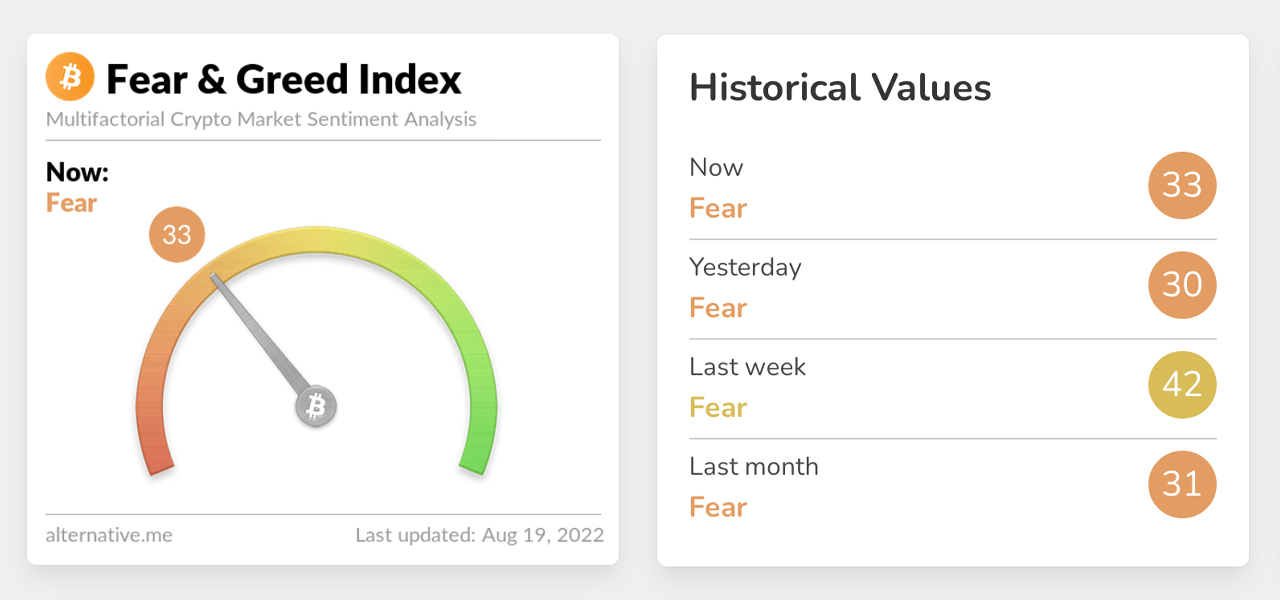

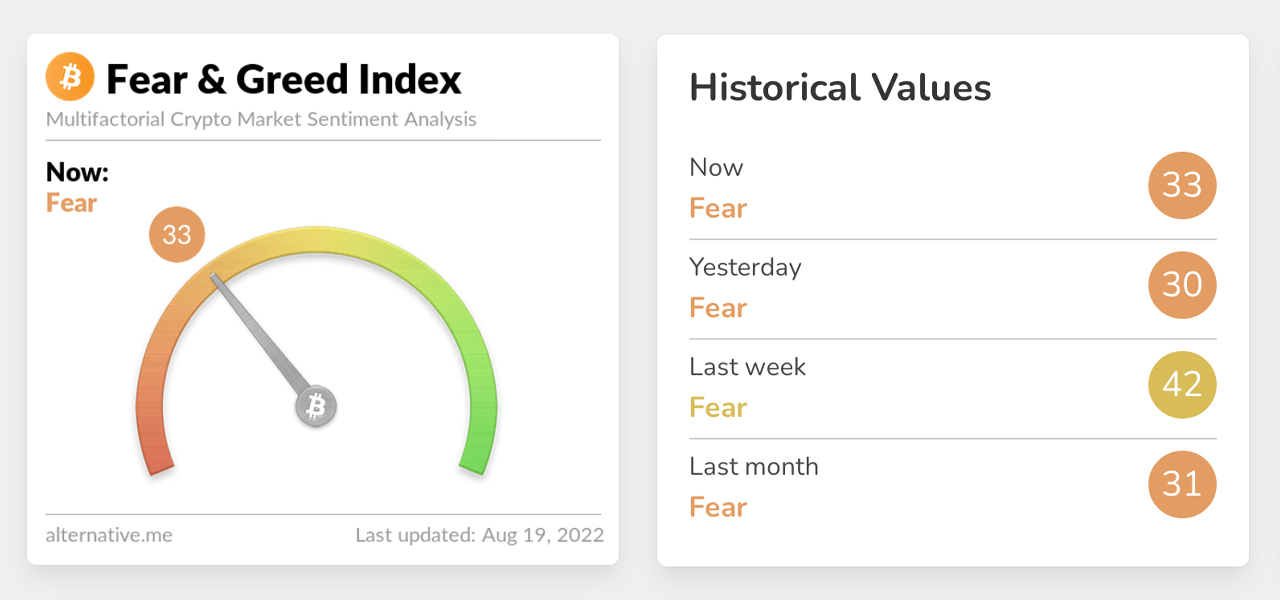

After the Crypto Fear and Greed Index (CFGI) fell to significant lows pointing to “extreme fear” in the crypto markets at the end of May, and throughout most of June, the CFGI rating today remains in the “fear” zone, but it has seen an improvement. On June 19, the CFGI rating achieved a low score of 6 meaning “extreme fear”, and 61 days or two months later, the CFGI rating now shows a score of 33 or “fear”.

CFGI Rating Score shows that Crypto Winter continues to keep investor sentiment in the “fear” zone

While the crypto economy has jumped back above the $1 trillion range, prices have started to fall again after the recent rally. After the Terra blockchain implosion, the crypto economy lost significant value and extreme fear shook the community also into June. The Crypto Fear and Greed Index (CFGI) on alternative.me fell sharply at the time, and on May 31, 2022, Bitcoin.com News reported that the CFGI rating was 16 out of 100 or “extreme fear”.

Each day, the CFGI ranking analyzes “emotions and sentiments from various sources and crunches them into a single number.” Alternative.me indicates that a value of 0 means “extreme fear,” while a value of 100 represents “extreme greed.” The site adds:

The crypto market [behavior] is very emotional. People tend to get greedy when the market rises, resulting in FOMO (Fear of missing out). Also, people often sell their coins in irrational reactions [to] seeing red numbers — There are two simple assumptions: 1) Extreme fear can be a sign that investors are too worried. It could be a buying opportunity. 2) When investors get too greedy, it means the market needs to correct.

In mid-June, the CFGI ranking dipped even lower, falling to a low score of 6 out of 100 on June 19, 2022. Historical crypto price data shows that BTC traded at $20,553 per unit on that day and the day before June. 18, BTC hit a 2022 low of $17,593 per unit. Today, the CFGI rating scores have improved and the sentiment value has moved out of the “extreme fear” position into the “fear” zone with a score of 33 out of 100.

BTC managed to recoup some losses after the market disruption in May and June, and on August 14, 2022, the price drained $25,212 per unit. On the same day, the CFGI ranking jumped to 47, showing that sentiment was reversing. Over the past 48 hours, however, BTC has dropped significantly in value, falling from $23,593 per unit to today’s low of $21,268. The CFGI rating has not been able to rise above the “fear” zone and appears to be returning to the “extreme fear” score range.

Tags in this story

Analysis, Bitcoin, Bitcoin (BTC), Bitcoin Markets, BTC, BTC Market Sentiment, CFGI, CFGI Ranking Score, Crypto, Crypto Fear, Crypto Fear and Greed Index, crypto market update, Crypto Markets, data, extreme fear, Fear, Greed , greedy , market interest, market sentiment, markets, price

What do you think about the recent CFGI ranking and the crypto economy diving in USD value again? Let us know what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 5,700 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons, CFGI via Alternative.me

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.