Crypto Exchange Stablecoin Inflows Increase as Traders ‘Buy the Dip’

Centralized crypto exchanges seem to be seeing an increased supply of stablecoins. This could be a sign that the buying pressure is about to increase.

On March 6, research firm CryptoQuant reported an increased influx of stablecoin exchanges.

Furthermore, the firm reported the “highest level this year” as stablecoin balances on crypto exchanges increased on March 5.

The analysis noted that Bitcoin prices fell in the short term, but added, “the potential purchasing power of the market is increasing.”

Stablecoin inflows are usually a sign that investors may be preparing buy orders at current or lower levels.

Ethereum dominates the Stablecoin share

However, the data is in conflict with recent findings from Glassnode. It noted that the average number of USDC receiving addresses just hit a one-month low of 1,544 per hour.

Nevertheless, USDT average transaction volume has just reached a monthly high.

Glass node added that the average number of BTC exchange deposits is also at a monthly low. This reinforces the notion that holding and accumulating appears to be preferable to selling at the moment.

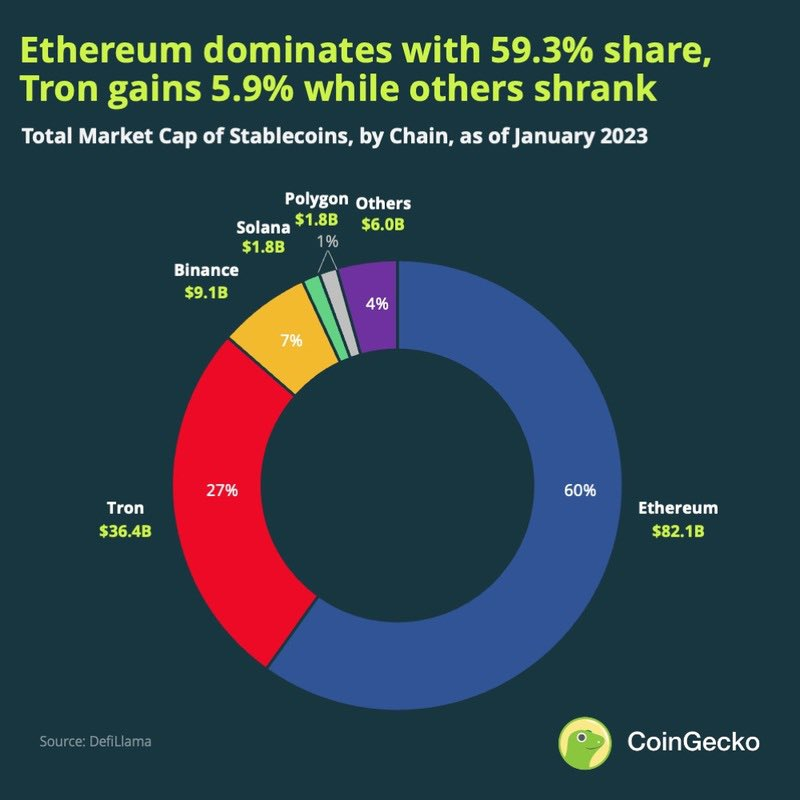

Also on March 6, CoinGecko reported that Ethereum remained dominant for stablecoin market share.

Ethereum is the market leader for stablecoins by a large margin, with 60% of the total share. TRON is the second largest stable asset supply network with a share of 27% after an increase of 5.9%. Binance’s BNB chain is in third place with a market share of 7%.

Stablecoin Ecosystem Outlook

Stablecoins currently account for around 12.7% of the entire crypto market. The total capitalization of all of them together is around $136 billion, according to CoinGecko.

Market leader, Tether, has a share of around 52% with $70 billion in circulation. Furthermore, Tether’s supply has increased by 7.8% since the beginning of this year as an additional 5 billion USDT have been minted.

Circle’s USD Coin has just under $44 billion in circulating supply, giving it a 32% market share. Circle started minting again in mid-February, and has added around 3 billion USDC since then.

Supply gains have come at the expense of Binance and BUSD. Since the SEC took action against BUSD issuer Paxos, its circulating supply has fallen by 46%. There is now $8.7 billion in BUSD in circulation, giving it a market share of 6.4%.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.