commitment to complying with regulatory requirements.

Interestingly, the report dropped while Binance published a blog post titled “Building Trust in the Crypto Ecosystem,” in which the exchange says customer funds “should only be used in the ways that customers have explicitly authorized.”

BeInCrypto reached out to the team at Binance for comment on the issue. However, the team responded by saying:

– We have no comments on that.

Further, ‘This is a Binance.US issue; they are a separate and independent entity from Binance.com. You can forward your request for comments/questions to them.’ Binance spokesperson told BeInCrypto.

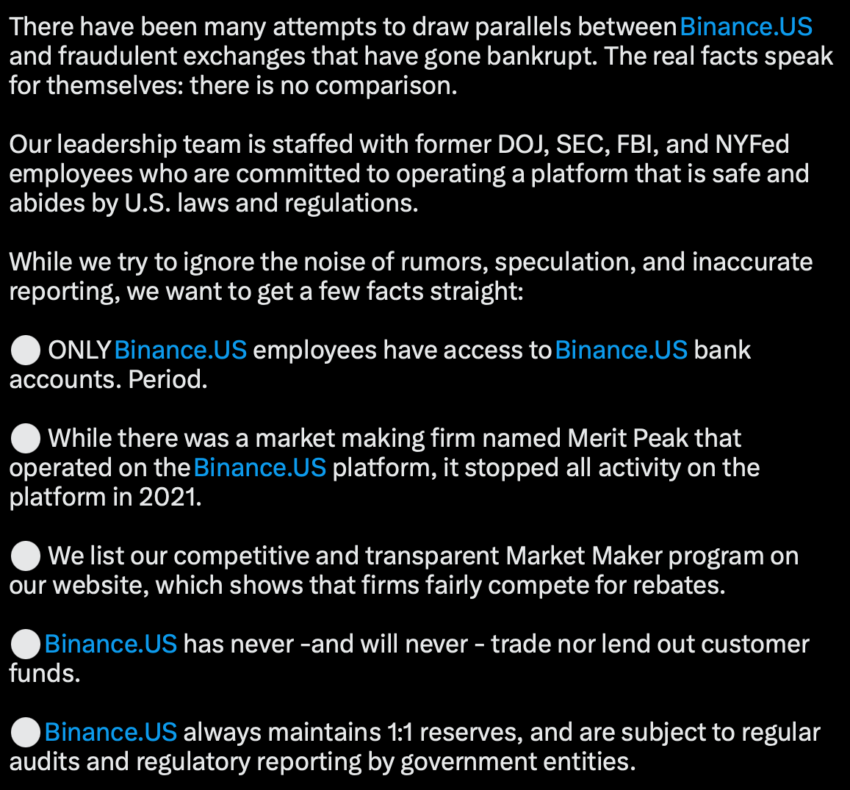

Following this, the team at the US branch shared a screenshot with BeInCrypto which reads as follows:

Reminiscent of FTX Collapse

The tale of commingling funds between entities and accounts echoes concerns about what happened to FTX. The now-bankrupt exchange was involved in moving and exchanging funds across accounts managed by a single entity.

This raises the question of regulation and the SEC’s crackdown on crypto exchanges. Many criticize the SEC for being slow to regulate the cryptocurrency industry, but it has recently stepped up its enforcement actions.

Several regulations exist today to prevent underground money movements in the cryptocurrency industry. One of the most significant is the Bank Secrecy Act (BSA), which requires financial institutions, including cryptocurrency exchanges, to report suspicious activities to the Financial Crimes Enforcement Network (FinCEN). This includes large transactions, unusual transaction patterns and transactions involving individuals or entities with known criminal or terrorist links.

In addition to the BSA, the SEC has recently taken action against cryptocurrency exchanges that violate securities laws. This includes offering unregistered securities or engaging in fraudulent activities. For example, the SEC is currently involved in a lawsuit against Ripple, the company behind the XRP cryptocurrency, for allegedly selling unregistered securities. The SEC has also charged the founder of the BitConnect cryptocurrency platform with fraud.

It is worth noting that cryptocurrency firms do not necessarily do anything that traditional financial firms cannot do. However, the nature of cryptocurrency transactions and the anonymity of participants can make it easier to engage in illegal activities. This is why BSA regulations are essential to prevent money laundering and other illegal activities in the cryptocurrency industry.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.