Crypto affected by Fed more than stocks: Macroeconomist explains

Crypto is affected by US monetary policy much more than stocks. While there appear to be multiple reasons for this new trend, macroeconomist Tascha Che believes there are sufficient concerns to underpin future market declines.

The tech investor, who prefers to be called only Tascha, pointed to three main factors: growing institutional adoption, massive increases in leverage and crypto’s reliance on the US dollar as a funding currency and unit of account.

She spoke ahead of those queuing up to become one busy month for crypto and traditional financial markets. US inflation data is set to be released on Tuesday, and the Federal Open Market Committee’s rate hike decision on September 21. Both Ethereum and Cardano will undergo major network upgrades in September.

Crypto and massive institutional inflows

“Institutional money has more access to leverage and is more sensitive to changes in interest/funding costs, leading to greater reactions of crypto prices to changes in the macro environment,” Tascha outlined in a long Twitter thread.

She said corporate money is heavily invested in conventional finance, leading “to greater spillover from stock markets to cryptocurrency when the former is influenced by macro. This is evidenced by increasing correlation between stocks and crypto since 2020.”

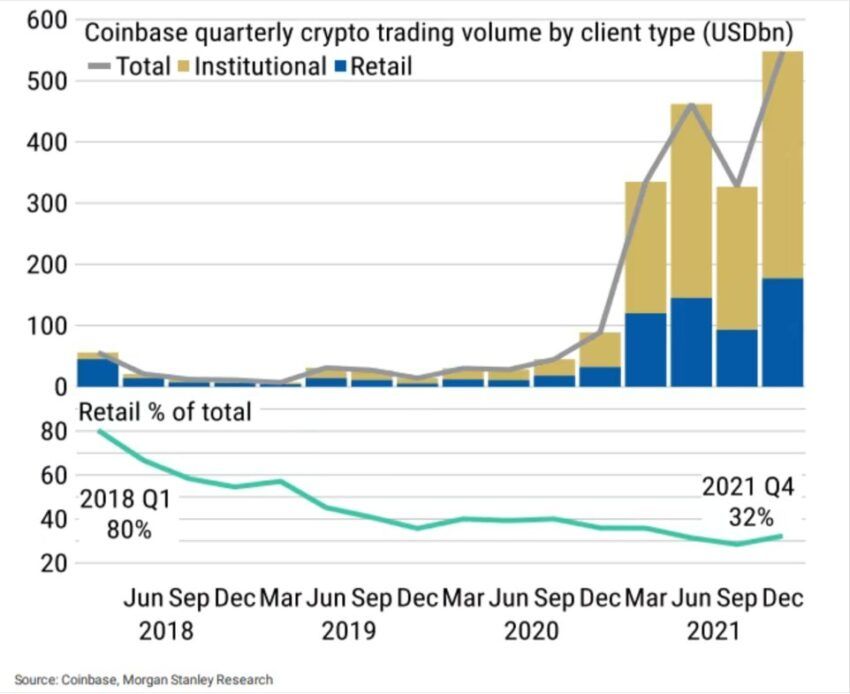

Inflows from institutional investors rose from zero to over 70% of total cryptocurrency transaction volume between 2018 and 2021, according to Morgan Stanley Research. That’s roughly $385 billion, using Coinbase’s quarterly data as a proxy for the entire market.

Estimates suggest that crypto prices have become more sensitive to US monetary tightening than stocks over the past cycle – meaning that when the Federal Reserve raises interest rates, it “hurts” the crypto industry “much more than stocks”.

It’s quite ironic, says Tascha, given bitcoins [and cryptocurrency’s ] major selling point as a “hedge” against volatility in traditional financial markets and inflation. On the contrary, crypto has grown increasingly correlated with stock markets in recent months.

This year alone, billions of dollars have left crypto markets, in line with declines in technology stocks on the Nasdaq, as US economic output shrank and the Federal Reserve either signaled or raised interest rates to curb inflation.

Businesses drive leverage

While Fed Chair Jerome Powell indicated in a recent speech that the US economy needed tight monetary policy to bring inflation under control, Tascha said a “massive increase in leverage” could mean more volatility for crypto.

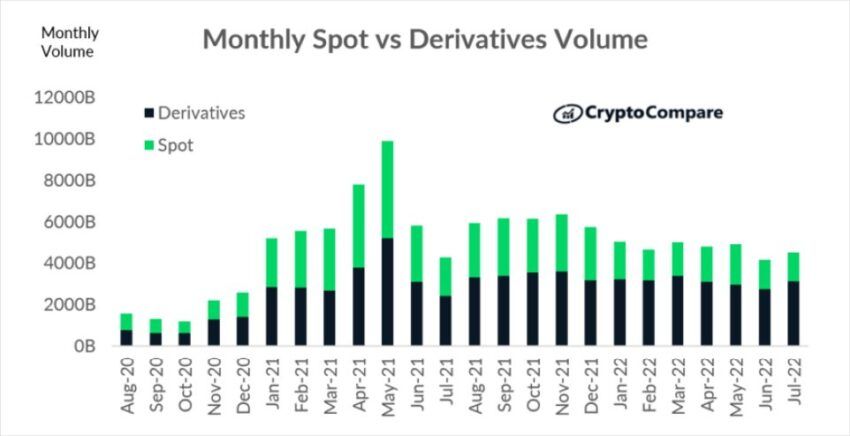

She said that the rise of decentralized finance in 2020 led to an increase in on-chain liquidity, causing both leverage and the total amount of money locked in DeFi money markets, liquidity pools and complex yield products to hit the roof.

“Rapid growth of crypto derivatives on centralized exchanges also led to the demand for leverage, which was met by new influx into crypto by predominantly, again, institutional players,” she explained.

And as several crypto companies like Celsius and Voyager exploded earlier this year, some DeFi die-hards have argued that “if lending/borrowing was done” it would be safer for the system, as loans would be over-collateralized and programmatically liquidated.

But Tascha, the macroeconomist and technology investor, dismissed it as “wishful thinking”.

“Yes, DeFi may be less exposed to certain risks … but it magnifies other risks … leading to more interconnected protocols and encouraging higher overall leverage,” she said, adding:

“The entry of institutional players increases the demand and access to leverage in crypto. Higher systemic leverage increases the impact of stock market spillovers and dollar appreciation. The result is that Fed policy and the macro environment have an even greater effect on crypto than on traditional financial markets.”

The dollar factor

Tascha also discussed the impact of the dollar on the crypto markets in relation to US monetary policy actions. She said the use of the dollar as the main funding currency and unit of account in the crypto industry was a major weakness.

The dollar is the largest single currency in the crypto market. Tokens are predominantly priced in dollars, USD stablecoins account for 95% of the stablecoin markets, and lending and borrowing is mostly done in USD stablecoins.

“But crypto is worldwide and most users are outside the United States,” said Tascha, who has a Ph.D. in macroeconomics.

“As the USD rises, tokens de facto become more expensive for non-US investors whose purchasing power is based on other fiats – mechanically reducing inflows into the cryptocurrency market.”

Got something to say about crypto or something else? Join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook or Twitter.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.