Coinbase and FTX-backed Mara launch crypto wallet for sub-Saharan Africa

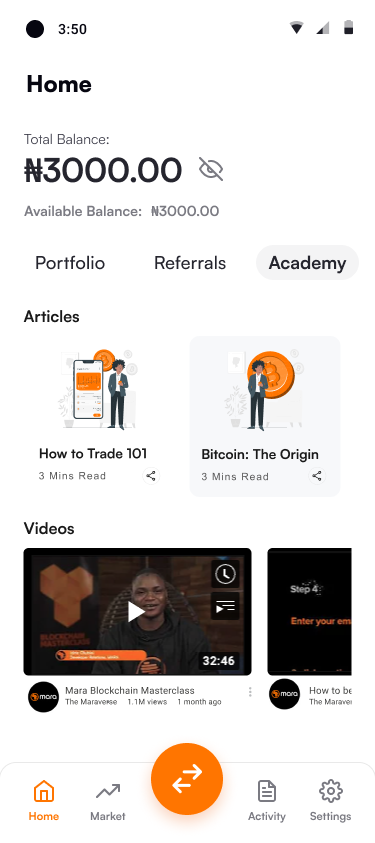

Nairobi-based financial technology company Mara today announced the launch of Mara Wallet, a brokerage app that will allow users to buy, send, sell and withdraw fiat currency and the top 30 cryptocurrencies by volume.

Mara raised a $23 million seed round in May backed by prominent crypto investors including Coinbase Ventures and FTX affiliate Alameda Research.

In an interview with Fortuneco-founder and CEO Chi Nnadi said Mara was designed specifically for the African crypto ecosystem through money transfer services and plans for a broader suite of financial products, which sets it apart from other global exchanges and brokerages.

“A lot of times, when people think of crypto, they think of it purely from a Western perspective, and they think of it purely as a consumer tool for investment,” he said. “I got into crypto because I wanted to solve a real problem that existed in Nigeria.”

While sub-Saharan Africa accounted for the lowest cryptocurrency transaction volume of any region included in Chainalysis’ 2022 Global Adoption Index, it has grown 16% from last year. Despite the low volume, Chainalysis found that Africa has one of the most well-developed cryptocurrency markets due to deep consumer penetration and cryptocurrency being used more frequently for everyday purchases. Nigeria and Kenya both rank among the top 20 countries in Chainalysis’ adoption index.

According to Nnadi, Mara Wallet currently has over 3 million users on its waiting list, with the vast majority in Nigeria. At launch, Nigerian users will gradually gain access to the wallet’s brokerage and trading services. Nnadi said the full product will be rolled out to other countries, including Ghana and Kenya, although he gave no timeline.

Users will receive a local currency wallet as well as a wallet through Mara’s UK unit that will allow them to access dollars, pounds and euros that can be used to buy and sell crypto. Users will be charged a fee ranging from 0.5% to 1.5% for trades, although Nnadi declined to provide a specific figure.

Nnadi described Mara Wallet as more than just a retail wallet or brokerage. “It’s really about building the crypto infrastructure for Africa,” he said Fortune.

Compared to peers such as Coinbase, Mara differentiates itself by catering to the needs of African users by facilitating services such as sending money and trading between currencies, as well as building out a broader financial ecosystem, Nnadi added. The wallet will also contain educational tools.

Along with the wallet, Mara has launched the Mara Foundation, which partners with Circle to facilitate Web3 developer projects, and later this year there are plans to launch a layer-1 blockchain called the Mara Chain, plus a native token that will allow developers to build decentralized applications.

With Kenya’s M-Pesa mobile money transfer service and Nigeria’s government-issued digital currency, the eNaira, sub-Saharan Africa is proving to be one of the most innovative regions when it comes to financial technology – a prospect bolstered by 70% of the region’s population being under 30 .

“It’s a huge opportunity for this generation,” Nnadi said. “These tools need to be built by young people.”

This story was originally featured on Fortune.com

More from Fortune:

I proudly wake up at 08:59, one minute before I start my telecommuting job. There are thousands like me and we don’t care what you think

You may have Crohn’s disease, rheumatoid arthritis or lupus because your ancestor survived the Black Death

Housing’s astonishing fall in one chart: Prices have plunged in 51 of these 60 cities, and there’s much further to fall

Let’s not circle back on it: These 10 business words are the most hated in America