Crypto Capital bets on Cardano (ADA) – The Cryptonomist

Crypto Capital CEO Dan Gamberdello said he is more confident in Cardano (ADA) now than when it was at its $3 high. The crypto has gained 6%, although in the last 24 hours it has returned to $0.39.

CEO of Crypto Capital says he is more confident in Cardano (ADA) than when it was worth $3

Dan GambardelloCEO of Crypto Capital, wrote a tweet that he feels more confident now in Cardano (ADA) than when it was worth $3 at the height of the bull market.

I’m more confident in Cardano now than I was on $3 ADA in the peak market.

— Dan Gambardello (@cryptorecruitr) 10 April 2023

It was September 4, 2021 when the ADA had passed $3just days before Alonzo fork which added support for smart contracts on Cardano’s mainnet. Since then, ADA’s price has dropped by more than 85%, while the ecosystem has seen great growth.

And it actually is now 122 projects launched on Cardanowhile 1221 is under construction. Not only that, the network has picked up 64.2 million transactionswith 8.09 million native Cardano tokens.

In addition, it is now 7,597 Plutus script: that is, the ecosystem is filled up with different dApps.

It is likely that Gambardello of Crypto Capital is referring to just this growth in the ecosystem that makes the crypto more reliableas opposed to just the bull in price.

Crypto Capital CEO and Cardano (ADA) price trend

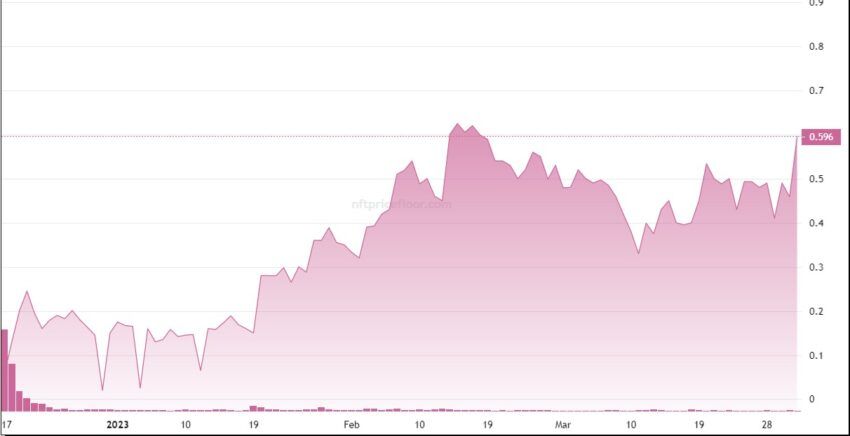

Despite the confident message from Crypto Capital’s CEO, the price of ADA has followed the general trend of cryptocurrencies.

Although it had gained 6% yesterday, reaching $0.41, in the last 24 hours it seems to have settled down again, falling back to $0.39.

Cardano is the seventh largest crypto by market capitalization. It has remained one of the historical crypto assets, along with Bitcoin, but also Ethereum and Ripple, to be in the top 10 cryptocurrencies. Litecoin, on the other hand, is in 13th place.

At the time of writing, ADA’s market capitalization exceeds $13.6 billionwhile Cardano’s dominance is 1.12% of the entire crypto market.

This April, Cardano’s platform announced that it has integrated Liqwid Financea protocol that offers decentralized interest rates for loans and mortgages on Cardano.

Liqwid Finance uses Charli3 technology for new loan calculations, updating security values and initiating liquidations for sub-secured loans.

Charles Hoskinson: “crypto vs banks”

With news of the collapses of various banks, Cardano founder Charles Hoskinson said that the crypto world should mature to a point where it will be able to move away from banking risk.

Unusual to say, given that for many it is the crypto world that is volatile, but the recent news of troubled banks has given pause for thought.

Hoskinson actually said that the only way to expand the cryptocurrency ecosystem is to cut their ties with bankswhich only endangers the whole system which has done nothing but grow so far.

Not only that, in a podcast, Hoskinson told it again 2014 the Swiss bank Credit Suisserecently acquired by UBS to avoid collapse, had refused him to open an account. At the time, Hoskinson was CEO of Ethereum (ETH) and was based in Switzerland.

Credit Suisse’s reason for that choice was that “crypto is dangerous.” ONE dismissive attitude of the bank against the cryptocurrency industry, which Hoskinson wanted to revoke precisely because it backfired on them.